The stakes are higher than ever in today’s K–12 assessment environment. News outlets across the United States have captured the challenges that states, districts, and schools are facing as they prepare to implement new standardized assessments. Summative assessment providers are also feeling the pressure.

The introduction of the Common Core State Standards in 2010 led to the creation of two federally funded multi-state assessment consortia, the Smarter Balanced Assessment Consortium (SBAC) and the Partnership for Assessment of Readiness for College and Careers (PARCC), a move that impacted state-level autonomy in the development and administration of assessments and thereby the market for assessment providers. Our work to understand the implications of this market shift for summative assessment providers has borne the following high-level findings:

- There is no material change to the total size of the summative assessment market, which is greater than $1B. The dynamics are indeed shifting for how 31 states and the District of Columbia – members of PARCC and SBAC – procure and administer math and English language arts (ELA) exams. However, the size of the market is not shifting in a significant way. The per-student price of the new Common Core assessments will be higher for some states than their historical rates, while other states will see a per-student price decline; in almost all states, initial student performance levels are expected to be lower than previous state exams.

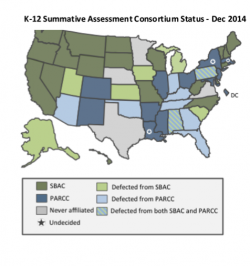

- More than 60% of the summative assessment market actually sits outside of PARCC and SBAC. Although PARCC and SBAC are dominating the national and local assessment conversations, the summative assessment market includes programs and services related to the development, delivery, scoring, and reporting of standardized assessments across other high-stakes subject areas outside of math and ELA. Tests for science disciplines and English language learners account for hundreds of millions of dollars in high-stakes assessments. There are also now 19 states operating independently from the two consortia.

- 15 states have defected from the consortia to date, raising questions about sustainability and renewed opportunities for providers. What used to be a group of 47 states participating in PARCC and SBAC is currently down to 32; this decline has raised concerns about the future and sustainability of the two consortia. The reasoning behind the defections from the consortia in some states has been connected to political backlash to the Common Core. The reality is that many state education agencies prefer to maintain control of their testing programs while cherry-picking the best of what the consortia have to offer, working all the while to keep their state costs low. Importantly for suppliers, these dynamics create “new” opportunities for them to retain their existing state contracts and bid on new ones.

- More flexibility – and supplier opportunity – exists within SBAC states. SBAC currently maintains 19 state members and has experienced a greater level of stability than PARCC. This is most likely a product of SBAC’s decentralized approach to assessment administration, providing a greater degree of autonomy to states regarding their testing partner. SBAC states are authorized to select their own supplier for test administration and scoring activities, thereby preserving opportunities for summative assessment providers to work with SBAC states on their Common Core implementation.

- 2015 and beyond will bring greater stability and more headlines. The 2015–2016 academic year will bring greater contractual stability to the high-stakes assessment market as states work through the logistics of full-scale implementation of Common Core exams. However, we expect to see more than a few headlines related to states and districts struggling with implementation of these new tests and the IT infrastructure needed to administer online testing. At the risk of stating the obvious, suppliers will bare most of the blame in these headlines.

The longer-term and more interesting issue relates to the future of the consortia. Our prediction is along two paths. First, the consortia will stabilize their role and service offerings, albeit within a much smaller sphere of influence than originally expected. Second, competition will increase from new or re-envisioned players. New consortia will be formed – as we have seen in the area of assessments for English language learners – and organizations like ACT and the College Board are sure to play a more explicit and proactive role in the K–12 high-stakes assessment market.