Beyond Partnership: The Integrated Model of the College of Saint Benedict and Saint John’s University

August 20, 2025 BlogIn our second edition of Five for the Future: Spotlight on Transformative Institutional Partnerships, we turn to the…

Education sector transaction activity bounced back in 2024 following the plummet experienced in 2023. Announced deal volume was up more than 15% driven by announced deals across the second and third quarters, which accounted for ~63% of the year’s transactions. With a lull during the post-election year-end period, anticipation of forthcoming processes suggests the potential for a robust first half of 2025 on the M&A front. Before looking forward, however, we want to offer a quick look back into underlying dynamics of the 2024 education sector investment and M&A landscape.

In 2024, the prevailing sense among investors, business executives, and advisors was a sector rebuilding momentum. Many early- and growth-stage businesses remain challenged to find investment capital, as evidenced by the continued decline in announced minority capital raises. In banked processes, the gap between companies’ “story” and presented financials and their actual market position and operating realities led to a seemingly high percentage of processes that started strong but did not finish. Part of this dynamic was a valuation challenge, particularly among PE-backed businesses that raised or were acquired during the 2020-21 go-go period.

Despite these dynamics, investor interest in the sector remains incredibly strong. More important than simply the greater number of investors now focused on the education sector is the heightened rigor of business model and investment opportunity analysis they are bringing to the space. Over time, these sharper perspectives can help support entrepreneurs, executives, and policymakers striving to improve our teaching and learning systems and resources, technology infrastructure, and supporting services, from early childhood through workforce.

In the summary of 2024 that follows, we highlight notable shifts across deal types and segments and what they might mean as we look ahead to 2025 and beyond.

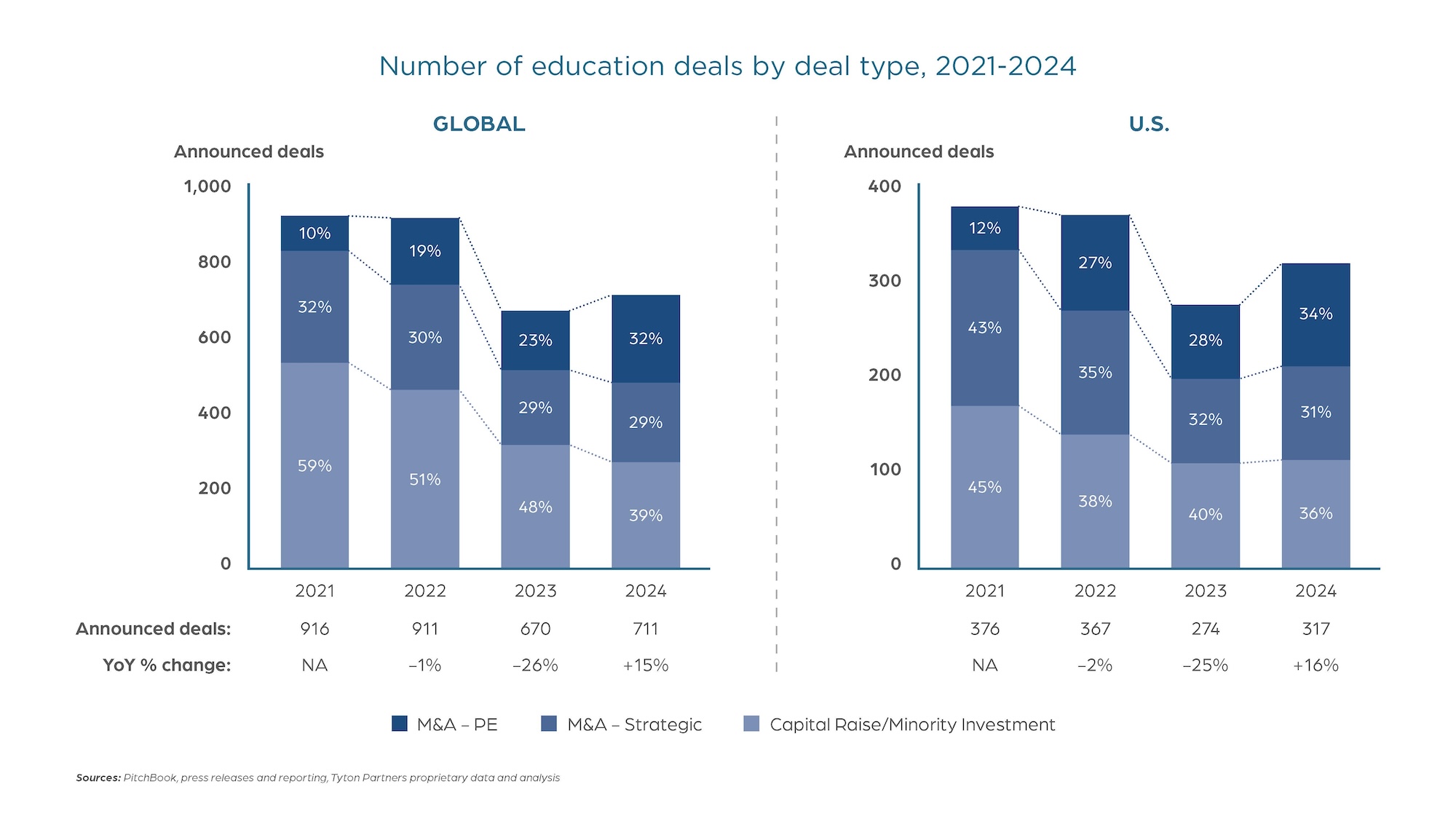

Both global and U.S. deal activity rebounded in 2024, up ~15% from 2023’s low-water mark*. M&A volume expanded considerably, driven primarily by private equity firms seeking platform investments in the sector. This level of M&A activity likely underrepresents the potential for PE-driven M&A; we expect strong interest from PE buyers to persist in 2025. This dynamic will drive valuations of attractive, high-performing businesses to uncomfortable levels for some investors; on the flip slide, businesses (and bankers) with inflated valuation expectations will find a Darwinian investor environment with more modest outcomes available.

Announced capital raises have contracted steadily since 2021 as a percentage of overall activity, now accounting for 39% of all global transactions and 36% of U.S. ones. In terms of actual deals, this represents an ~44% decline in the number of announced investments globally and a ~33% decline in the U.S. Beyond the current challenges faced by entrepreneurs and executives seeking capital, this trend is likely already contributing to a smaller pipeline of compelling, established businesses for later-stage PE investors and strategic acquirers. While the caliber of this cohort should be stronger, its size will lead to more competitive processes and richer valuations for interested parties.

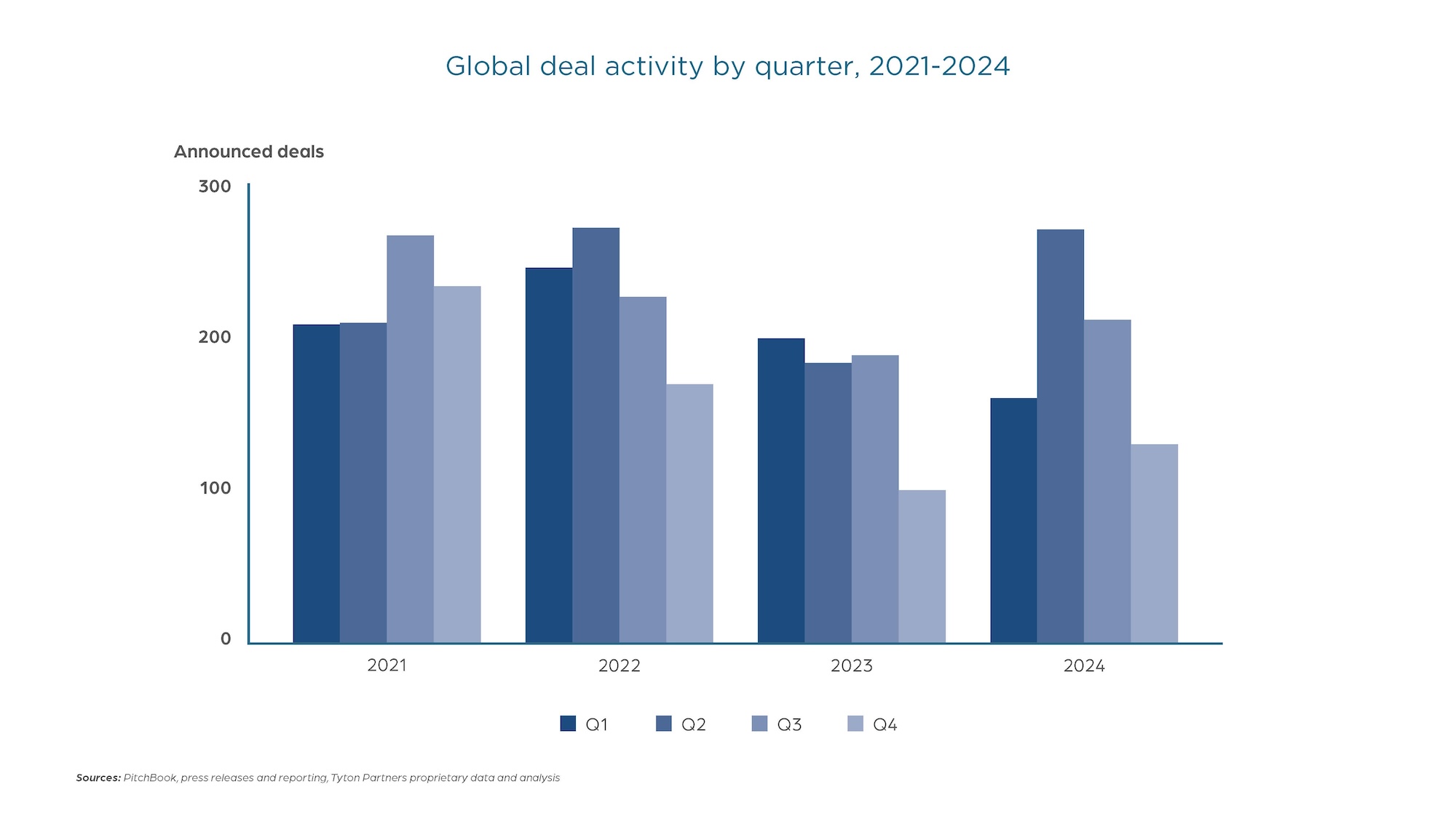

The sector also experienced a steady decline in deal volume from Q2 through year-end, similar to what we witnessed in 2022.

While a traditionally compressed end-of-year calendar contributes to this trend, investors’ perception of deal quality – or lack thereof, a degree of uncertainty regarding the impact of the incoming Trump Administration’s policy priorities and execution on education markets, and a still recovering financing environment contributed to fewer deals getting done. We’ll be tracking deal momentum – and quality – early in the year to gauge the sector’s ability to build on 2024’s expansion.

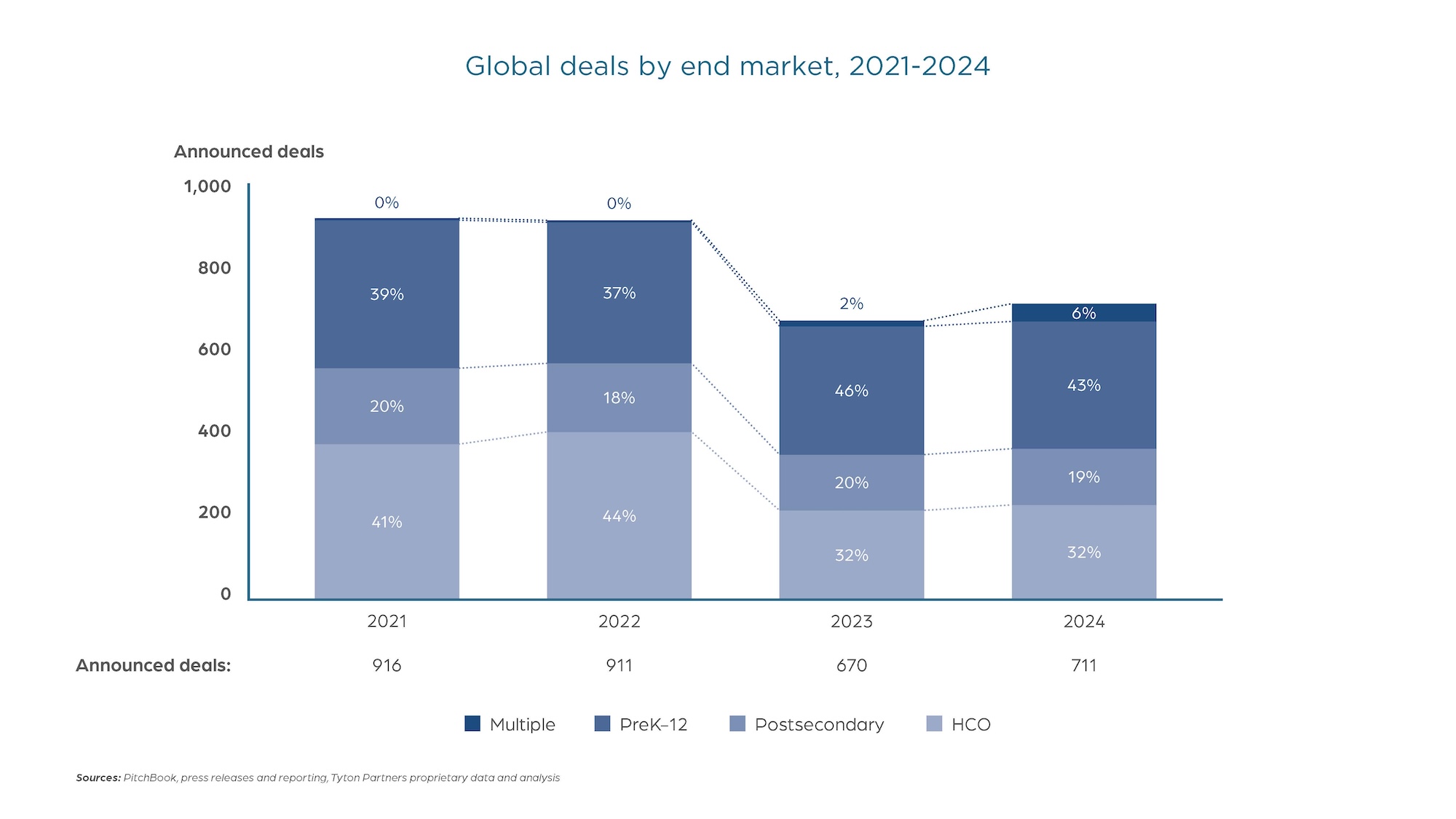

The distribution of deals by end market segment remained consistent year-over-year, with PreK-12 businesses accounting for ~43% of global deal volume and a comparable percentage within the U.S. market. Notwithstanding a relatively constant share of deal activity, each segment – PreK-12, postsecondary, human capital optimization (“HCO”) – experienced an increase in overall deal volume, with the HCO segment achieving the most growth in announced transactions.

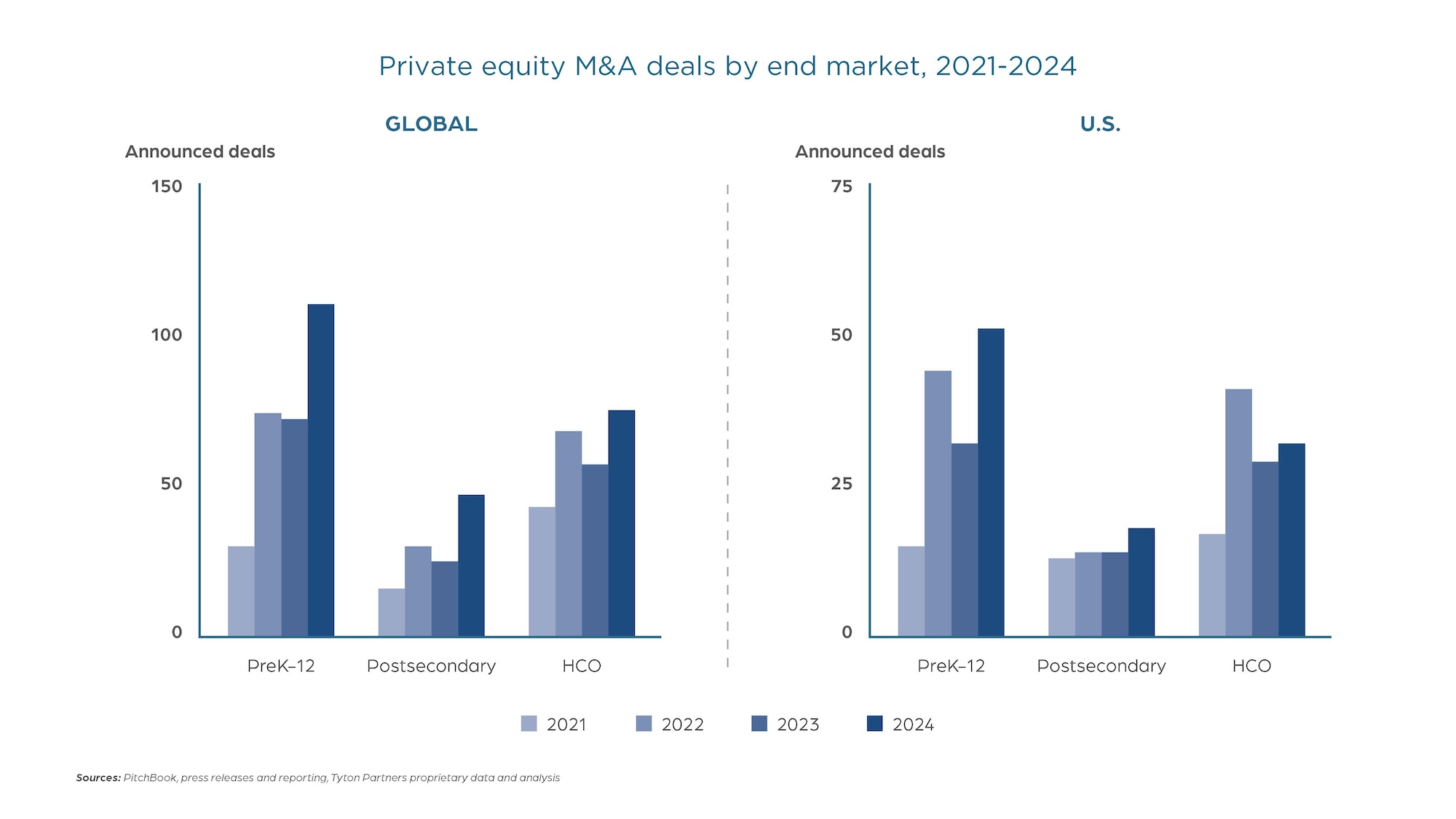

Digging into last year’s deal activity by type reveals trends that bear watching in 2025. The PreK-12 segment continues to lead in terms of announced capital raises and PE M&A activity, where we saw a significant uptick relative to prior years’ levels. At the same time, consolidation in the HCO segment, highlighted by our banking colleagues last week, regained momentum in 2024 both globally and in the U.S. and will persist in 2025. Finally, 2024 may be the year the postsecondary segment finally broke its slump and returned to favor among PE buyers with a doubling of announced M&A activity in this segment.

It feels like the market has been waiting for “202x” since 2021. Said differently, investors and executives have been willing a return to the vibrancy of the pandemic-era deal environment ever since it ended. While most would pass on the level of froth demonstrated during that period, we do expect to see continued transaction momentum across the sector this year.

In PreK-12, “delivery” businesses – both early childhood centers and private and alternative school models – will garner continued interest as they address longstanding supply/ demand gaps and capitalize on K-12 school choice tailwinds. In addition, special education, staffing and mental health services, school safety and security solutions, and more broad-based enterprise administrative software businesses remain compelling K-12 themes for investors.

In the postsecondary segment, we expect to see enrollment and analytics businesses actively in market as institutions continue to sharpen their efforts across the student lifecycle and enterprise performance management. Additionally, the current Administration is breathing life back into the private postsecondary institutional ecosystem; we anticipate more investors will take a harder look at the innovative, workforce- and outcomes-aligned players demonstrating success with students and working adults.

From an HCO perspective, the upskilling and reskilling theme will continue to propel considerable activity. An emphasis on technology-enabled vocational and technical training models will persist as industries and geographic regions retool and rebuild their workforces. Similarly, industry- and functional-specific businesses that present long-standing customer relationships, strong brand awareness, and smart investments in emerging tech-enabled development and delivery models will generate interest from those chasing opportunities in this part of the market.

Across all these segments, we expect M&A to outpace investment activity, as sponsors seek platforms and strategic acquirers seek to reinforce their market advantage and positioning.

***

We are actively tracking investment opportunities both currently in and coming to market this year. We encourage you to stay connected to our consulting and banking teams to learn more and stay current on broader sector headwinds and tailwinds.

*Tyton Partners tracks education sector transaction activity through various public and proprietary sources. All announced deals are reviewed to ensure accuracy of data and alignment with methodologies developed across more than a decade of monitoring the landscape.