Catalytic Capital: From Recognition to Action in Education-to-Workforce Investing

July 8, 2025 BlogThe education-to-workforce pipeline is under pressure – and changing fast. The World Economic Forum notes that employers around…

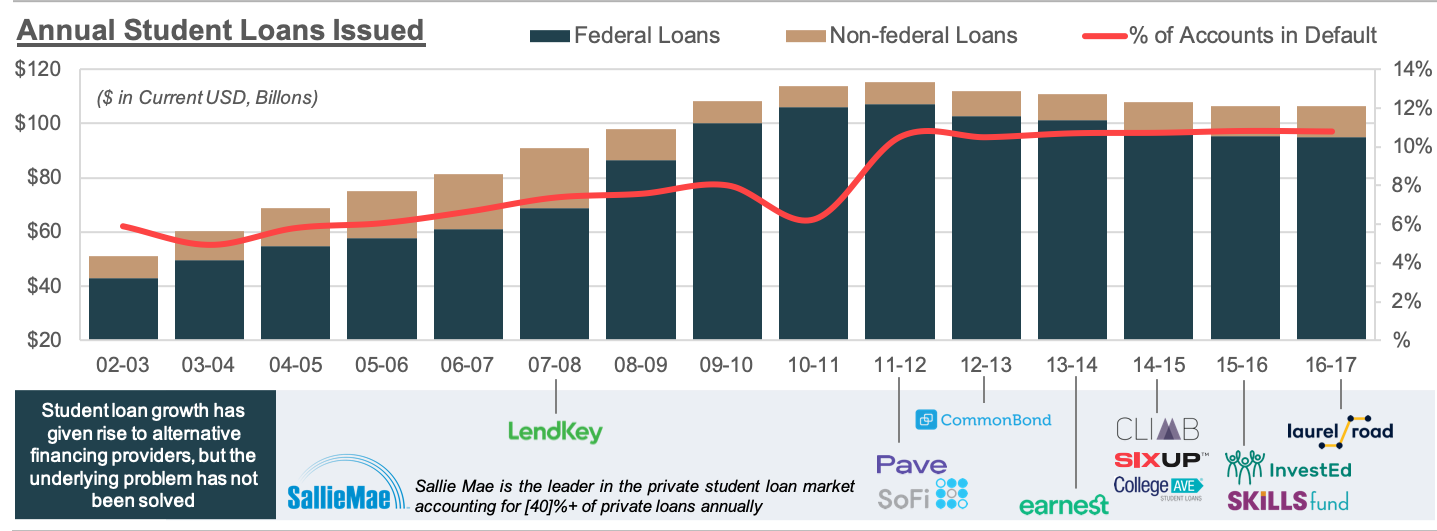

The predicament facing higher education is well chronicled: its costs continue to rise ahead of inflation and well ahead of direct government subsidies, forcing tuition prices higher even as its student population grows more diverse, less affluent, and less able to pay full price, without access to ever-higher amounts of aid and loans. And barring any dramatic would-be interventions by aspiring Democratic presidential candidates, the Congressional Budget Office projects that federal student loans outstanding will grow from roughly $1.5 trillion today, to nearly $2.5 trillion by 2025.

Traditional private lenders have grown increasingly ambivalent toward this changing student marketplace over the past 10 years, giving rise to new categories of student finance companies, each tackling different inefficiencies in the federal student lending market. Some, like SoFi, are focused on lifting attractive borrowers out of the undifferentiated federal portfolio through refinancing. Others are focused on providing tools and services to help prospective students make better decisions. A third category are finance companies focused more on program quality and outcomes than credit scores. All of them are attempting to solve problems that political players seem unable to effectively address.

***

In a fittingly symbolic action this month, one of these new wave lenders, Skills Fund, was acquired by one of the largest servicers of both federal and private student loans in the country. The Austin-based company was acquired by Goal Structured Solutions, a company that manages more than $27 billion in federal and private student loans. Financial terms of the deal were not disclosed.

Skills Fund focuses on programs for which federal funding is not currently available, including coding schools and short-term vocational programs. The company decides to partner with a school (or more precisely a program) before it partners with a student. It examines the school’s selectivity, the rigor of its curriculum and assessments, the length of the programs and, of course, its graduate employment outcomes. It has helped to encourage the consistency of outcomes reporting as a founding member of the Council on Integrity in Result Reporting, a coalition of bootcamps that in 2017 created a set of transparent standards.

Skills Fund works with more than 70 schools, including Bloc, Thinkful and Galvanize, as well as a handful of vocational schools, including one that teaches power-line repair skills and another focused on commercial driving training. Importantly, it has terminated agreements with a dozen providers and says it has historically rejected about one-third of the programs that have approached it. To date, it has funded roughly $150 million in loans to more than 10,000 students. Repayment terms range from 3-5 years and interest rates range between 8-10% (versus 6% for federal loans). Skills Fund claims defaults are in the “low single-digit” percentage range.

In further evidence of investor enthusiasm for this new approach to student financing, Climb Credit, a Skills Fund competitor that also expands options for low-income borrowers by partnering with high-impact education programs, raised $9.8 million in Series A funding led by Third Prime and New Markets Venture Partners; the round also included participation from Acumen, Impact Engine, Two Culture Capital, and Elizabeth Tse as well as existing investors 1/0 Capital, Learn Capital, Montage Ventures, Hill Hedge Funds, and Michael Sidgmore. Climb aspires to offer students valuable market feedback by easing pathways to the highest quality, most impactful programs.

In the student loan refinancing market, start-up Splash Financial raised $4.3 million in an early round led by CUNA Mutual Group, a PenFed partner, and Northwestern Mutual Future Ventures, the corporate investment arm of Northwestern Mutual. Splash Financial provides borrowers with student loan consolidation options at fixed interest rates ranging between 3.87% and 7.03% and variable interest rate loans ranging between 3.05% and 7.79%. These refinancing options provide qualified borrowers with the ability to simplify and potentially reduce the overall cost of their federal student loan debt; it provides Splash and its affiliates with the ability to form a relationship with prospective high-value clients early in their financial journeys.

Finally this month, Pay4Education, a financial literacy tool that attempts to help prospective students and their families make better-informed college choices by determining college costs and monthly affordability in advance, raised seed venture funding of $575,000 from Springfield Venture Fund, a division of MassMutual, with participation from Alchemy Group. The company was founded by experienced student finance and financial aid professionals who saw an opportunity to mitigate some of the damage associated with poor education funding decision-making and to fill a void they saw in the market for actionable advisory tools.

***

Each of these companies is addressing an inefficiency or outright deficiency in the student financial market today. And while some politicians and policy-makers have called for expanded federal funding for short-term programs, including coding bootcamps, we find it notable that the private market has been able to foster the growth of this nascent post-secondary category while at the same time providing greater transparency and improved consumer decision-making ability.

If big returns come to those solving big problems, we see this emerging sector as ripe for further investment. For private equity, we see platform options among the remaining independents to benefit from consolidation as well as from the ability to extend the value chain associated with serving these customers through their education experience and beyond.

PreK-12

Illuminate Education acquires Fastbridge Learning

Smoothwall acquires Safegaurd Software

Bright Scholar acquires St. Michael’s School and Bosworth Independent College

Reflection Sciences raises $1.3M

Raptor Technologies acquires Lobbyguard Solutions

Higher Ed

Human Capital Optimization

BARBRI acquires The Center for Legal Studies