Catalytic Capital: From Recognition to Action in Education-to-Workforce Investing

July 8, 2025 BlogThe education-to-workforce pipeline is under pressure – and changing fast. The World Economic Forum notes that employers around…

In May, we detailed a few of the open questions relating to the impact of COVID-19 that we knew would be relevant for our workforce and corporate training networks. This month we’re back with updated views on those same questions, based on fresh data and several months of dialogue with companies and organizations on the front lines of the ecosystem.

Nearly a half a year into COVID-19, we’re beginning to see the early uncertainty of the spring evolve into a new normal for workers, employers, and companies and organizations focused on training. In that new normal there is opportunity. This month’s newsletter provides our most recent perspective on what sectors are proving relatively more resilient in terms of job loss and hiring as well as the possibility of alternative credentials to substantially expand in the months and years ahead.

If you’re interested in hearing more about our thoughts on the future of work, we are hosting a webinar on September 10th at 11:30 am ET in collaboration with SOCAP, titled “How Impact Investing Can Help Get People Back to Work.” Please register here. We hope to see you there.

We will also be attending ASU-GSV (September 29th – October 1st) this year as a sponsor, so if you plan on being there you can book a time with us in our virtual booth or reach out to us directly.

As always, we look forward to connecting with you on any of these topics.

Andrea Mainelli, Senior Advisor

Jeff Dinski, Managing Director

Which sectors will prove relatively more resilient during COVID-19?

As workforce-focused organizations seek to help new graduates, unemployed professionals, and job-changers navigate their way back to work and to better opportunities, they’ll benefit from carefully considering what industries are hiring at a relatively strong rate, and which are lagging.

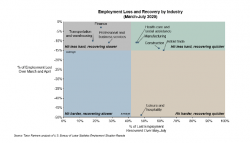

Over the past few months, we’ve seen hiring increase across all major industries. Over May to July, the overall U.S. economy added jobs every month. Of the roughly 21 million jobs lost in March and April, about nine million of them have returned. But these first few months of the economic recovery have been uneven, with some industries re-hiring more quickly than others. Industries like construction and manufacturing are steadily rebounding and have already added back more than half of the jobs they lost back in the spring. But other industries, like professional services have not yet recovered even a third of those jobs initially lost.

In the chart below, we’ve mapped U.S. Bureau of Labor Statistics data from eight industries that comprise nearly three-fourths of the U.S. labor force according to their jobs lost in March to April and their jobs gained in May to July.

There are some industries that have indeed proved relatively resilient since March. Health care, manufacturing, and construction can all be characterized as having below average job loss rates early in the crisis and above average hiring rates in the first few months of recovery. We anticipate these industries to be key focus areas for training and employment programs in the months to come, especially as newer data helps inform career pathways from jobs in harder hit or slower recovering industries.

There are some industries that have indeed proved relatively resilient since March. Health care, manufacturing, and construction can all be characterized as having below average job loss rates early in the crisis and above average hiring rates in the first few months of recovery. We anticipate these industries to be key focus areas for training and employment programs in the months to come, especially as newer data helps inform career pathways from jobs in harder hit or slower recovering industries.

Where and how will unemployed and underemployed adults seek to reskill or upskill?

Given the nature of the COVID-19 crisis, it appears likely that enrollments will be down this fall across most of traditional place-based higher education, though there is uncertainty about the magnitude of the decline. The longer-term question is where will adult learners turn to for learning and credentialing as we emerge from the direct effects of COVID-19 and the resulting recession? Will it be traditional colleges and universities, either place-based or online? Or will adult leaners’ demand shift to alternative credential models that simply weren’t available at scale in the aftermath of the previous recession? Early data points indicate that regardless of what COVID-19 means for degree-granting colleges and universities, alternative credentials will continue to grow across the postsecondary education and training landscape.

In May, we reported that alternative credentials like those offered by skills-focused bootcamps were already showing impressive growth prior to COVID-19. Over the past few months we’ve seen signs of both current and potential future growth of various alternative credentials. 2U, the publicly traded OPM and alternative credential supplier, reported at the end of July an impressive ~18% growth in revenue for their alternative credential offerings in the second quarter of 2020 compared to the first quarter.

Survey results published in July by the Strada Center for Consumer Insights indicated that roughly a quarter of adults plan to enroll in some form of education or training program within the next six months. Of the adults in that group, nearly two-thirds plan to enroll in education or training typically associated with alternative credentials.

Large technology companies have also stepped into the alternative credential space more fully during the past few months. Microsoft announced an initiative at the end of June to provide “free access to content in LinkedIn Learning, Microsoft Learn, and the GitHub Learning Lab, and [to couple] these with Microsoft Certifications and LinkedIn job seeking tools” for “25 million people globally by the end of 2020.” Google followed fast with their own initiative related to skills and alternative credentials, announcing the not only the launch of a “new suite of Google Career Certificates that will help Americans get qualifications in high-paying high-growth job fields—no college degree required,” but also the funding of 100,000 need-based scholarships to obtain those certificates.

It remains to be seen how the unemployment situation and learner’s demand for skills-based credentials attracts additional new entrants to the alternative credential market. This will be an area we will be closely watching over the coming months.