Beyond Partnership: The Integrated Model of the College of Saint Benedict and Saint John’s University

August 20, 2025 BlogIn our second edition of Five for the Future: Spotlight on Transformative Institutional Partnerships, we turn to the…

The education-to-workforce pipeline is under pressure – and changing fast. The World Economic Forum notes that employers around the world are prioritizing reskilling as AI and automation reshape nearly every industry. Yet even as companies prepare for disruption, many are still struggling to hire: The Times recently reported that nine in ten businesses face persistent skills shortages, especially in entry-level and specialist roles.

Earlier this year, in partnership with World Education Services and Strada Education Foundation, we published Catalytic Capital: Funding the Missing Middle in the Education-to-Workforce Ecosystem. We explored how catalytic capital—flexible, patient funding focused on impact—can help these solutions move beyond early success to reach learners and workers at scale.

Since publication, our team has continued the conversation through salons and working sessions with funders, operators, and advisors. This dialogue has surfaced important questions and new use cases about how the field can move from recognition to action.

One of the biggest challenges for investors (and entrepreneurs/operators) is understanding “when” and “why” catalytic capital is the best source of capital to fuel growth.

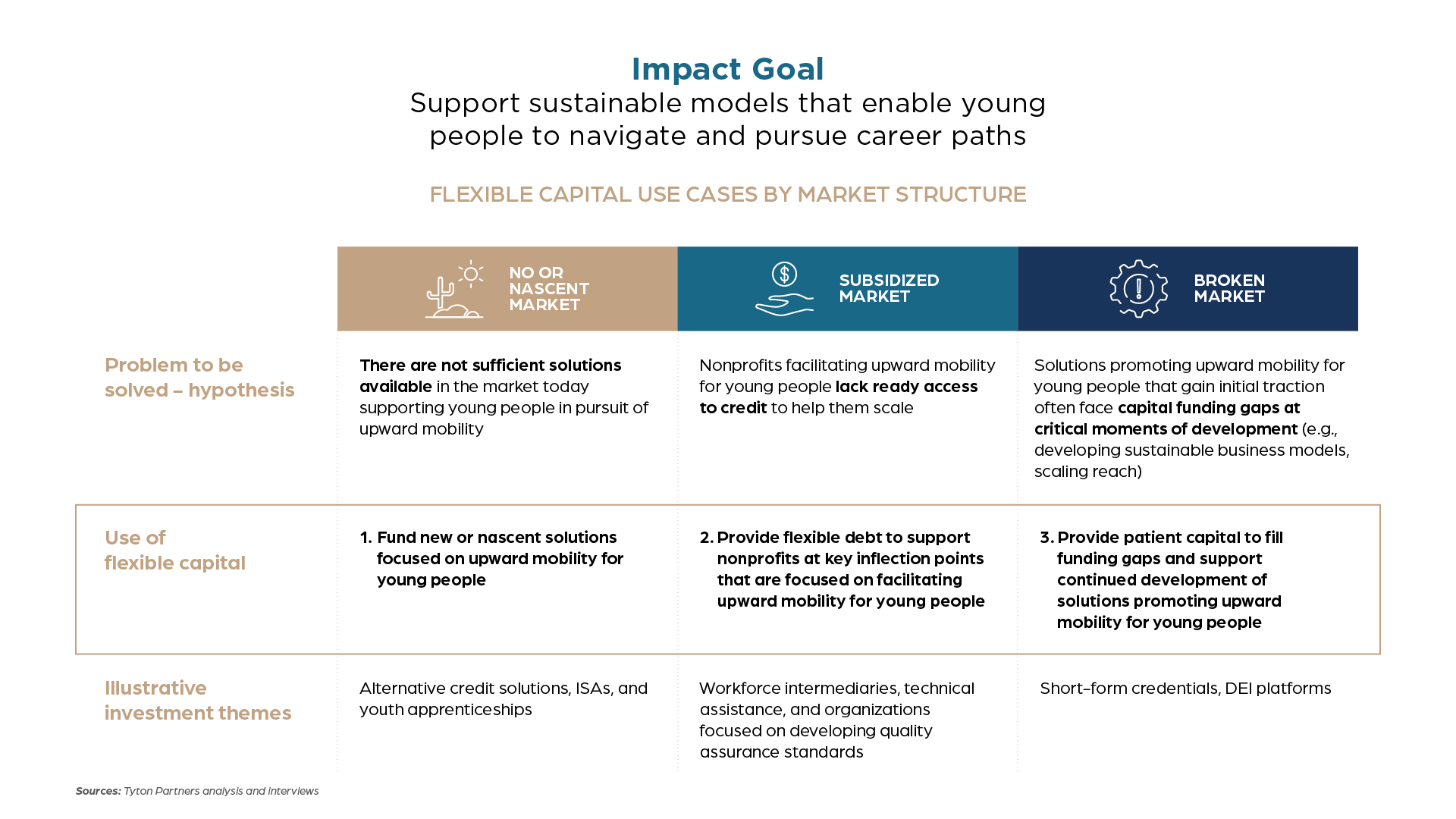

We described three situations of market failure in workforce where catalytic capital can be the most powerful approach:

The table below illustrates the “use cases” and illustrative investment themes that may be appropriate for catalytic capital:

In practice, one or more of these use cases can be pursued to drive impact – knowing when and how to use catalytic capital versus other forms is critical to an integrated and impactful investment strategy.

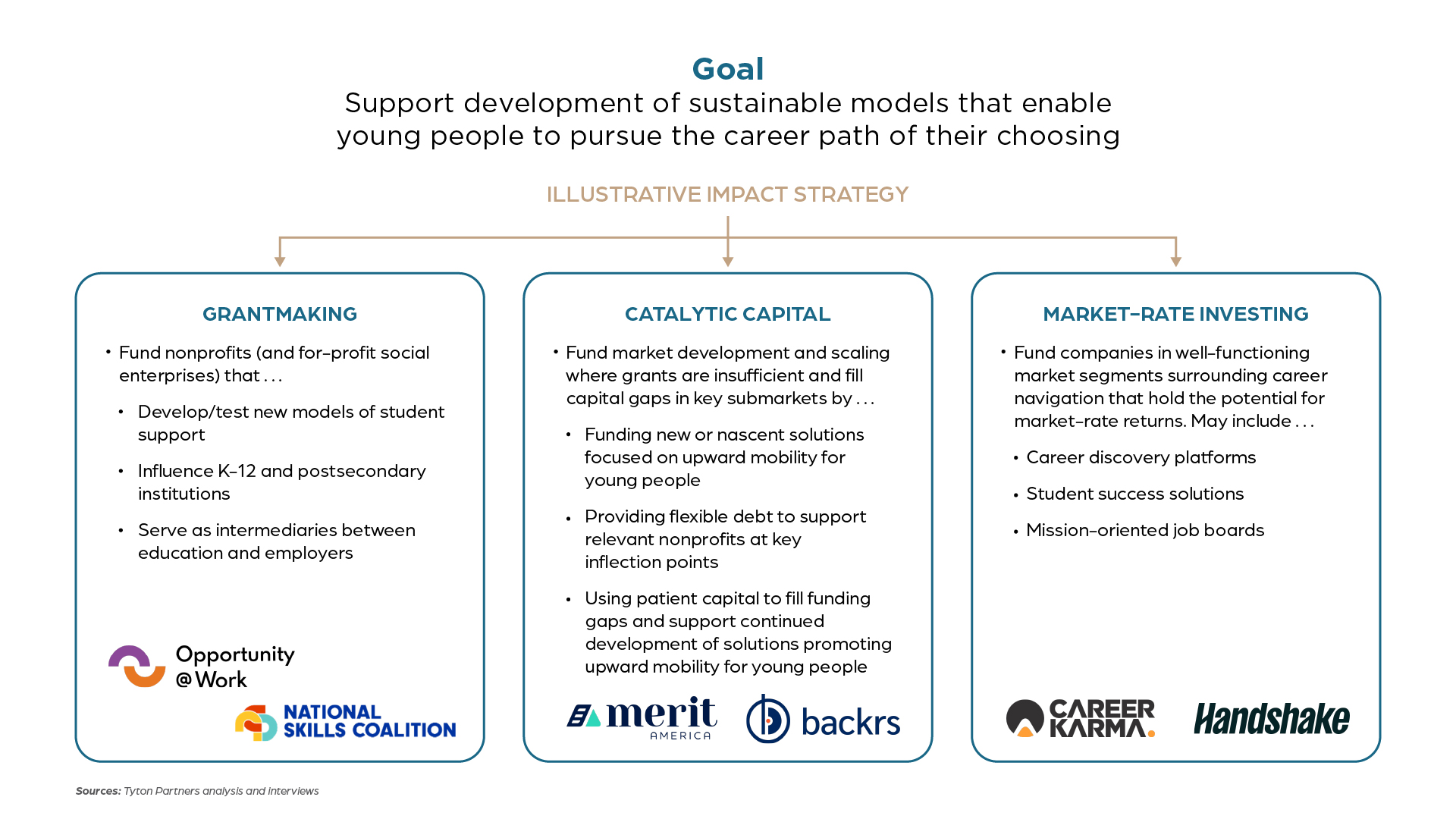

The salons also reinforced that catalytic capital is most effective when integrated into a broader strategy. The example below shows how different forms of capital can work in concert:

One theme that came up repeatedly in these discussions was the need for more structured guidance and a “roadmap” for how to invest using catalytic capital. To address this, we developed two practical decision trees that help investors determine when and how to deploy catalytic capital alongside other funding types.

These decision tree frameworks, which we will introduce in our upcoming webinar, don’t dictate one “right answer,” but they do prompt essential questions about return expectations, desired impact, and market conditions. For many participants, simply mapping these factors clarified why certain funding approaches felt misaligned with their goals.

Running specific investment opportunities through this rubric can help funders clarify priorities, pressure-test assumptions, and build confidence in deploying catalytic capital alongside grants and market-rate investments.

Perhaps the most valuable insights have come from candid practitioner reflections. In a pre-salon attendee survey, 80% of participants said they already deploy catalytic capital in some form, yet many described a lingering discomfort about when and how to use it effectively.

Common themes included:

Throughout these discussions, what stood out was the tension between a genuine desire to innovate and the practical realities of deploying capital in ways that balance mission, risk, and accountability. These are not trivial issues—and they underscore why catalytic capital continues to feel like unfamiliar territory for many investors, despite its long track record in other sectors.

Catalytic capital isn’t just a funding mechanism—it represents a mindset shift. It asks investors to re-examine old assumptions about risk and return and to design strategies that meet the realities of the markets they seek to influence.

In the months ahead, our team hopes to provide support to practitioners navigating these questions through salons and additional publications. For those interested in following this work, or contributing to it, I invite you to reach out directly or join our upcoming webinar (REGISTER HERE), where we will be discussing the decision frameworks focused on when and how to use catalytic capital, along with specific workforce company use cases.

You can read the original paper and request the full presentation deck here:

Catalytic Capital: Funding the Missing Middle in the Education-to-Workforce Ecosystem

If you’d like to discuss how catalytic capital strategies could support your firm’s impact objectives, I would welcome the conversation at amainelli@tytonpartners.com.