Behind the scenes of Otterbein University’s partnership with Antioch University

June 10, 2025 BlogWe’re excited to launch Tyton Partners’ new interview series, Five for the Future: Spotlight on Transformative Institutional Partnerships….

For many in the industry, 2023 was tumultuous. Numerous deals were close to transacting but fell through at the finish line. Interest rates continued their upward climb, inducing anxiety around the cost of borrowing, and requiring a higher ROI for investments to realize the same IRR levels. Investors took a step back to rethink their investment evaluation criteria that had shifted dramatically in the frenzy of the pandemic; many woke with a hangover from inflated valuations that made sense in 2021 but now appear unthinkable. Market segments were shaken up – from the increased regulation and the OPM market “on life support” in higher education, to the fear around implications from the expiration of ESSER funds that looms in preK-12. While the downturn in education-specific transactions was real, these difficulties plagued investments across the broader market as well, with global M&A activity shrinking to “its lowest level in more than a decade” in early parts of the year.

In the summary of 2023 that follows, we highlight which deals and segments were hit the hardest, and which ones escaped the worst of it. We also highlight the reasons for hope as we turn the page on our calendars. Down years are normal in a cyclical economy, and while the education sector is far from immune to this volatility, we share a strong belief that a rebound is coming.

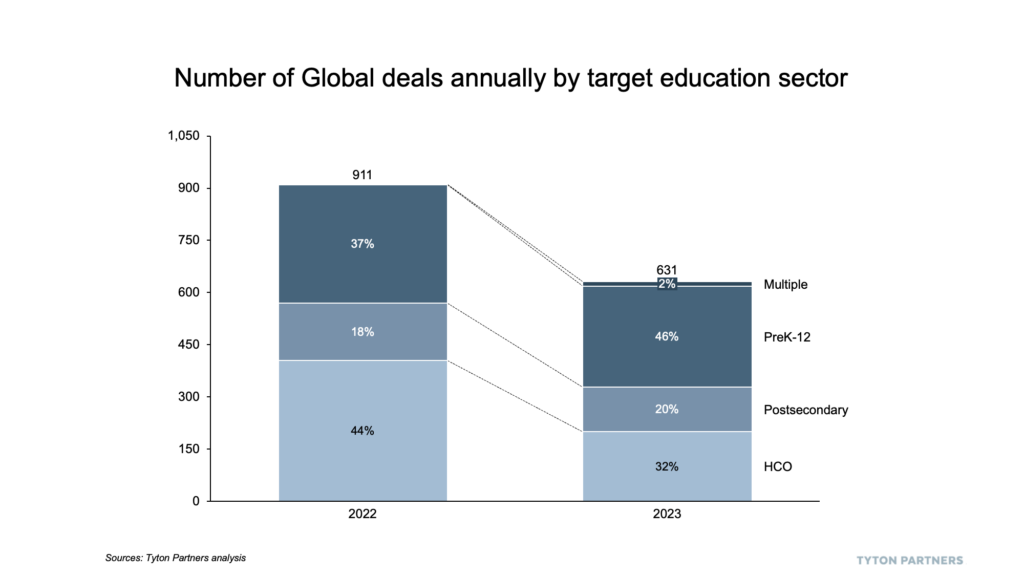

Globally speaking, there was no deal type that proved resilient in 2023. Coming off a slightly down year in 2022, M&A – both strategic and PE – and capital raises all tumbled in 2023, causing a 31% decrease in deal volume compared to the previous year. While deal value is less widely available and tracked, it is clear that this figure declined even more dramatically than deal volumes over the past year, with some decrease estimates as high as 70% for specific quarters. Capital raises and minority investments were hit the strongest (-35% YoY), reflecting the broader bearishness surrounding investments in the space. Strategic M&A transactions also fell dramatically (-34% YoY), with lower quality tuck-in opportunities on the market, and increased concern about what synergies would need to be true to make a return after the increased cost of borrowing.

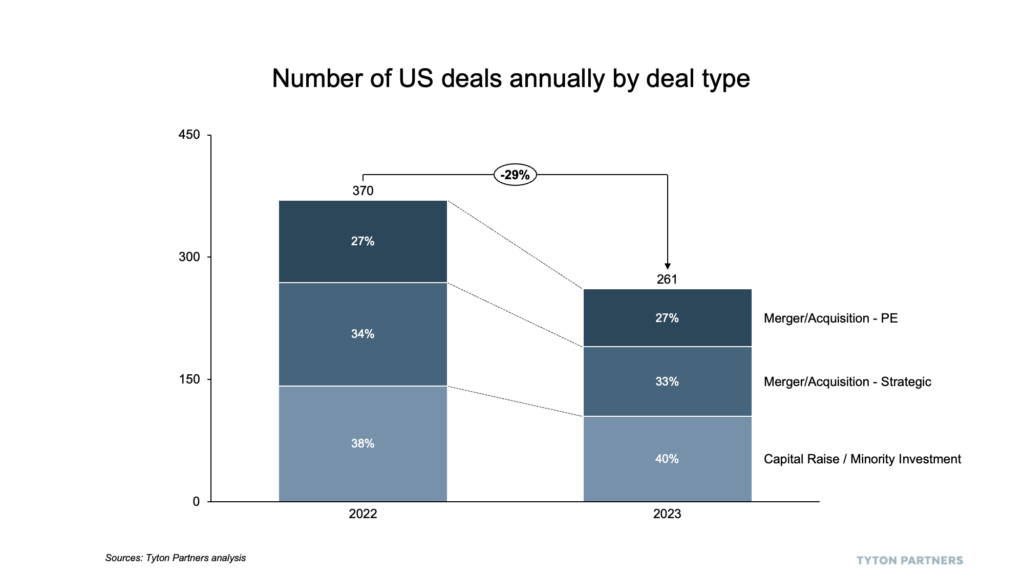

In the US, the top-line decline of deal volume was comparable to the international picture (-29% YoY), though the composition of this decline showed a different picture. PE activity towards US targets was more suppressed, down 30% on the year, relative to 14% globally. As referenced in our October newsletter, PE firms have aggressively looked to international opportunities as attractive assets in the US market have become harder to find. This search overseas proved to be an ‘easier-said-than-done’ task considering the also-competitive nature of the global environment, but it offers some context for the lower PE deal volume domestically.

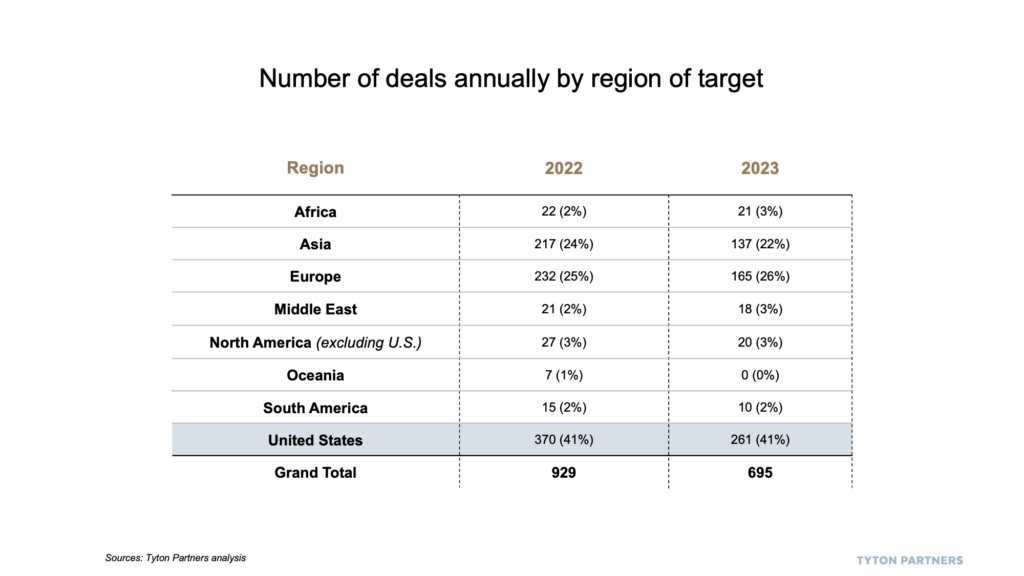

Deal transactions across world regions remained relatively stable, at least as proportions of the slightly smaller pie that was 2023. Targets in the US remained beneficiaries of 41% of transactions, and our neighbors to the North (Canada) and South (Mexico) held their combined 3% of the total. The most notable decline came from Asia, which fell from 24% of total deals in 2022 to 22% in 2023. A strained relationship with China (see China hits back after Biden calls Xi a ‘dictator’) is a likely a contributing factor – investors have become more wary as they consider this market, fearing future governmental interference may disrupt investments in the region. Africa and the Middle East picked up the ground lost by these Asian markets, slightly padding their relatively small size.

Human Capital Optimization organizations (HCOs), the transaction volume leader of 2022, led the global declines in deal volume in 2023 (-51% YoY), though no sector maintained their 2022 activity levels. . Notably, there was a lot of HCO sector buzz this year, especially concerning the implications of generative AI, but this has yet to translate to a high quantity of scalable opportunities ripe for investment. Postsecondary transactions also stumbled, though not as significantly as HCOs, experiencing 22% fewer deals than in 2022 with fewer clear-cut quality targets available internationally. PreK-12 was the most stable of the group from a volume standpoint, rounding out the sectors’ performance down 14% YoY.

HCO transactions in the US mirrored the global trends, down 51% YoY. Declines in PreK-12 were slightly more pronounced domestically (-17% YoY), with the expiration of ESSER approaching and districts actively prioritizing a narrower set of spending categories and solutions. US Postsecondary fared the best of all segments, but was still down 10% from 2022. One potential driver of this less significant decline: revenue streams in higher education can be relatively more secure and predictable than other sectors, providing a relatively ‘safer’ space for investors to park their dollars in a market where it’s difficult to do so.

While 2021 transaction levels may be a distant dream, we believe there are signs that the market is poised to rebound from 2023 in the near- to medium-term. One key factor driving our optimism is that interest rate increases have stopped and are expected to return towards more reasonable levels in 2024.

The corresponding improvements to cost of capital will bring with it more willingness to borrow and invest, and to bring assets to market.

There’s also a limit on how long dry powder can be held. Lower transactions didn’t slow capital raises in 2023, and the grace period of leniency extended by LPs for deploying capital is running out. As more interest from the buy-side emerges to put money to work, we expect assets will become more available to meet demand.

Early in 2024, we will share a detailed look of where we see the most promising potential within and across education sectors, and where we expect the strongest transaction growth to come from in the new year. We remain committed to supporting investors across all education opportunities. Regardless of whether it takes 24 days or 24 months for the market to fully return, we look forward to the conversations and collaboration to support you and your organization’s growth efforts. Reach out to continue the conversation or to ask any questions.