Parents and students are attracted to 3-year bachelor degrees, but can institutions make the business model work?

September 23, 2025 BlogDifferentiation is going to be critical for colleges and universities to compete, and more than 60 are now…

The Bottom Line

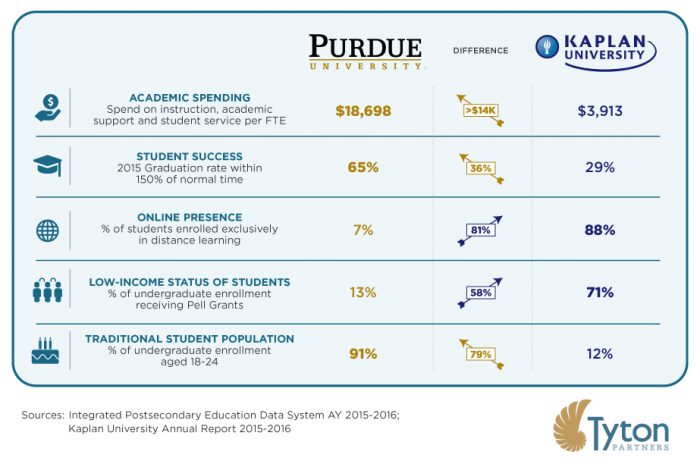

Purdue’s acquisition of Kaplan University has been the subject of much debate. Punditry aside, a look at the data offers a different perspective on the rationale for the combination: academic efficiency. Kaplan University’s online instructional delivery and related student support spending is nearly 4.5x lower than Purdue’s. Sure, graduation rates are lower, but not by nearly the same multiple.

Through this acquisition, Purdue is immediately gaining access to an online learning platform of considerable scale that may ultimately enable the combined institution to provide increased access to quality education at a lower cost. Pursuing “academic efficiency” is not a popular concept in traditional higher education. The question is, will this inconvenient truth now become a more open topic of conversation in the field?

Why expand Purdue’s online presence?

Why expand Purdue’s online presence?

Institutions are facing pressure to reduce cost for students. Purdue University has frozen tuition and fees at 2012-2013 levels, making this the sixth consecutive year the institution has not increased revenues through a tuition hike. Entering the online education market in a meaningful way increases Purdue’s enrollment and revenues in a cost-effective manner, while mitigating its “start-up” costs for a scaled online presence and avoiding the facilities costs inherent in any ground-based expansion effort. By expanding online offerings, Purdue will also expand its student body and serve students who are older working adults from lower income brackets. These students need the flexibility that online learning can provide; they also need support services to ensure persistence, graduation and career outcomes. These points have been well documented; the instructional efficiency of online learning has not.

Kaplan University’s online offerings provide Purdue a more cost-efficient delivery model. Kaplan serves 88% of students exclusively online and is spending less than $4,000 per full-time equivalent (FTE) on education and related spending; Purdue, which serves only 7% of students exclusively online, is spending approximately $18,700 per FTE. This dramatic difference will afford Purdue an opportunity to re-envision its instructional delivery model for a portion of its courses and a portion of the student body. Imagine the potential impact if a portion of the savings was reinvested in targeted student supports and financial aid to improve outcomes for those who are struggling most.

What prevents Purdue from scaling digital learning on its own?

Tyton Partners’ proprietary research reveals that some of the most crucial factors for digital learning implementation and scaling are:

Despite their importance, many institutions have not invested adequately in these factors, and doing so can be a considerable undertaking. By acquiring Kaplan, which already has 88% of FTEs exclusively online, Purdue can implement digital learning at scale without the time, resource investment, and financial risk that would be required to build out an online presence internally.

Purdue University’s challenge will be to integrate Kaplan and its competencies into the culture of the institution. So can leadership do it? While faculty opposition to the deal has been well-publicized, Purdue is not a stranger to innovative partnerships, technology development and the inevitable criticism that comes with new approaches. Purdue was the original developer of Course Signals subsequently commercialized by Ellucian, and last summer it developed and launched a new tool, Forecast, for its students to track their progress toward a degree. Purdue has been at the forefront of adopting innovative income share agreements as an alternative to private loans. Perhaps these experiences will equip Purdue’s leadership to navigate the difficult road ahead.

To learn more about scaling digital learning…

Tyton Partners advises institutions on teaching & learning innovation and tracks the evolution of the digital learning market through its series “Time for Class”. First published in 2015, the series will be updated with new insights from 3,500 postsecondary faculty and administrators in June 2017. Contact us here to discuss how the evolving digital learning market impacts your institution.