Beyond Partnership: The Integrated Model of the College of Saint Benedict and Saint John’s University

August 20, 2025 BlogIn our second edition of Five for the Future: Spotlight on Transformative Institutional Partnerships, we turn to the…

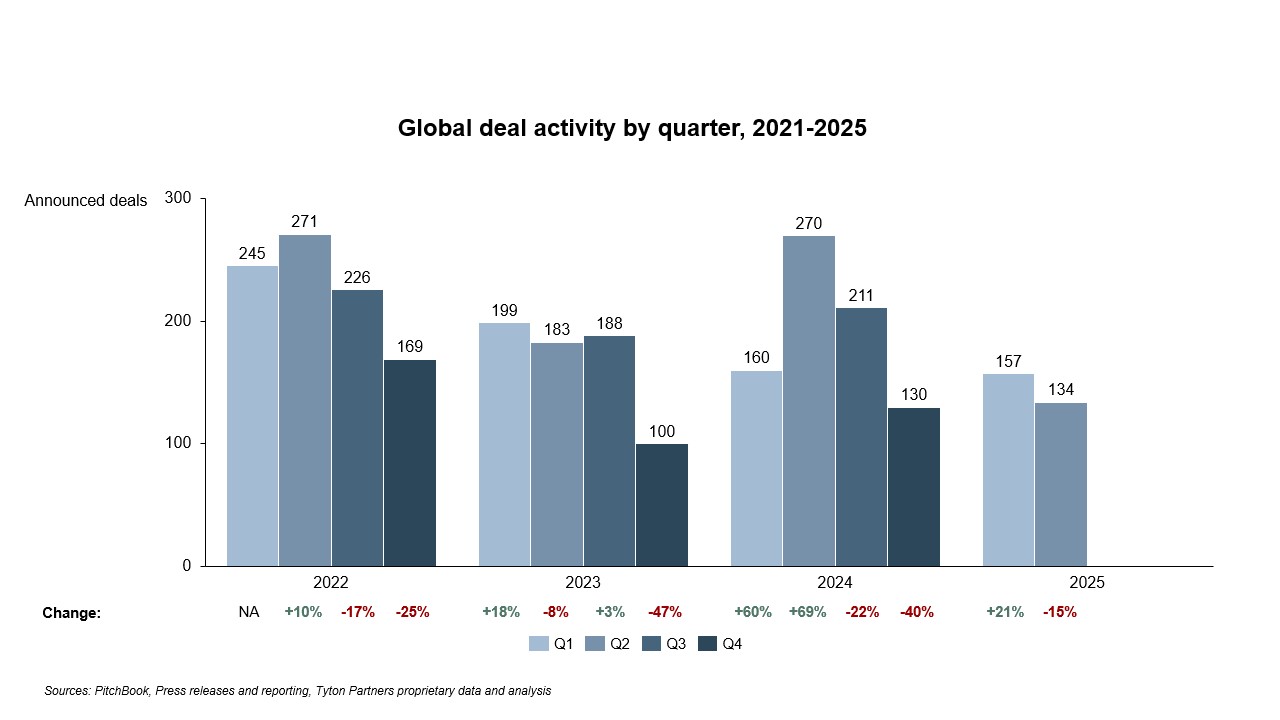

Despite investor optimism entering 2025, the first half of the year has not delivered the rebound in deal activity many anticipated. In 2024, the education section offered a glimmer of recovery, with transactions increasing after the 2023 downturn. However, volatility in the macro U.S. environment has proven challenging for investors across many industries, including education, resulting in a further slowing of deal activity across most segments we track.

Softness in transaction volume – particularly in Q2 – raises caution flags for the balance of the year and tempers expectations that 2025 will mark a clear inflection point. Pent-up demand among investors (and their LPs) and a growing logjam of companies seeking to come to market continue to suggest the potential for a flurry of activity. But timing is everything, and right now, it seems most folks are simply waiting.

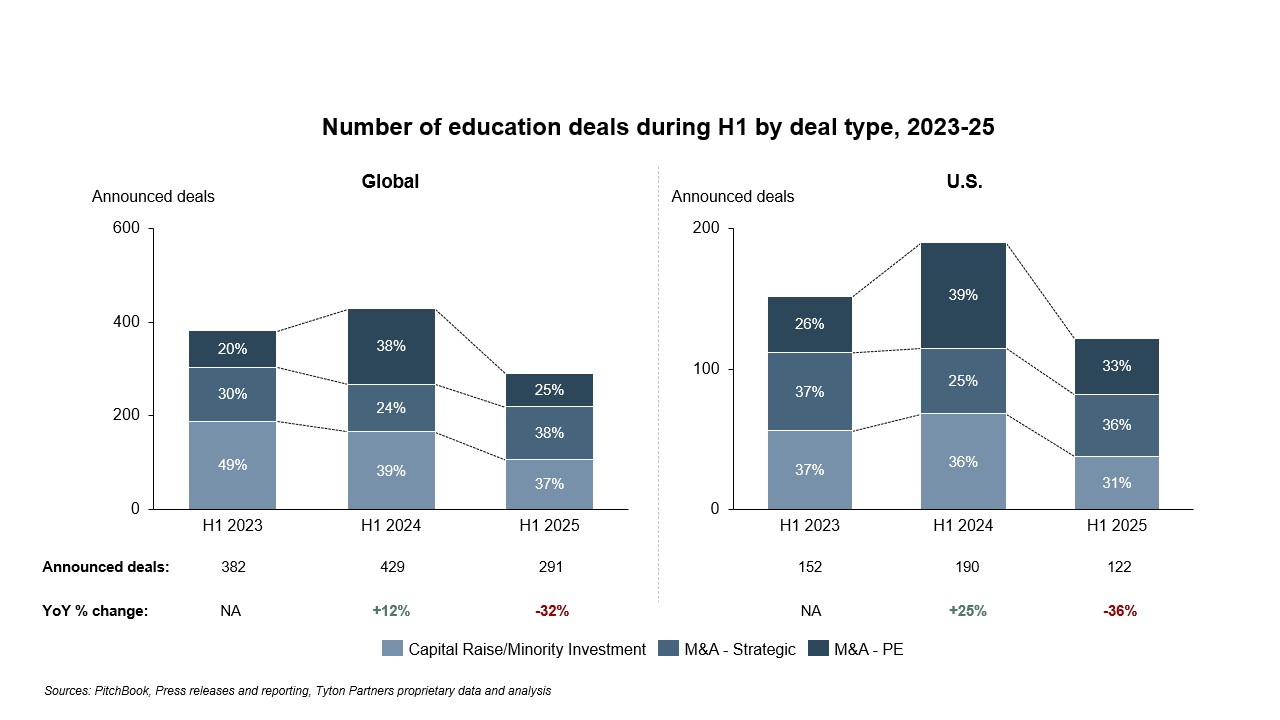

The education sector has seen a notable contraction in M&A and investment activity through the first half of 2025 relative to both 2024 and 2023. Total global education deal count in H1 2025 declined to 291, a 32% decline from H1 2024 (429 deals). H1 2025 also represents a 24% decline from H1 2023 (382 deals). The U.S. deal market was softer than the global one, falling to 122 deals, a 37% year-over-year decline; investors remained wary of U.S. tariff and economic policies generally and intimidated by uncertain Federal legislative and funding environments for education-related markets and institutional customers specifically.

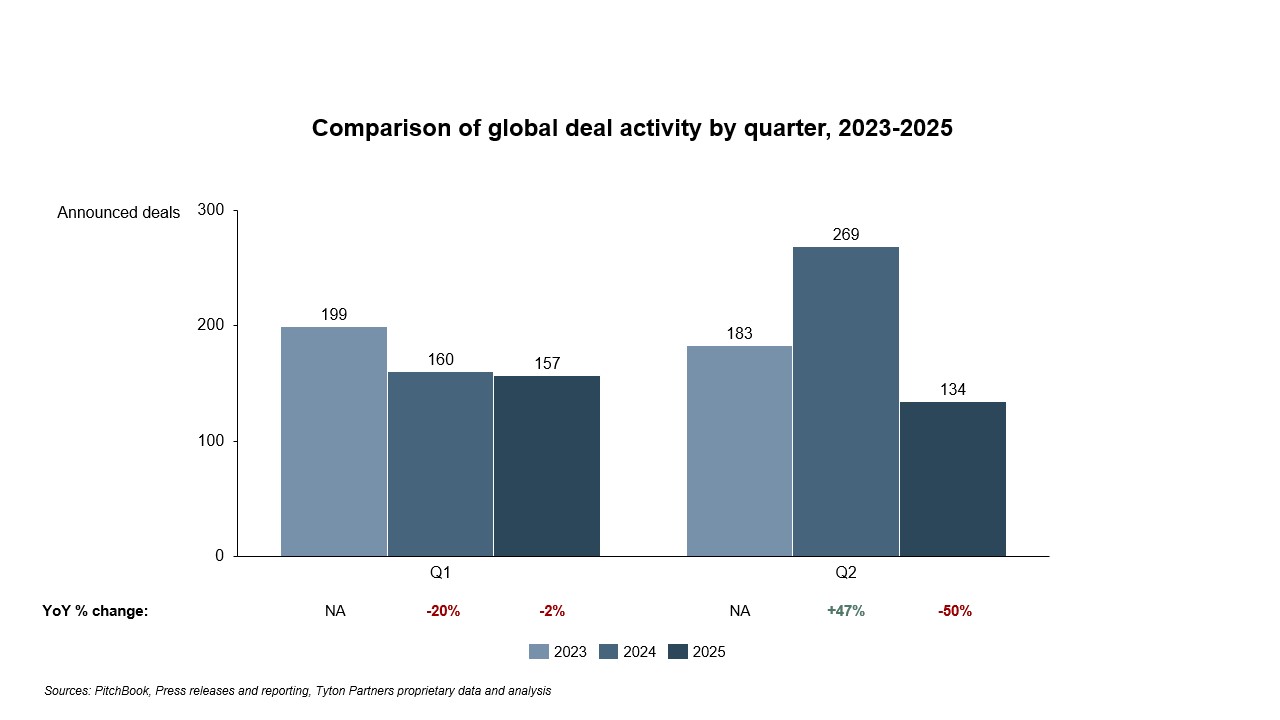

While the overall H1 softness is striking, the significant downturn between Q1 and Q2 may be a greater cause for concern. Investors remained optimistic in the early portion of the year, as Q1 deal counts still suggested the potential for a rebound year, seeing activity levels comparable to those in prior years. However, Q2 brought a significant drop-off, with only 134 global deals – and 51 U.S. deals – occurring during the period.

This intra-year deceleration reflects the greater macroeconomic volatility introduced across the first half of the year in the U.S. in conjunction with continued valuation mismatches between buyers and sellers, factors that may not relent in the near-term. For U.S.-oriented investors, the recent passage of President Trump’s “Big Beautiful Bill” and early July freezing of nearly $7 billion in K-12 federal funding, much of which had already been allocated and spent by districts, will inject further headwinds into the M&A and investment landscape during the early days of the second half of 2025.

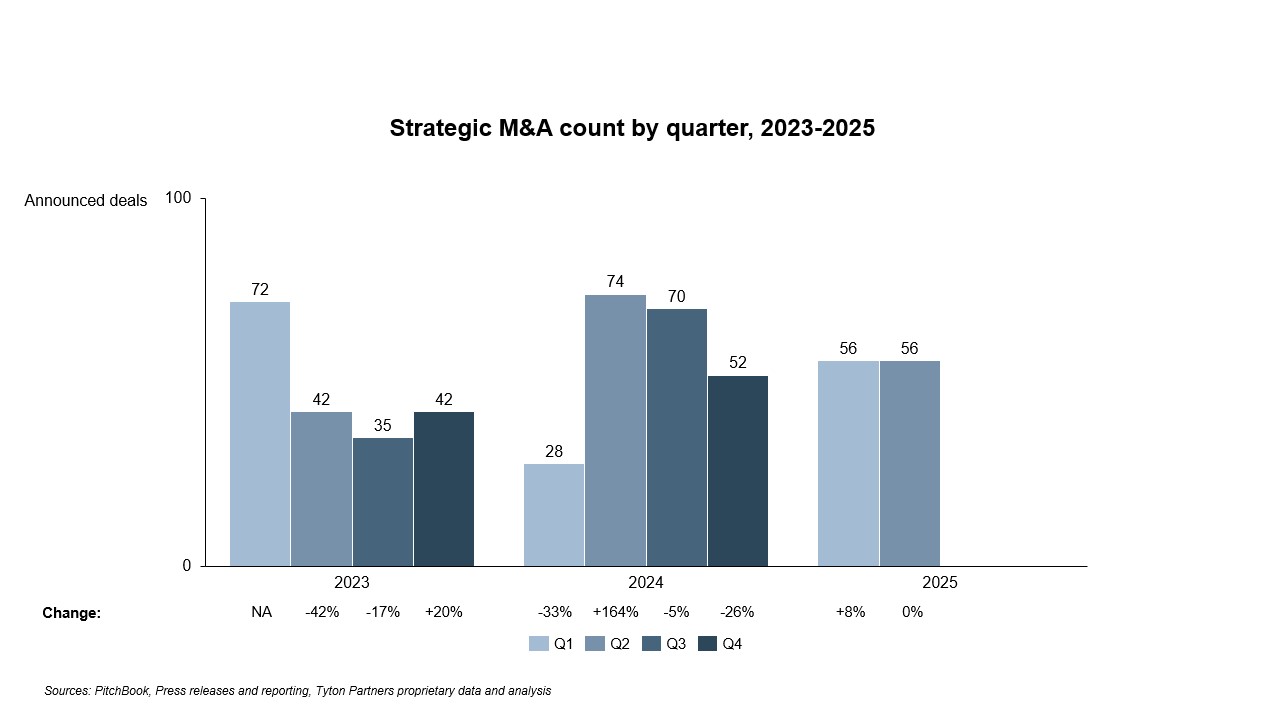

A notable bright spot in the slow start to the year has been the persistent level of strategic M&A activity. This segment experienced more activity in the H1 2025 than all but one half-year period since 2023; 112 strategic M&A transactions were reported globally, a 10% increase from 2024, with consistent activity across Q1 and Q2.

The current strength of the strategic acquirer is driven by established businesses seeking to fill portfolio and capability gaps as they seek to extend and protect their positions in established channels. Echo360’s acquisition of GoReact illustrates this trend (boosting skills-based learning, assessment, and AI capabilities), as does Ascend Learning’s acquisition of Clover Learning (broadening offerings in the healthcare learning space).

Alongside this strong strategic M&A activity is continuation of a persistent trend from prior years – the shrinking role of capital raises and minority investments in the overall mix of education deals. As of H1 2025, capital raise transactions represent 37% of global deals and 29% of U.S. transactions (down from 36% in 2024 and 37% in 2023). In a year-over-year comparison, these transactions fell 36% globally and 44% in the U.S., reflecting the challenging environment for all but the most compelling early- and growth stage businesses.

Finally, PE-driven M&A activity has suffered the most so far this year, with 72 global deals marking a 55% decline from H1 2024, and 40 U.S. deals representing a 47% decline from the same period. As noted in prior newsletters, these contractions in capital raises and PE-backed M&A are resulting in a narrower pipeline of future targets for both PE and strategic investors.

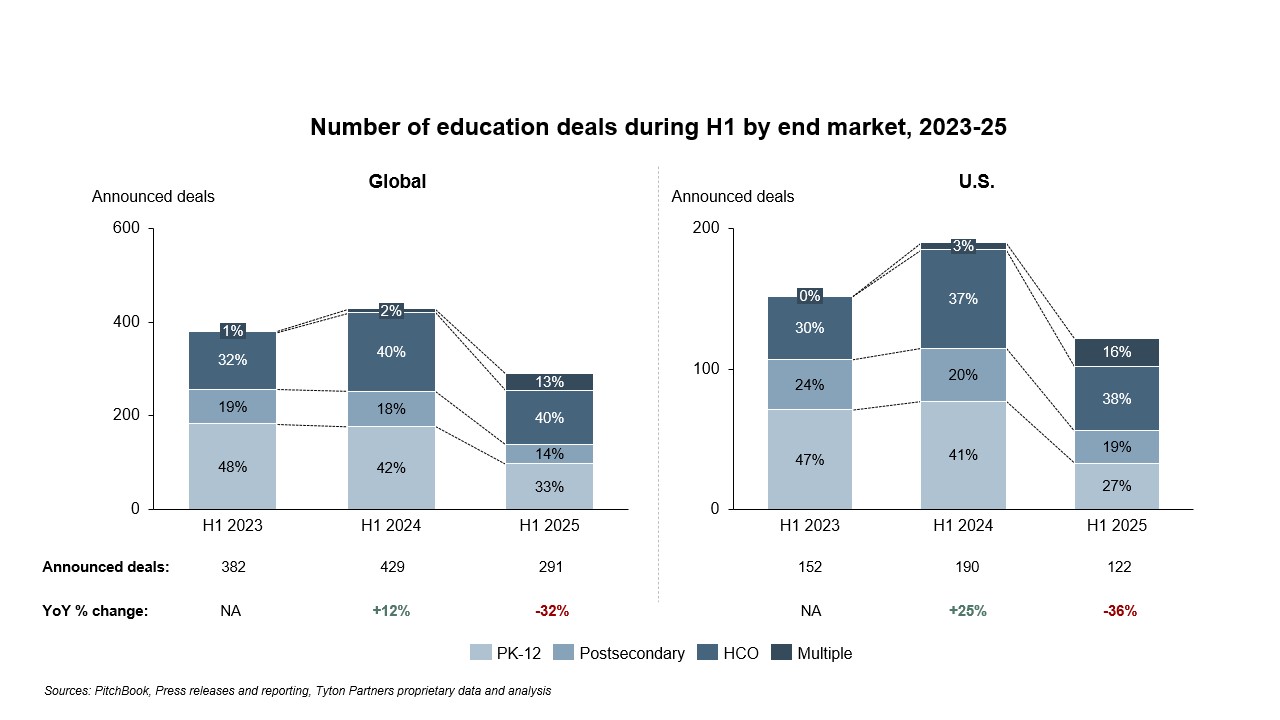

The human capital optimization (“HCO”) segment continues to take greater share of activity relative to PreK-12 and postsecondary, albeit in a significantly subdued market. Despite overall softer volume, HCO transactions represented 40% of H1 transactions in 2025 globally, and 38% of US deals. This relative outperformance likely reflects investor appetite for scalable reskilling, upskilling, and talent optimization platforms, as they avoid the more policy-influenced landscapes of PreK-12 and postsecondary markets. However, even HCO has not been immune to the broader slowdown – total deal volume in the segment is down 32% compared to H1 2024.

Of note, the number of multi-sector deals (“Multiple”) has also increased since 2023. These deals typically reflect technology providers, often focused on AI capabilities, that serve multiple customer segments with similar offerings. In many ways, these businesses are searching for a viable end market and, in lieu of committing to one, strive to play across multiple segments. Deals so far this year include capital raises for StudyFetch and Adaptive Reader and acquisitions of Daida and Identity Automation.

As HCO deal share expands, much of it comes at the expense of the PreK–12 segment, furthering a trend that started in 2023. While once the dominant end market in education dealmaking, it has steadily lost share, representing just 33% of global deals in H1 2025, and 27% of U.S. deals (down from 48% of global deals and 47% of U.S. deals in H1 2023). The specter of expiring ESSER funding generated initial cracks in investor’s PreK-12 confidence, particularly for classroom-based products and services; subsequently, the Trump administration’s aggressive efforts to unwind various PreK-12 programs and funding – including the July $7 billion freeze – have chilled districts’ purchasing this summer and further chilled this segment for many investors.

While many hoped 2025 would bring a return to pre-pandemic rates of deal activity, the reality appears to be significantly more modest. Despite signals of interest from many investors, persistent valuation mismatches, a tougher fundraising environment, and macroeconomic volatility are stalling momentum and the pace of execution.

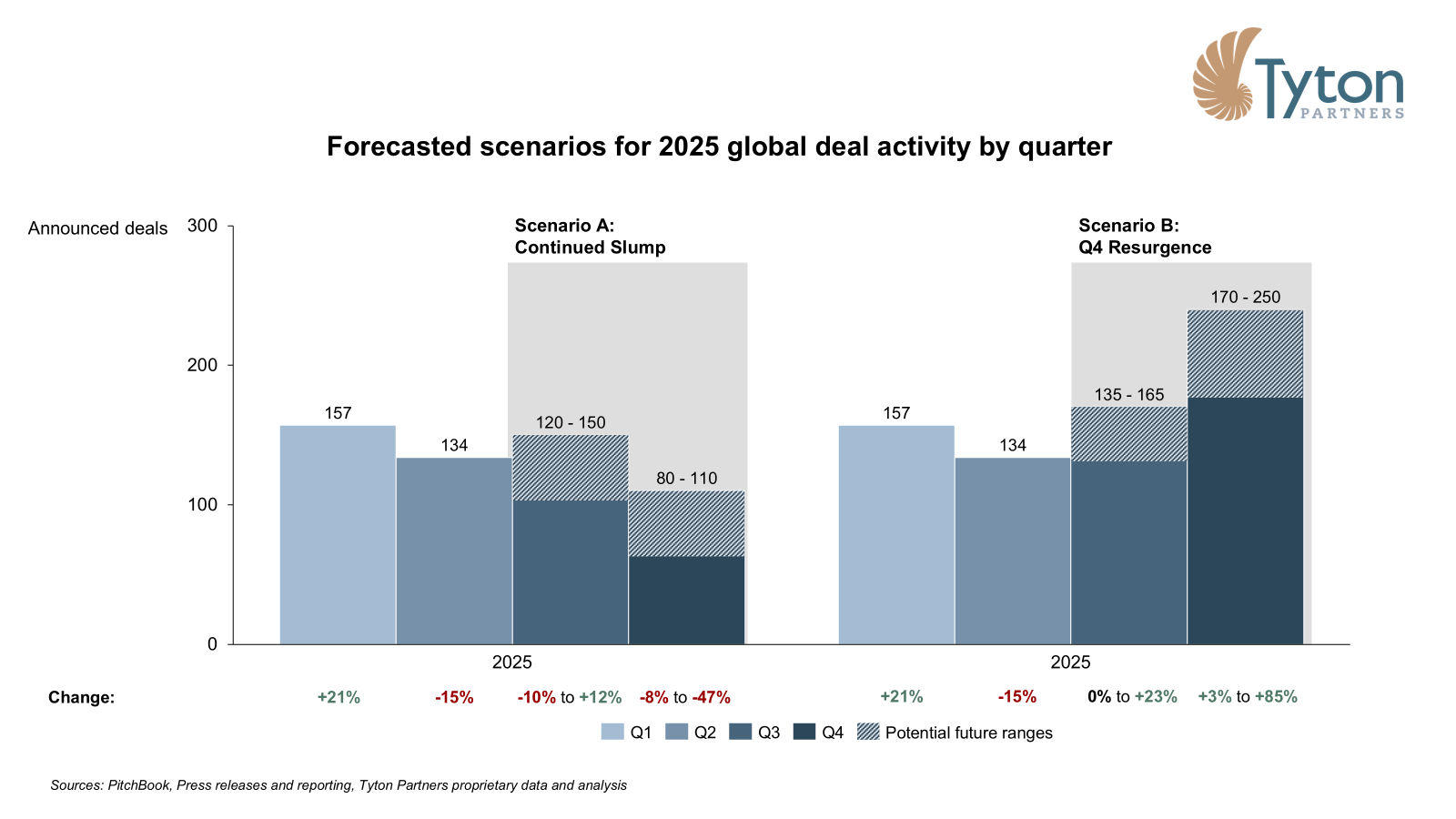

As investors consider their strategies for the remainder of 2025, the question of recovery remains on the minds of many. In 2023 and 2024, roughly 55% of deals occurred in the first half of the year, with a notable drop seen in Q4 activity both years. If prior years are predictive for 2025, we may see a larger softening than many could have imagined, with the extremely weak Q2 suggesting continued contraction through the end of the year. A slight drop in Q1 activity (down 2% compared to Q1 in 2024) followed by an extremely weak Q2 (down 50% compared to Q2 in 2024) leads to more questions for the back half of the year.

Given current market dynamics, we see two plausible H2 transaction scenarios.

The key question for H2 is whether investors feel comfortable bringing their mature, performing platforms – many of which are now approaching their typical PE hold periods – will come to market and lead to a rebound in transaction activity. If they do, we may yet see a second-half pickup; if they do not, we may be on the cusp of a rising number of continuation vehicles as owners try to protect and fully realize the value of their portfolio assets.

As the education investment space navigates this period of uncertainty, identifying and pursuing high-quality deals will remain a challenging process. Thesis-driven investors will have a keen advantage, seeing opportunities and understanding risks that less-committed players miss.

Keep in touch with our team at Tyton Partners to stay on the right side of your investment thesis and goals.