Behind the scenes of Otterbein University’s partnership with Antioch University

June 10, 2025 BlogWe’re excited to launch Tyton Partners’ new interview series, Five for the Future: Spotlight on Transformative Institutional Partnerships….

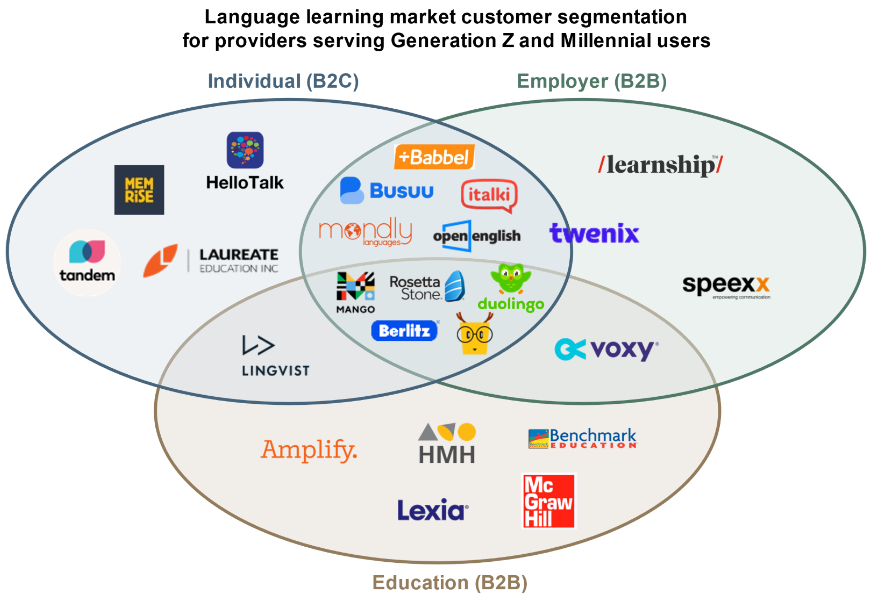

Online language apps exploded in popularity during the pandemic, but maintaining that momentum could prove an ongoing challenge as consumers begin to tighten their belts. Since reaching its all-time trading high in September 2021, Duolingo (NASDAQ: DUOL) shares have declined more than 47%, despite demonstrating continued growth in paid subscribers suggesting investors may be nervous about its future share of wallet. Duolingo and other leading providers like Babbel and Rosetta Stone would do well to consider diversifying into the employer benefits market based on data we recently collected in a consumer survey of younger workers.

In a Tyton Partners survey of Millennial and Generation Z (“Gen Z”) workers launched last week, most respondents indicated that language learning as a workplace benefit was somewhat to very important to them.1 When asked to rank language learning in comparison with other ‘nontraditional’ workplace benefits – such as mental health services, paid volunteer time, and personal development training – nearly 60% of respondents ranked language learning as their first or second most preferred workplace benefit. As employers continue to invest in workplace benefits, B2B sales for language learning providers offer an opportunity to capture additional customers.

Employer sponsorship of language instruction is not a new phenomenon. Among our survey respondents, 18% shared that their employer covers the cost of the language learning platform used. And the price points for employer-sponsored instruction are often more attractive to providers. Respondents receiving paid access to language instruction through work reported a higher average monthly spend than individuals paying for the platform themselves.2 For employers with a business need to foster foreign language proficiency, there are a host of available providers.

Indeed, many of the better-known consumer-facing apps have already taken steps to move into the B2B market. For example, Babbel currently partners with N26, a global company in the finance sector, leveraging Babbel’s language learning platform to improve collaboration and increase productivity across its workforce in Berlin, New York, Barcelona, Vienna, and São Paulo. Babbel’s partnership with N26 is also likely taking advantage of lower customer acquisition costs relative to its direct-to consumer (DTC) sales, in addition to the higher spend of B2B customers.

However, there may be another, less obvious opportunity for language instruction providers to attract employer dollars. As we noted in our recent newsletter, the tight labor market necessitates new approaches to attracting and retaining talent. Recent studies attest to the importance of personal and professional development in the workplace for retaining younger generations of talent. Retention remains a widespread and growing issue, largely because employers are not sufficiently investing in employees’ development.

In our recent survey, both Millennial and Gen Z respondents cited ‘personal growth’ as a top reason for learning a language, followed closely by ‘professional communication.’ More than 50% of Millennials included professional communication among their top reasons for learning a language, whereas Gen Z responses skewed toward personal reasons such as growth, the pursuit of hobbies, and communicating with family and friends. These expressed preferences track with what we know about younger talent – these workers are focused on both personal AND professional development. What’s more, they expect support from employers in accomplishing both.

Whether you’re an employer seeking to recruit and retain talent or a language learning provider aiming to achieve greater growth, we’re here to support you. Please reach out to us at any time to dive deeper into these dynamics or what might be next for online language learning.

1 “Gen Z and Millennial Language Learning Survey” (N=200); Tyton Partners survey and analysis

2 “Gen Z and Millennial Language Learning Survey” (N=200); Tyton Partners survey and analysis