What We’re Thinking About in Impact for 2026

January 21, 2026 BlogThe education sector is navigating a fundamental shift. Market forces are driving consolidation, capital is more selective, and…

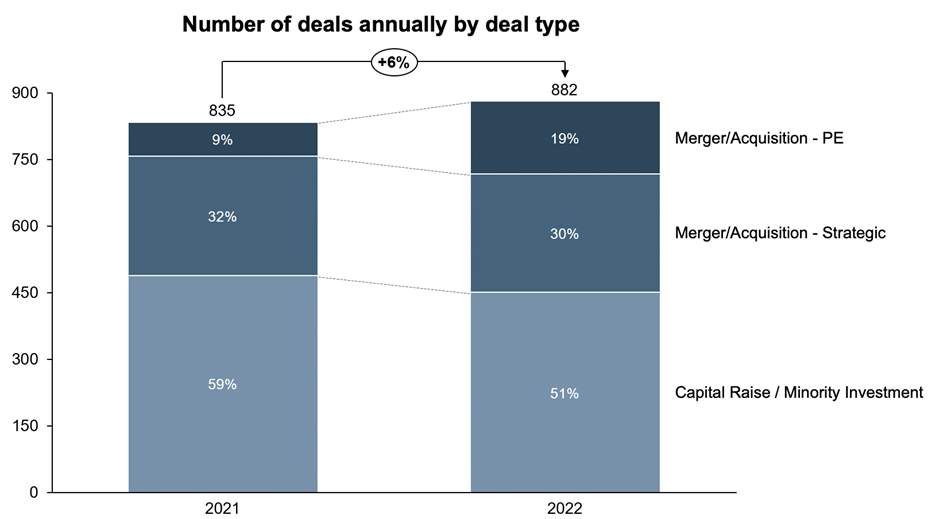

Our analysis of 2022 deal activity through November 30 confirms several anecdotal observations we have made during the year. While valuation multiples may have contracted, M&A activity in the education sector has remained robust and even increased in volume. At the same time, there has been a notable decline in venture-stage investments.

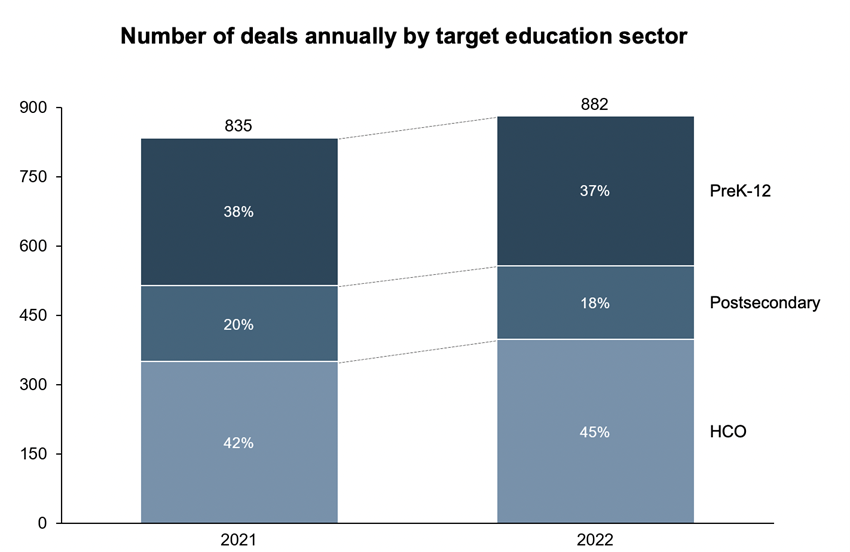

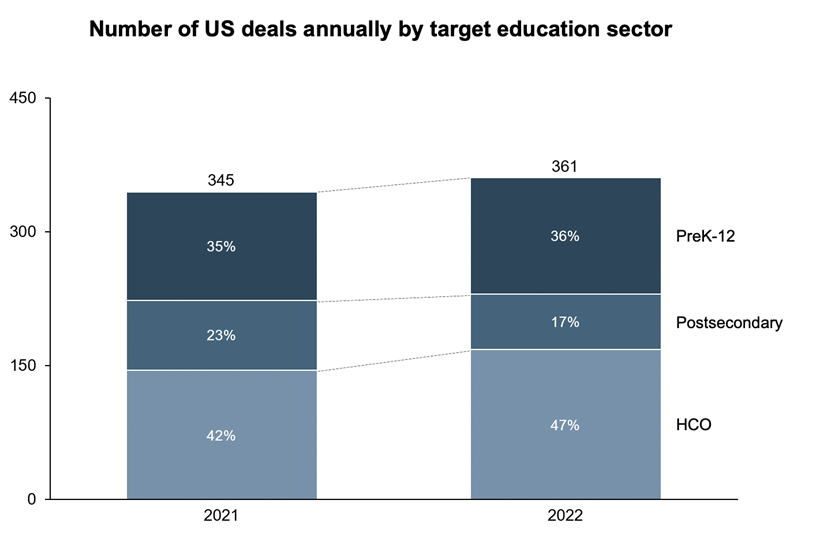

These patterns are equally evident globally and in the U.S. market. And while the mix of investments by sector has remained relatively constant globally, the migration away from Higher Education and toward K-12 and Human Capital Management was more pronounced in the U.S. market.

Globally, the number of education deals increased 6% y/y, though this reflects a 9% decline in venture activity and a 26% increase in mergers and acquisitions.

This shift in activity is typical of the later stages of an economic cycle. Also notable, though not surprising, was the fact that the increased M&A activity was predominantly among financial investors who still have capital to deploy and who may have experienced a more buyer-friendly price environment than in 2021.

Source: Tyton Partners1

Across sectors, the deal activity remained relatively constant, with the most significant increase (13%) in the Human Capital Management market where companies that are engaged in reskilling and upskilling workers (in what remains a tight labor market) remained attractive to investors. Interestingly, after a large post-pandemic surge in investment activity into consumer-facing K-12 companies in 2021, the mix – and trend – remained steady in 2022, with a slight majority of deals (53%) focused on consumer end-markets.

Source: Tyton Partners1

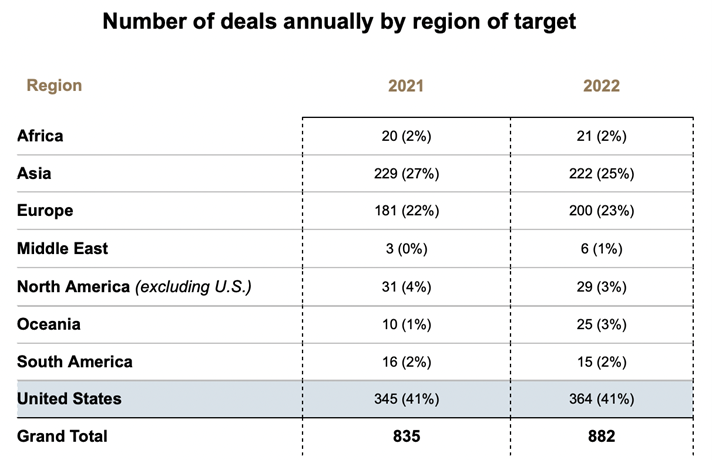

Deal activity also remained constant by region, with a residual decline evident in Asia as it lapped the sharper decline coincident with the 2021 crackdown by the Chinese government on private education companies. This decline was offset globally by a corresponding increase in Australian activity.

Source: Tyton Partners1

U.S. education deal volume trends were in line with global trends, though slightly more acute. Overall activity increased 5%, with M&A increasing 15% and venture investments declining 9%. The mix shift by sector was starker than in the global data overall, as the number of Higher Education deals declined 21% while Human Capital Management deals increased 16%.

Source: Tyton Partners1

We attribute the volume of activity on what had already been two prior years of robust growth to three primary factors.

In 2023, we expect the late cycle trends evident in 2022 to continue. Venture investing is likely to continue to slow and deal activity in general is likely to become even more focused on M&A. We further expect the price sensitivity of buyers, which has become more noticeable throughout the year, to continue. That said, if 2023 is a year of recession, we expect synergistic deal activity to continue as strategic and PE-backed platform companies look to engineer non-organic growth.

1 Tyton Partners tracks education market activity through a variety of sources including press releases, press reporting, and Pitchbook.