Behind the scenes of Otterbein University’s partnership with Antioch University

June 10, 2025 BlogWe’re excited to launch Tyton Partners’ new interview series, Five for the Future: Spotlight on Transformative Institutional Partnerships….

We all know the business case cliché on price strategy generally attributed to Gillette. King Gillette invented the disposable safety razor in the late 1800s but actually copied the pricing technique from early competitors. Thanks to perfecting the manufacturing technique for the blades and good marketing, the idea of selling an initial product at cost in exchange for a future stream of repeat, high-margin revenue was born. It only took about 115 years, but the pricing of disposable razors finally changed when Dollar Shave Club undercut the razor/blade model with its lower-cost subscription model.

More recently in EdTech, lots of venture capital has fueled the “freemium” approach to pricing. While “freemium” and razors make fodder for business school case studies, pricing a product or service in the education sector is more complex, and we definitely don’t have 115 years to figure out what works.

Your buyer might be distinct from your payer and your user. This multi-stakeholder dynamic isn’t unique to education, but it makes traditional willingness-to-pay methodologies challenging.

Take courseware and textbooks as an example: The buyer who sets prices is the college bookstore procurement leader. The user is both the instructor and the learner. The payer is the learner. Especially as this model continues to evolve, all three stakeholders’ willingness to pay should be understood.

Conventional wisdom is that price and value are tightly connected. With tangible products (shoes, cars, high-speed internet), the pros/cons of a high-price product are easy to evaluate. Edtech products and services often produce much less tangible value but can and do have an impact on catalyzing revenue, saving time/money or improving learner outcomes.

The EdTech industry is expending considerable effort to demonstrate outcomes and prove efficacy partly because its offerings deliver intangible value. With intangibles, how you price becomes a powerful signal about value.

With the adoption of new technology and an ongoing experiment with increased levels of outsourcing, higher education buyers aren’t just comparing your offering against “Option B.” They’re comparing you against doing nothing and zero incremental spending.

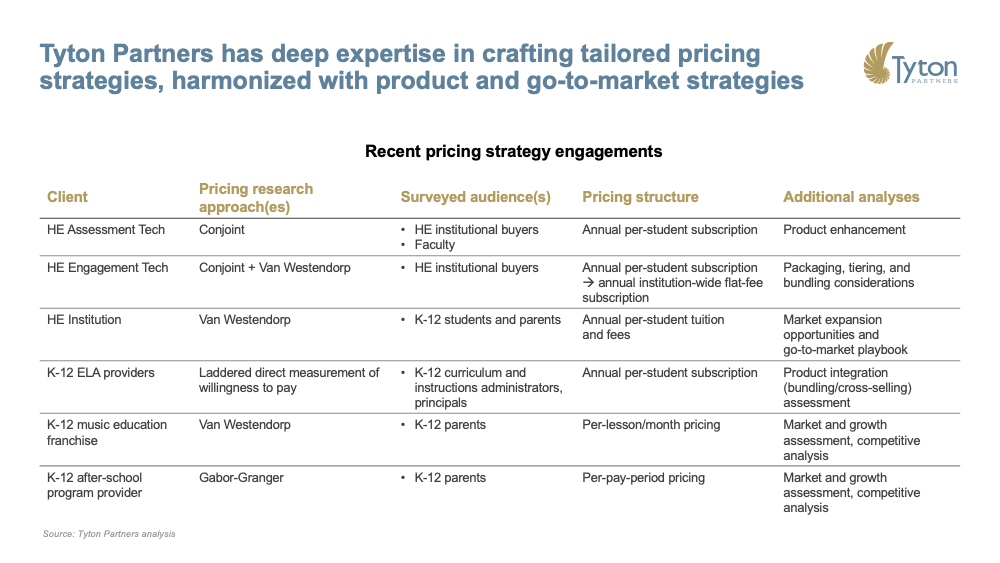

Answering these questions involves a mix of art and science, so we offer the following best practices from our pricing engagements.

Setting price involves determining your price model and price level. “Getting” the price involves your go-to-market decisions, your discounting policy and the effectiveness of the salesperson (in a B2B setting). Realizing the intention and value creation opportunity in your pricing strategy requires a methodical approach to both sides of this equation, and we’ve assisted lots of organizations with both aspects.

On the getting side, we find organizations undervalue the opportunity to gather real-time feedback on pricing by having a discounting approach that’s either too restrictive or too loose.

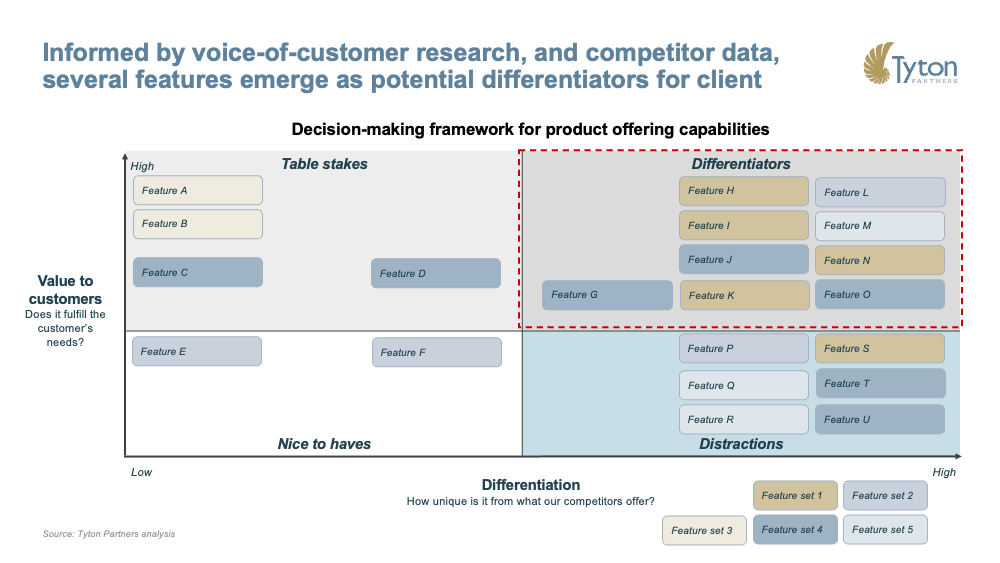

On the setting side, we find organizations’ aspirations to elevate their prices must be grounded in a product strategy that ensures that price and value are aligned. It’s difficult to increase price without delivering more value. Accordingly, several of our engagements have involved advising on the offering’s roadmap, grounded in voice-of-customer analysis.

Consumer research has developed a variety of techniques for measuring the relative value of features/functionality of a product relative to price—we have used conjoint analysis and Gabor-Granger as a starting point in the pricing strategy process. These techniques quantify relative differences in value; translating these differentiators to realized pricing gains requires careful consideration of how the value is distributed across all stakeholders.

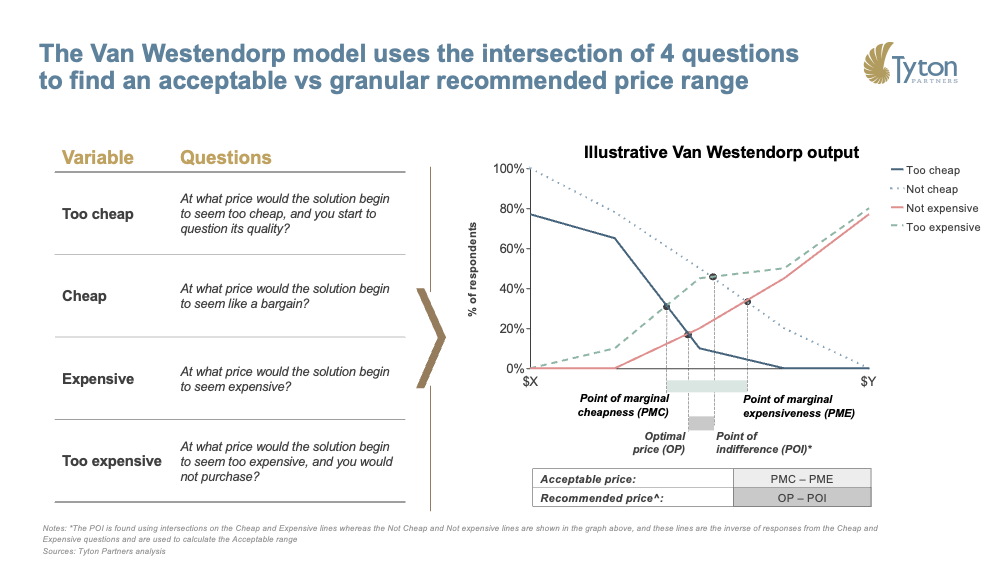

Finally, measuring willingness-to-pay in the higher education sector is a science but an imprecise one. Using the Van Westendorp price sensitivity meter in voice-of-customer research is one method that allows product and go-to-market leaders to establish an effective price range.

Developing a range of willingness-to-pay for a product creates an initial target for establishing a price level. Finalizing the price level requires close engagement and feedback from customers. We have had clients effectively use product advisory councils, focus groups or live sales situations to refine and finalize their price.

Whether you’re considering a price increase or decrease, taking a rigorous approach following these best practices will ensure your price strategy is an extension of your value proposition. Leaders throughout the education sector rightfully approach pricing with some trepidation—one wrong move and customer trust can be eroded.

However, we find that when approached holistically with how solutions have evolved to generate more value for customers—catalyzing revenue, saving time/cost or improving learner outcomes—your price becomes a powerful signal of value and an enabler of sustainability and expanded impact.

If you’d like to discuss this article and our research more, please don’t hesitate to contact us.