Parents and students are attracted to 3-year bachelor degrees, but can institutions make the business model work?

September 23, 2025 BlogDifferentiation is going to be critical for colleges and universities to compete, and more than 60 are now…

Last month, we launched the first in a three-part series titled “School Disrupted,” describing the ways in which the K-12 market has been fundamentally altered by pandemic mitigation measures. Our own survey of parents identified a 9% decline in families enrolling their children in traditional public schools versus the prior year. This migration away from traditional public-school models and towards alternative solutions continues to be a prominent theme in private market investing. Last month, we saw several early childcare providers transact including:

We also saw continued interest in consumer-facing tutoring businesses:

Also related to the effects of the pandemic has been increased interest in commercial providers of social and emotional learning (SEL) supports for students, as schools across the country report increased behavioral issues. These programs are not without controversy as parents are increasingly wary of non-academic instruction in public schools, but investors seem undeterred:

In this month’s newsletter, we focus on the significance of the Frontline sale – perhaps the second most significant piece of private equity news in August after Kim Kardashian’s recent announcement. The question of where the largest EdTech players will land seems increasingly relevant as the cost of debt continues to rise and some large assets are poised to come to market.

Last month, Roper Technologies (ROP.N) announced plans to acquire Frontline Technologies from Thoma Bravo for $3.38 Billion. Thoma Bravo acquired Frontline in August 2017 for approximately $1.35B or 7.4x revenues. With Thoma Bravo’s backing, the company has made several acquisitions over the last five years meaningfully widening its school administration software portfolio. At the same time, this growth likely narrowed the range of potential exits for Thoma Bravo.

The publicly traded Roper (previously Roper Industries) is a former industrial products company that has transitioned in recent years into a diversified software company serving a range of vertical markets. Its current market cap is approximately $40B. The Frontline asset will remain independently managed but will be added to an existing set of software solutions for the education market contained in Roper’s Horizon Software suite, which includes campus card and cashless systems, food and nutrition service management software, integrated security solutions, eCommerce platforms, and campus housing management software.

In announcing the sale, Roper expressed enthusiasm for Frontline’s staffing software which it sees as a critical offering during a dramatic K-12 teacher shortage. In addition to these products, which encompass recruiting, hiring, development, and HR solutions, Frontline also provides back-office solutions for schools in attendance, inventory management, IT support, special education, Medicaid billing, data analytics, and of course SIS and ERP solutions. Given the combination of available COVID funding and school needs, the timing of the sale seems well-suited to both parties.

But what seems most notable about the transaction was that it was to a larger, diversified technology company. Ordinarily a company with a market position, brand reputation, track record of profitability, and enterprise value comparable to Frontline’s would be a natural candidate for an initial public offering. But K-12 companies have a spotty record as publicly traded companies, given the unique nature of the market they serve.

While Frontline sells administrative software on a subscription basis (SaaS) and should be somewhat insulated from cyclical trends as a result, school budgets are notoriously volatile and can contract dramatically when state tax receipts contract. There are dozens of examples of public K-12 companies that listed, went private, and never returned to the public market. The most recent example of this extreme volatility is Houghton Mifflin Harcourt (HMHC) which was taken private by Veritas Capital for $2.8B last April.

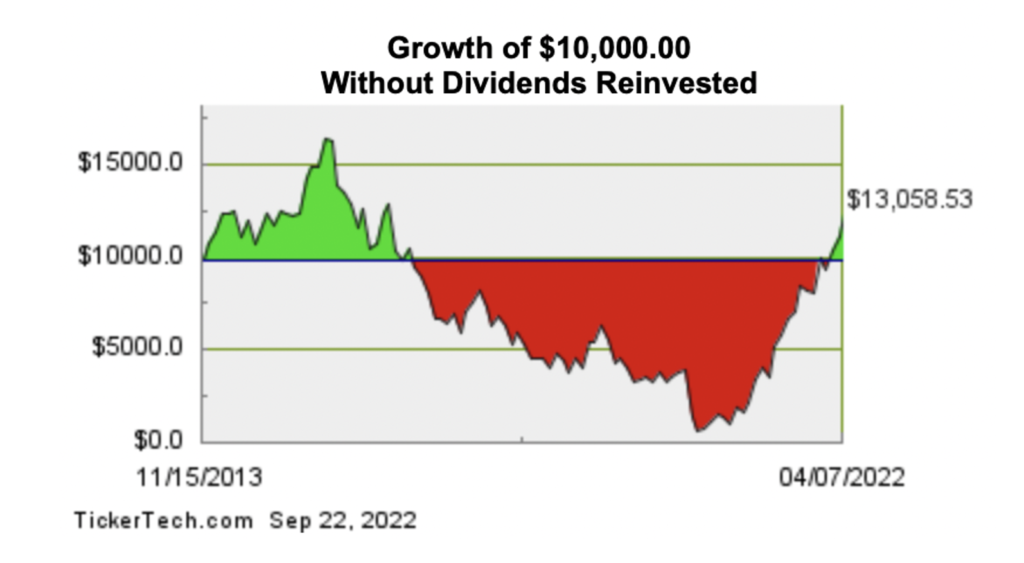

While HMHC stock yielded a return since its 2013 IPO of just over 30% (3.23% compounded), during most of that period it was well underwater. This performance was not related to the transition from print to digital content, which the company weathered reasonably well, but impacted by the ups and downs of state textbook budgets and buying patterns. Even more problematic from the perspective of public market investors was the extreme volatility the stock experienced as a result. The overall return may be considered acceptable, if not exceptional, but success in the public markets is as much about a low Beta (volatility index) as it is about total return, and on this measure Houghton Mifflin failed badly. It is important to note that during this same period Pearson, also publicly listed, chose to divest its K-12 business entirely.

Frontline may experience the same ups and downs associated with volatile school spending that HMH experienced, but its effects will be muted inside Roper by the parent’s exposure to other vertical markets. This means that during periods of peak tax receipts and flush school spending (or extraordinary Federal interventions), Frontline’s contribution may be obscured. However ultimately, the smoothing effect of diversification should work to Frontline’s advantage, allowing it to look through the economic cyclicality of the K-12 market and invest against a longer time horizon more associated with underlying secular trends.

We are happy to discuss these trends or others in the sector any time.