What We’re Thinking About in Impact for 2026

January 21, 2026 BlogThe education sector is navigating a fundamental shift. Market forces are driving consolidation, capital is more selective, and…

Weighing the relative merits of fixed and variable costs is not unique to education. Earlier this month, a notice to renew my City Sticker to park on Chicago’s streets arrived in the mail. I wrote the $91 check and tucked the receipt close to last month’s $158 bill to renew my registration. As I weighed these and my other ongoing auto-related expenses (e.g., insurance, maintenance), it begged the logical question: wouldn’t it be cheaper to just Uber everywhere? Quality, control, convenience, and cost are all considerations when making that decision, with enough points in favor of car ownership—“Didn’t I miss a flight last month because Uber kept canceling my ride?”—to keep me writing the check(s) and move about my day.

Now more than ever, K-12 superintendents are grappling with similar, albeit more consequential, types of questions. The question around using a variable or fixed cost approach is pressing; from how to recruit and develop staff and tutors, to where and how they will support their special needs populations, to how to manage their bus operations. In each of these areas, increasingly persistent labor shortages play a critical role in swaying influencing district leaders to consider outsourcing functions that are key to running the district, while the comparative costs of outsourcing are also becoming more competitive relative to keeping functions in-district.

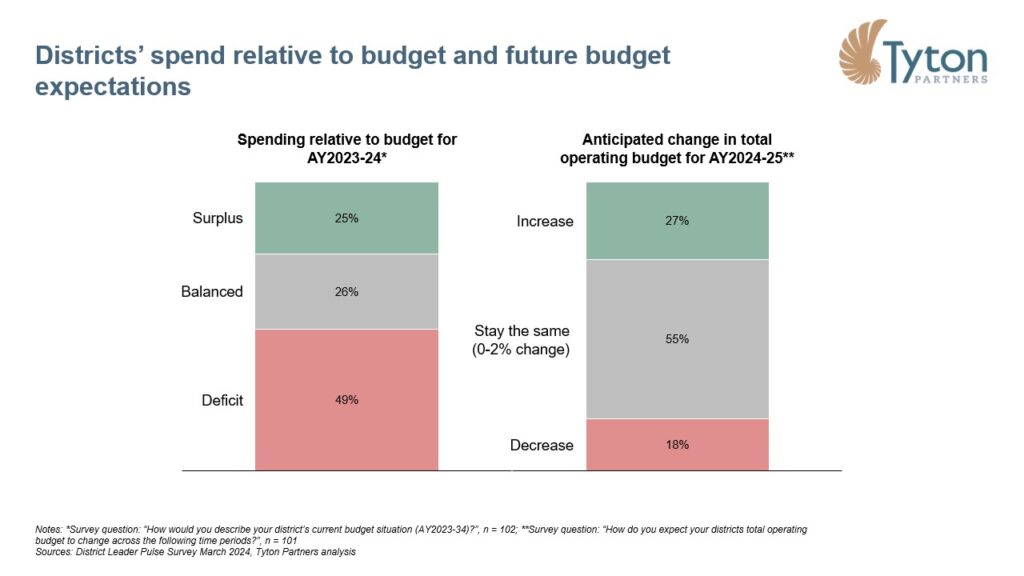

The benefits of leveraging third-party service providers have led some district leaders to consider outsourcing in areas that they traditionally haven’t, seeking quality solutions to complex needs that don’t carry long-term commitments (see: Chicago Public Schools could see a $391M budget deficit next school year). At a time when nearly half of districts are facing budget deficits and only a quarter expect relief in the form of an increase this year (see graphic below), financial constraints are forcing uncomfortable decisions.

In the near-term, the expiration of ESSER funding will magnify this pressure for many superintendents to do the same or more with less. In the three K-12 sectors profiled below (staffing, special needs, and transportation), we dig deeper into the dynamics and related transactions that highlight increased investor interest regarding this variable cost theme. We also explain the business model nuances that may play a role in which providers win out and become a more common approach to how districts stand up their future operations.

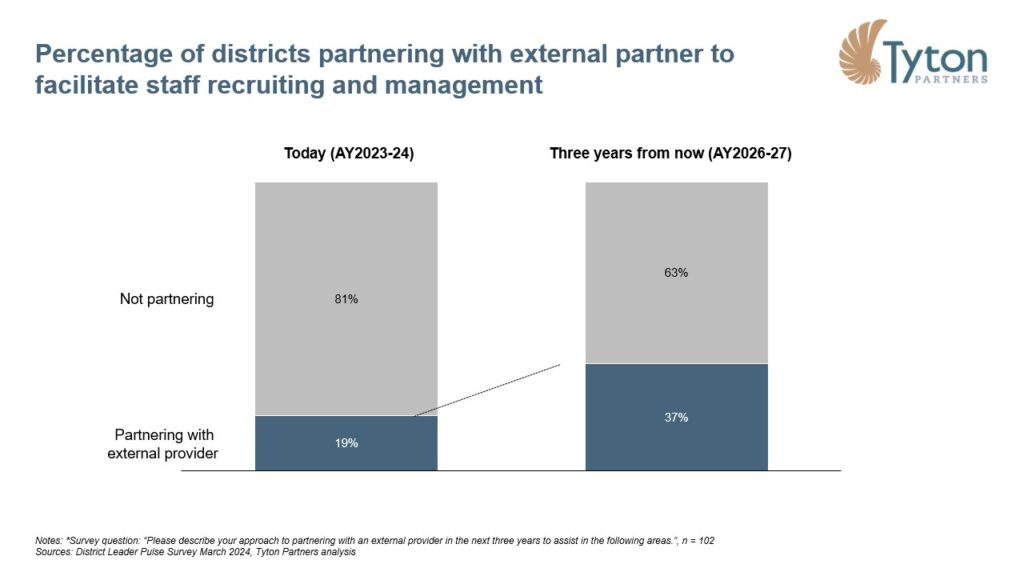

Once considered a core role of the central office, hiring and training has been an area where districts are increasingly engaging third-party support. The pandemic has left many classroom and student-support vacancies that still need to be filled in order for schools to function. Over the next three years, the number of districts expecting to partner with staff recruitment and management firms will nearly double (see graphic below).

Numerous providers have emerged seeking to alleviate staffing pain points for administrators, albeit with different approaches. Elevate K-12, which connects classrooms with certified virtual instructors, secured $25M in growth capital from Trinity Capital in May. In June of 2023, Swing Education, which supports a technology-enabled marketplace for districts to find substitute teachers, received $38M in series C funding from Apax Partners and Reach Capital.

PCG’s acquisition of University Instructors in late 2023 further underscores the growing interest in, and the many forms of, third-party staff augmentation. University Instructors’ portfolio supports districts across a variety of staffing-related areas:

All the areas above are unified around the goal of providing districts with more and better quality staff.

These types of models—with inevitable refinements and evolution—will persist as districts find partners better able to fill staffing gaps and do so in manners that may be more flexible for resource-constrained school communities.

Among the most difficult-to-staff positions are those that deal with special needs, and districts’ demand for variable-cost models is especially acute in this area. To serve students under IDEA with the Free and Appropriate Public Education they are entitled to, many districts struggle to find specialized staff and share frustration with the hard-to-predict volume and nature of the special needs they must support. When unable to fill special education positions, a decision must be made to either rely on third-party partners to augment their staff in this area, send students to intermediate districts that have the appropriate scale, or cover the cost for students to attend private schools.

This labor-related pressure has driven growth for providers with varying models. SESI (part of the FullBloom portfolio owned by American Securities) and operate as a partner to districts, serving students within district buildings or in standalone schools. Audax-backed New Story Schools and Gersh Autism are examples of providers that serve students with special needs (e.g., autism) through day-school models that increase the supply of appropriate support to students, with or without district partnerships. The loss of “control” when using third-party partners impacts some district leaders more than others, but the value of the variable cost model to flex up and down with changes to the special needs population is widely viewed as a benefit.

Tangentially related to special needs, mental health services are also an area where districts are struggling to staff full-time counselors and are weighing the relative pros and cons of variable cost models. Providers like Leeds Equity-backed eLuma, which offers online therapy services and solutions, allow districts to overcome hiring difficulties, avoid fixed costs associated with counselors, and scale the necessary supports for students who are increasingly in need post-pandemic. Hazel Health offers a similar model and recently secured an investment from UnitedHealthcare to expand its services across Iowa.

In both cases, third-party providers are filling a critical need for districts and proving success in supporting the most vulnerable populations, which should lead to a durable position serving K-12 districts.

District leaders are also grappling with staffing challenges— and potential solutions— outside the school buildings, with transportation being a prime example. The number of bus drivers working in schools in 2023 was down 15% from 2019, leaving routes unattended and parents of the ~50% of students who rely on these buses frustrated. The shrinking driver population suggests that internal solutions to this problem may be difficult to find, but third parties with innovative approaches to the challenge have driven to the scene to alleviate these pressures.

Zum closed a $140M funding round earlier this year and serves a broad spectrum of K-12 customers—from small private schools to large public districts—with end-to-end transportation services. 4mativ, a technology and performance management platform that optimizes fleet mix and routes and handles administrative-related tasks, raised an undisclosed amount earlier this year from Mairs & Power. HopSkipDrive offers another unique model in this area, supporting transportation needs for students who don’t fit on traditional bus routes or who need extra help, offering a ride-share-like service connecting students with vetted drivers through a platform that allows parents, schools, and students to monitor and track each ride’s status.

Whether making existing district operations more efficient and effective or providing the services that enable students to get to school, we expect providers like those noted to be a lasting component of districts’ approach to safe and reliable transportation.

Budgetary pressure is not new for district leaders, but it feels more acute after the stimulus years. As districts explore third-party partnerships to alleviate the pain, various markets and models are available to consider. If variable-cost approaches that apply technology- or services-oriented models align with your priorities and strategy, contact us to learn more about these opportunities. At Tyton Partners, we have extensive insights into the markets poised for post-ESSER growth and can help you find the right fit for your next investment in the K-12 ecosystem.