Behind the scenes of Otterbein University’s partnership with Antioch University

June 10, 2025 BlogWe’re excited to launch Tyton Partners’ new interview series, Five for the Future: Spotlight on Transformative Institutional Partnerships….

One of the most notable events across the past month occurred in the waning days of July as 2U experienced a significant decline in its stock price coming out of its earnings call. As we highlight below, while the headlines may have appeared grim, the underlying story is one that should reassure investors of the fundamentals underpinning companies effectively enabling student growth and program expansion for colleges and universities.

Strategic investors – among them Edmentum, Frontline Education, Wiley – continued to make targeted acquisitions to enhance their portfolios and extend their capabilities, while international EdTech players raised funding as a prelude to a US-oriented go-to-market initiatives.

While we hope you find a bit of quiet time this August, we plan to update you on all that you may have missed on the other side of the Labor Day holiday weekend.

Best,

Chris & Adam

2U’s second quarter earnings call was one for the history books. The acknowledgement of recruiting headwinds in an increasingly crowded online marketplace; a capitulation on its strict revenue-share model; a pivot to signing fewer, smaller programs; and an embrace of an institution-wide (rather than program-specific) strategy caught investors by surprise and sent the shares 65% lower in a single trading day. However, the shock was more a function of missed expectations among its narrowly-informed investor base than a revelation regarding the OPM market more generally; most of these trends have been well evident to those more familiar with the industry’s current state.

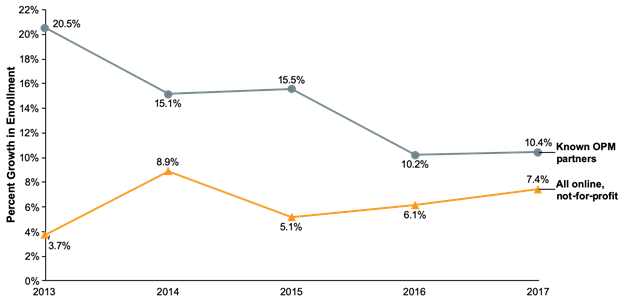

Indeed, publicly-available data suggests the proliferation of both OPM and non-OPM programs have been contributing to a more crowded market space for some time. Tyton Partners’ analysis (below) indicates that the enrollment growth advantage among institutions partnered with an OPM persists, even as non-affiliated schools have ramped up their own programs.

Note: Data is from 170 known OPM provider and institutional partnerships; Sources: IPEDS; Tyton Partners analysis

It is less likely a difference in effectiveness than a result of a rapid increase in the number of online programs being offered. A report published by OPM provider Learning House (Wiley) in June indicated that students are increasingly choosing online programs offered by schools ever closer to where they live. In the 2012 survey, 44% of online students chose a school within 50 miles of their home; in 2019 that distance had narrowed to 25 miles. We’ve long understood that college brands are driven by proximity, so it follows that as more schools have begun to offer programs, more local options have become available.

In an increasingly competitive environment, and one in which (as 2U noted) scale brings such clear advantages, consolidation is inevitable, and this is what we believe the next two years has in store as larger players acquire contracts, capabilities, and talent from smaller generalists and niche vertical players. At the same time, we expect to see other providers follow the 2U example by diversifying into additional service areas including non-degree programs, lead marketing, student success, and even alumni development. Specialization by type of school, program vertical, value chain, and range of offerings are all viable strategies that firms are likely to emphasize as the market matures to the middle innings of its lifecycle. And as is generally the case with consolidation, we expect the process to drive toward increasingly high quality offerings.

And once the number of OPM players has consolidated, we expect student enrollment to consolidate as well. Today college brands are local, but the Internet is a powerful force for disruption at scale and though nearly any university can recruit 3,000 online students, very few can recruit 30,000 without a competent private partner. In time, we believe the importance of geography will diminish in favor of more meaningful distinctions related to specialization, price, and quality of employment outcomes, leading to fewer, stronger online brands.

How long this process might take is unclear, but we believe it will happen in Internet vs. university time and that 2U will be a significant beneficiary. 2U shares are adrift, as public market investors feel unmoored, but its competitive strengths are too great to imagine this situation will be long-lived, and public investors’ confusion could well represent an advantage for a private investor. By taking 2U shares private (at a price that is close to what 2U paid for Trilogy alone), an enterprising PE investor could accelerate the company’s market transition and move to profitability.

Minerva Project, the provider of a redesigned approach to high quality and highly-selected post-secondary education announced a Series C raise of $57 million, bringing the company’s total capital raise to $128 million. The raise was led by Chinese EdTech giant Bytedance who will be joined by other existing Chinese investors TAL Education Group (NYSE: TAL) and Yongjin Group. Additional investors in the round include Pinpoint Ventures, Kakao Ventures, Tan Tan Ventures, Lighthouse Combined and a number of other new and existing investors. As part of its investment, Bytedance’s CEO and Founder Zhang Yiming will join Minerva’s board.

The injection of new capital will be used to create a new line of business providing Minerva’s unique curriculum and pedagogical approach to other institutions, many of which have expressed interest according to the company. And while this strategy is complicated by regulatory limits on the quantity of instruction that a college may outsource, Minerva’s new strategy is banking, perhaps, on the example of its own unique partnership with Keck Institute. Minerva has degree-granting authority through Keck under the auspices of a Department of Education incubation program intended to foster greater innovation and diversity in program offerings. (This is the same program that is allowing a unique partnership between Dominican University and MakeSchool.) In these programs, the limits on third-party instruction are relaxed and a high-quality collaboration has emerged. Minerva may also see the potential to leverage its success in emerging global markets like China, where post-secondary demand is projected to far outstrip supply over the next 20 years.

Indian edtech giant Byju’s announced an additional $150 million capital raise led by the Qatar Investment Authority, bringing its total capital raised to date to $925 million. Owl Ventures also participated in the round. TechCrunch reported that the implied valuation in this latest round was $5.75 billion. The company projects revenue of $430 million for the fiscal year that ends March 2020. The cash will be used to fuel the company’s expansion outside of India, including entry into the U.S. market. Earlier this year the company acquired a U.S.-based edtech start-up called Osmo, popular with kids aged 5-12, for $120 million.

Byju’s provides engaging online education content for young children and its investors are banking on its success with India’s youthful population, as well as its already impressive scale to successively conquer other, more affluent markets. In 2017, KPMG and Google sized the entire Indian edtech market at $2 billion, only a fraction of Byju’s current enterprise value. Implicit in the incremental investment and its lofty valuation, is that the global edutainment market for young children will continue to expand at impressive rates as it transitions from a historically “hit-driven” market to one that is more reliably bankable. The underlying industrial logic suggests that if Byju’s can sustainably hang on to pre-adolescent eyeballs and their parents’ credit card numbers, its lofty edtech valuation will represent a pittance for a future acquisition by $320 billion Netflix or $1.2 trillion Google.

Frontline Education announced the acquisition of Perennial EdTech, the parent company of Escape Technology (ERP), Digital Schools (school business software), eDoctrina (curriculum, assessment and accountability software), Healthmaster (school health management) and Software Answers (classroom and student management software) for an undisclosed amount. Although the extent of the planned integration with Frontline’s existing products is unclear, the company heralded “additional resources, solutions and services” to support its customers’ “programs, strategies and success.”

Frontline is the leading, but not the only, entity consolidating back-office SaaS offerings aimed at the K-12 school market. As we’ve described before, the advent of the SaaS business model has led to a renaissance in software tools for schools that are highly reliable subscribers, but ill-equipped to make capital purchases given the nature of the municipal budgeting process. As such, all of the entrepreneurial energy that has gone into software-based business process improvements over the past 20 years is now being applied to the school market. At the same time, the peculiar scale challenges and costs associated with selling to this fragmented market that forced consolidation in the textbook market 25 years ago, is now in effect in the administrative software space and private equity is helping to smooth the transition.

Privately held test-prep company UWorld announced its acquisition of Roger CPA Review for an undisclosed amount. UWorld provides test-prep for high-stakes exams across a variety of subject areas including ACT, SAT, MCAT, NCLEX, USMLE, ABIM, and ABFM and differentiates itself with the efficacy of its content, which includes adaptive elements. The addition of Roger CPA Review adds an important category within the high-stakes occupational test landscape with a proprietary approach to methods and a value proposition that, like UWorld’s existing products, is also built around efficacy.

Professional test prep is a favorite area for investors because of the perennial and predictive nature of the demand and we have seen steady consolidation in this market area over the last several years given the advantages of scaled operations. And with a steadily-growing but relatively finite universe of test-takers, we expect the consolidation toward a handful of very large, well-scaled players to continue.

K-12

Apax Partners Acquires MetaMetrics

Edmentum Acquires Calvert Education

Education Solution Services Acquires Enriched Schools

Education Solution Services Acquires Proximity Learning

EPAM Systems Acquires Competentum

Frontline Education Acquires Perennial EdTech

Troxell Merges with CDI Technologies

Zaner-Bloser Acquires Word Heroes

iTutor Group Raises Undisclosed Amount

Higher Ed

Wiley Acquires Zyante (ZyBooks)

Human Capital Optimization

Riverside Company Acquires Compana