Insights from K-12 Superintendents on post-ESSER Investment Priorities

April 11, 2024 BlogWhile pandemic-driven disruptions to classroom learning may feel like they are in the rear-view mirror, new and ongoing…

As we exit the pandemic, workforce reskilling and upskilling sectors continue to see strong interest. Rapid dislocations in the labor market fueled by everything from emergent technologies to supply chain disruptions have created demand for skills instruction among both consumers and employers that is inspiring rapid innovation in both corporate and consumer training.

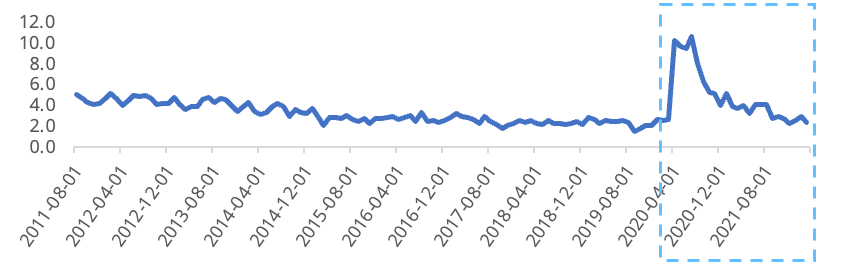

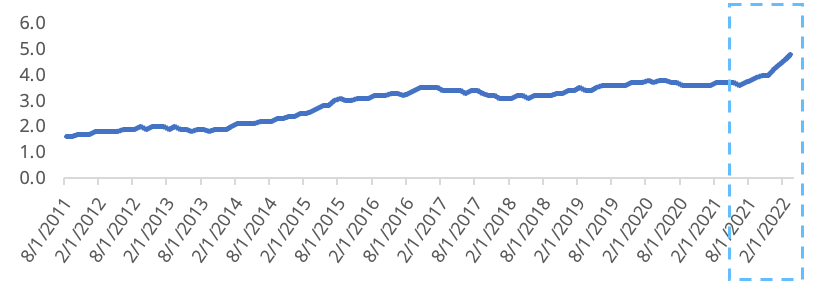

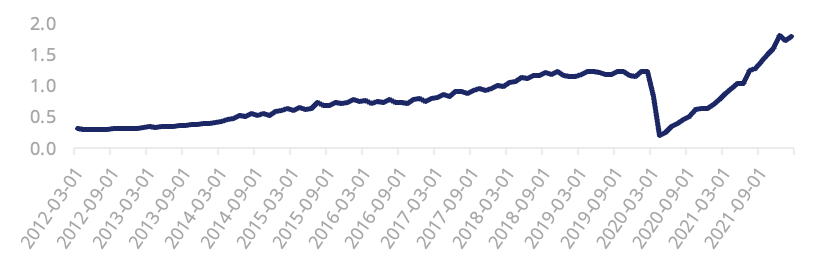

For all the havoc wreaked by the pandemic on the education system, its impact on the labor market has arguably been even more severe. Dramatic swings in consumer consumption, supply chain disruptions, government payments, mandated vaccines, remote work, and more have forever altered how we work. The unemployment rate for college-educated workers has jumped back to historic pre-pandemic lows at the same time that wage growth for this group has accelerated beyond pre-pandemic levels to new highs. And of course, unfilled job openings are at new all-time highs as well.

The unemployment rate for college-educated workers has returned to 2%

(Source: U.S. Department of Labor Bureau of Labor Statistics)

Wage growth for college-educated workers is accelerating

(Source: Federal Reserve Bank of St. Louis)

Job openings per job seeker has reached record levels

(Source: Federal Reserve Bank of St. Louis)

These labor market conditions have empowered workers to change jobs more readily and fueled greater interest in consumer-based training solutions. And on the flip side, employers have turned to training and education both as a benefit and as a way to move workers into higher value roles. The net result has been an acceleration in demand for all types of workforce training.

There may be no better signifier of the sea change taking place in post-secondary education than Instructure’s purchase last month of Concentric Sky. Concentric Sky and its lead product, Badgr (soon to become Canvas Badges), is a platform that supports the tracking and sharing of specific acquired skills. The tool allows users to track and catalog competencies in hard or soft skills such as management, marketing, or analytics – regardless of their source. For an added fee, users will be able to upgrade to “Canvas Credentials,” which will offer unlimited badging, leaderboards, analytics and “personalized visualizations” of one’s progress to obtain market-relevant skills. That the premier learning management system for college and university degree programs should be investing in a platform that supports the growing popularity of more flexible, non-accredited credentials speaks volumes about the growing importance of the new ecosystem of non-university-based methods of continuing education.

Another transaction that reflects more directly how employers are leaning on training to address labor shortages is the acquisition of Talent Path by Skillstorm. Skillstorm provides on-demand technology talent to companies by hiring college graduates and service members exiting the military and then training those hires in the tech skills needed by its clients. This unique approach to sourcing talent solves a need in a particularly tight area of the labor market and provides an opportunity for workers to reskill into tech careers. While the model could be tested if the economy slows, the bet is that the skills and talent gap in technology is sufficiently wide that the model can continue to work, even in recession. Skillstorm also received additional investment from Achieve Partners, the prior owner of Talent Path.

The enthusiasm extends through to the early stage investing as well.

While the labor market conditions that gave rise to the current enthusiasm for personal and corporate training solutions could and likely will change over the coming months, the demand for tech skills and the pressure among employers to grow their own talent are likely to persist. Regardless of the pace of growth in the overall economy, this shift toward technology and the need for technology-related skills to be more widespread in the labor pool are likely to continue such that both consumer and corporate solutions for upskilling and reskilling have a bright future ahead.