Behind the scenes of Otterbein University’s partnership with Antioch University

June 10, 2025 BlogWe’re excited to launch Tyton Partners’ new interview series, Five for the Future: Spotlight on Transformative Institutional Partnerships….

The United States is living through a unique period of economic uncertainty as we grapple with inflationary pressures coupled with unprecedented labor market dynamics. Despite an anticipated cooldown, the labor market remains tight, especially as some industries still struggle to fill their talent needs. While it is clear economic upheaval has the potential to affect millions of workers, less has been said about how the impact sector is responding to these changes. Through our Tyton Partners Voices of Impact Pulse Survey, we set out to address these questions.

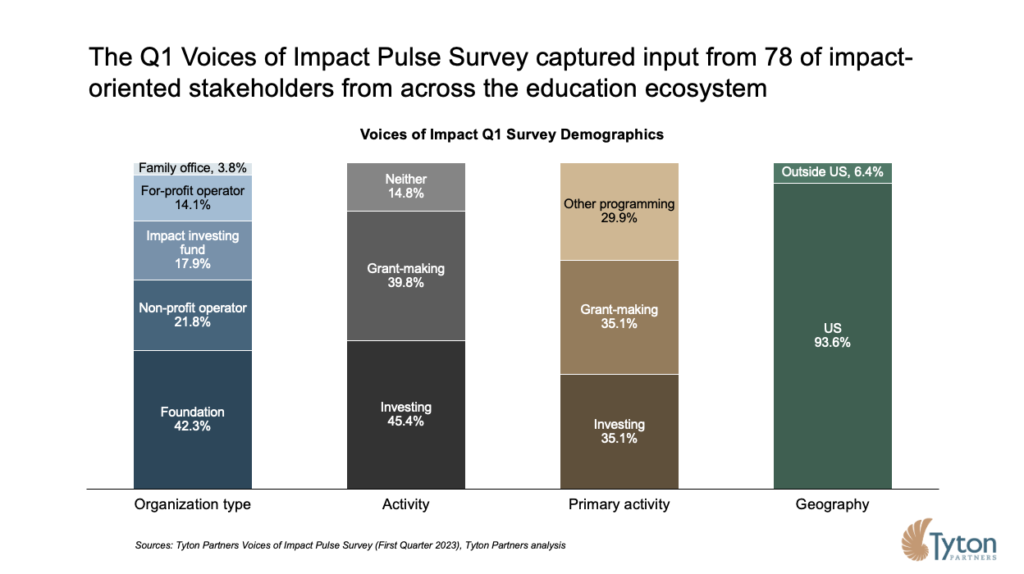

This March, Tyton Partners fielded the first of these surveys to a diverse set of impact-oriented stakeholders from across the education ecosystem, including philanthropists, non-profit operators, thought leaders, and other change-makers. The survey tracks the perspectives, priorities, and challenges of these stakeholders as they navigate a rapidly growing and evolving ecosystem on a quarterly basis.

While we see a clear shift in focus to workforce education, skills training, and alternative credentials, stakeholders hold vastly different economic outlooks and near-term priorities as economic uncertainty looms. In this report, we share a summary of key findings that have emerged from the data and welcome any questions and thoughts that come while reading.

We thank the participants in our inaugural survey, and extend a warm welcome to foundation, impact- investing, non-profit and other impact-oriented leaders in the education sector interested in participating in future iterations, please contact us at impact@tytonpartners.com.

The Voices of Impact Pulse Survey Q1 2023 received responses from 78 of the stakeholders listed above. While education is the primary vertical of focus for 69% of respondents, 92% additionally participate in impact-oriented programming in other verticals. Within education, respondents in our sample report equal levels of participation across different education segments, including K-12 (72%), higher education (64%), workforce (72%), and skills training / alternative credentials (74%), with the exception of early childhood education (36%).

38% of represented organizations drive impact through a combination of grant-making, impact investing, and other impact programming. For the purposes of analysis, we segmented participants into investors, grant-makers, and operators (depending on their specific area of insight and responsibility within their organization). As shown in Figure 1, respondents were nearly equally divided across these three categories, allowing us to segment and compare responses when key differences in perspectives emerge.

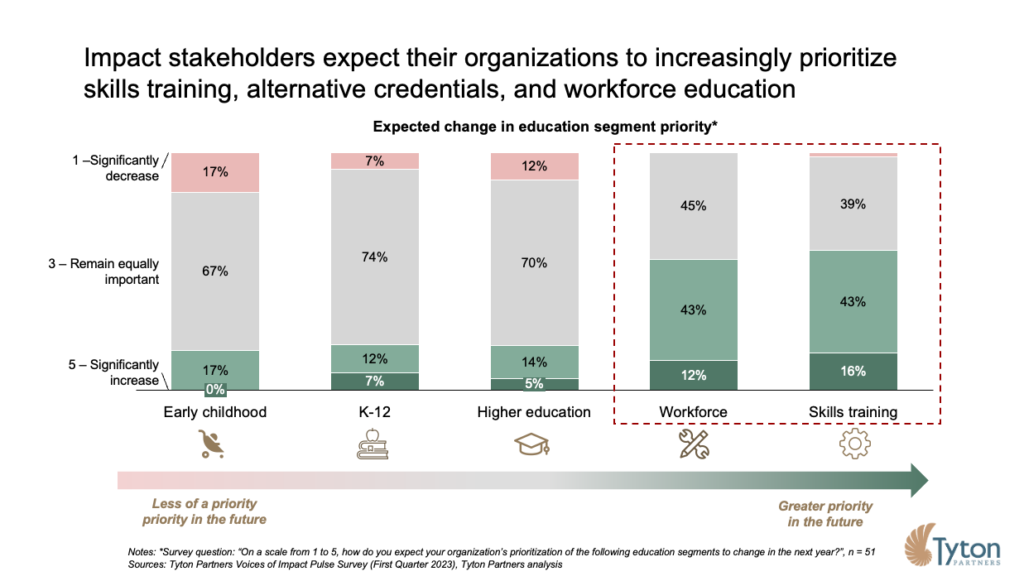

Impact stakeholders across the education ecosystem report a clear shift in focus to workforce education, skills training, and alternative credentials. When we asked respondents which education segments they prioritize today, 32% said K-12 education, followed by higher education at 29%. While this may be more reflective of our sample than the larger ecosystem, it is not altogether unsurprising that the two traditional stages of education experienced in the U.S. are the top priorities for 64% of respondents.

However, 55% and 59% expect their organizations’ focus on workforce education and skills training/alternative credentials to increase in the next year, while only 19% said the same for K-12 or higher education.

Activity from across the public and private sectors suggests this shift has already begun to materialize. The U.S. has historically lacked a comprehensive education infrastructure outside of K-12 and higher education, leaving workers of multiple skill and degree levels behind. The labor market challenges faced by companies during the COVID-19 pandemic exposed workforce education and skills training as a key area of underinvestment. Tyton Partners’ internal tracking suggests workforce and skills training companies accounted for only ~25% of education-focused capital raises in 2018, with K-12 accounting for ~50%. However, the annual number of investments in workforce education and skills companies has increased nearly 70% between 2020 and 2022, compared to 31% for K-12.

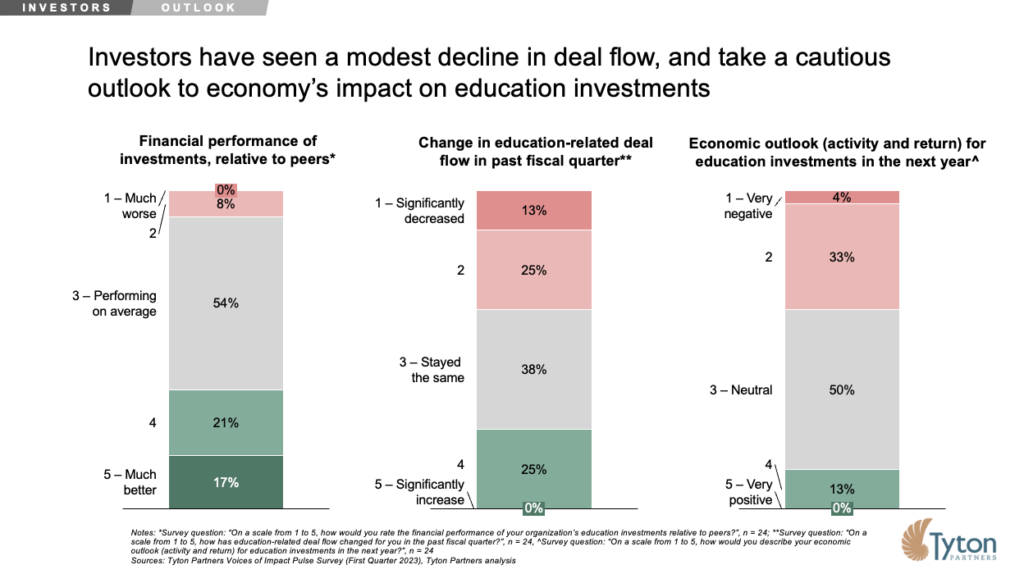

Stakeholders hold diverging outlooks on the future state and impact of the economy and are adjusting their priorities accordingly. Of the three groups in our panel, investors have the most pessimistic outlook for the economy.

While most investors feel they have financially performed on-average relative to their peers, 38% have reported a decline in education-related deal flow in the past fiscal quarter. In turn, 37% have a negative or very negative economic outlook for education investments in the next year, with only 13% holding a positive or very positive outlook.

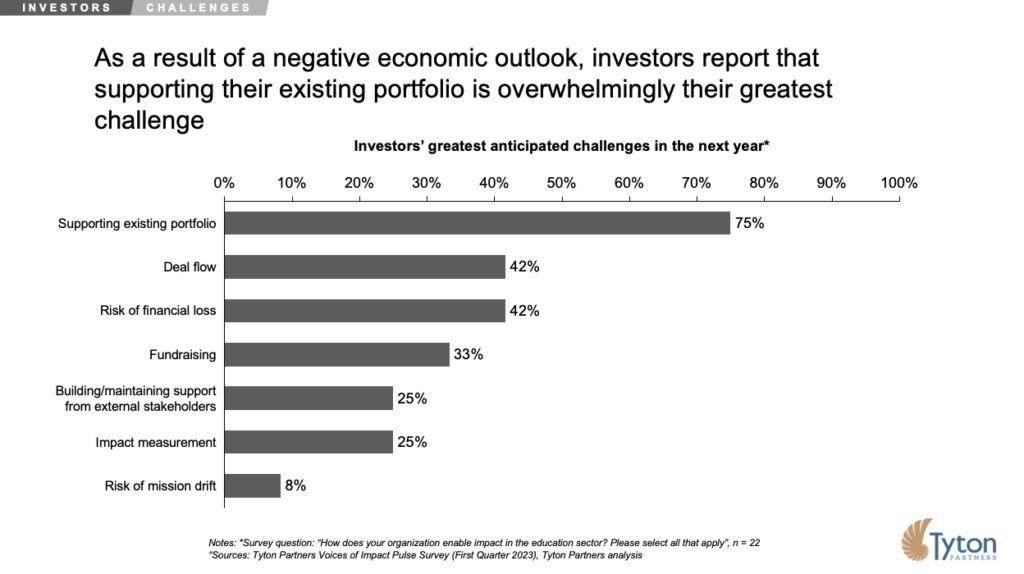

Impact investors who seek to balance impact and return are, like all investors, always wary of uncertainty and their concerns are more than jitters and they have begun to act on them. 75% of investors expect supporting their existing portfolio to be their biggest challenge in the coming year, signaling a shift in focus away from new deals to securing existing ones. 42% of investors also report significant concerns with the risk of financial loss and deal flow, suggesting the macroeconomic environment may deter investors from driving innovation in the private sector at the same rate seen between 2020 and 2022.

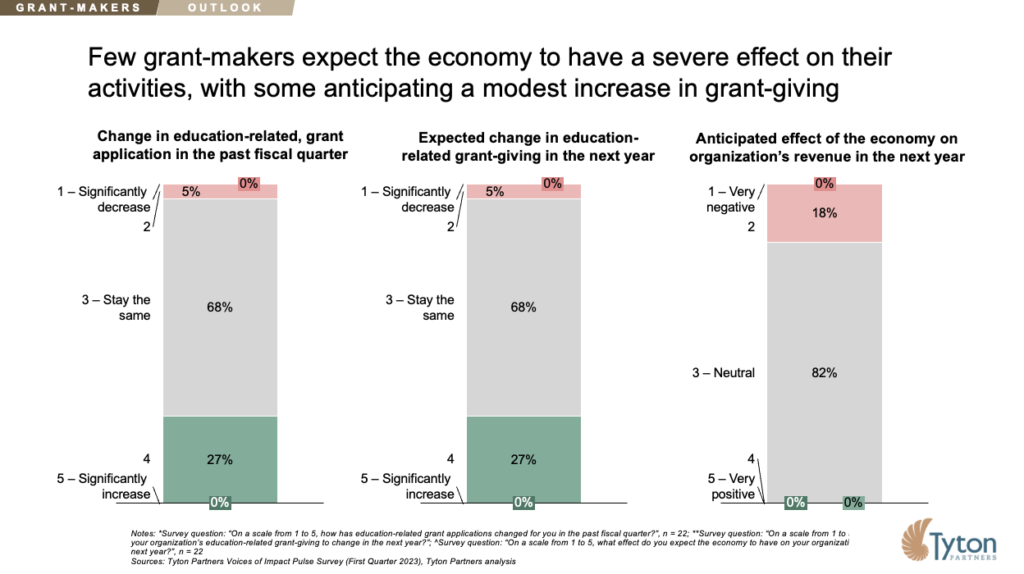

While investors are reacting strongly to economic uncertainty, grant-makers are cautious, but not overly worried. Only 18% of grant-makers anticipate the economy will have a “negative” or “very negative” effect on their organization’s revenue in the next year. At the same time, 27% expect education-related grant applications to increase, while the same percentage expect education-related grant-giving to increase.

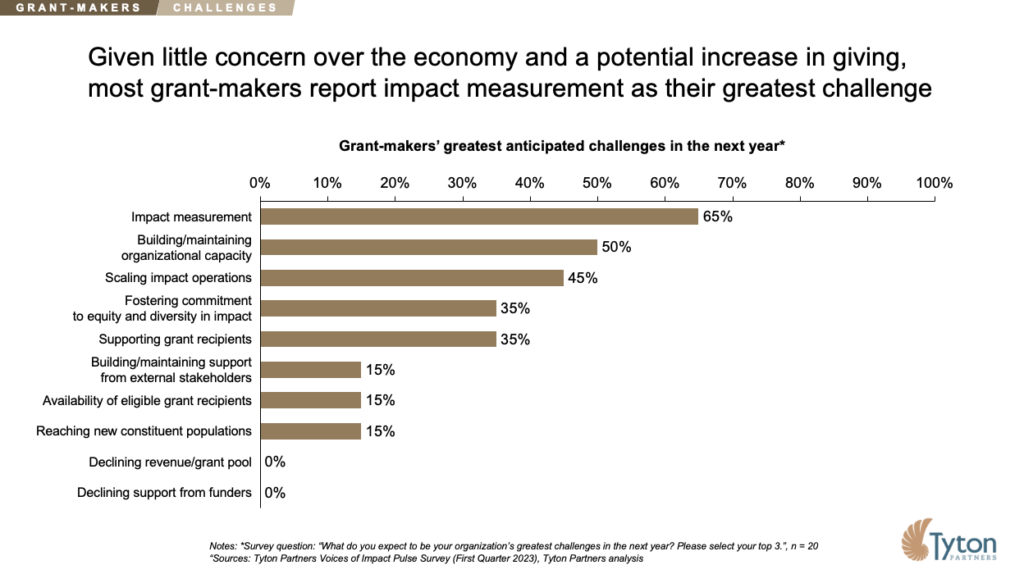

Continuing or even increasing funding from grant-makers may signify there is an increased role for philanthropic capital in the wake of economic uncertainty and investor hesitancy. 65% of grant-makers report impact measurement as their greatest challenge going forward. Grant-makers may be willing to deploy more dollars, but an enduring question will be whether these dollars are actually making a measurable the 50% concerned with building and maintaining organizational capacity, and 45% who anticipate challenges scaling impact operations. challenges scaling impact operations.

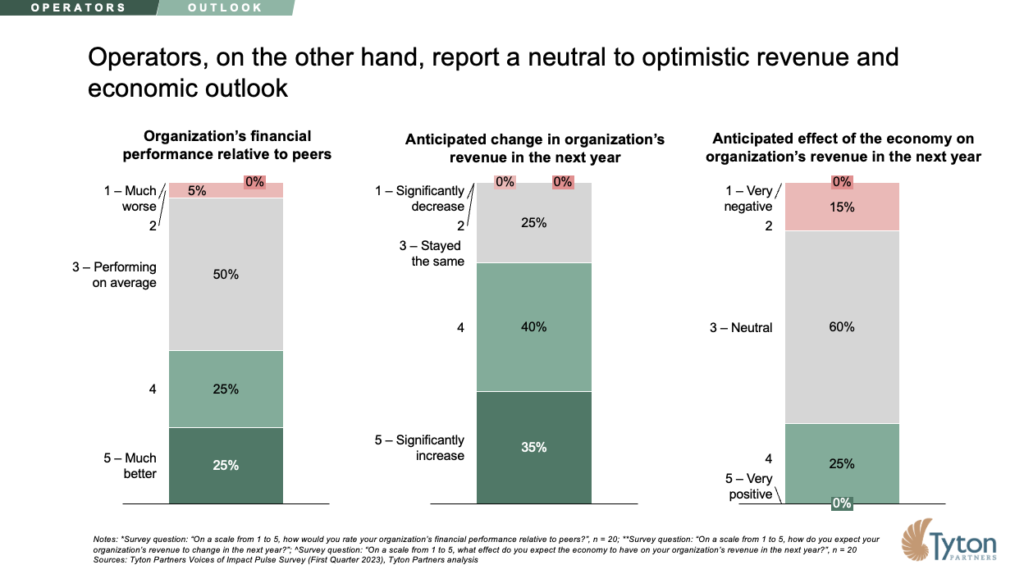

Operators who may be on the receiving end of funding from investors and grant-makers, and who are ultimately responsible for converting dollars to impact, are the most optimistic of the three stakeholder groups we surveyed. 75% of participating operators report that they anticipate their organization’s revenue to increase in the next year. In turn, only 15% believe the economy will have a negative or very negative effect on their revenues, with 25% actually expecting it to have a positive effect.

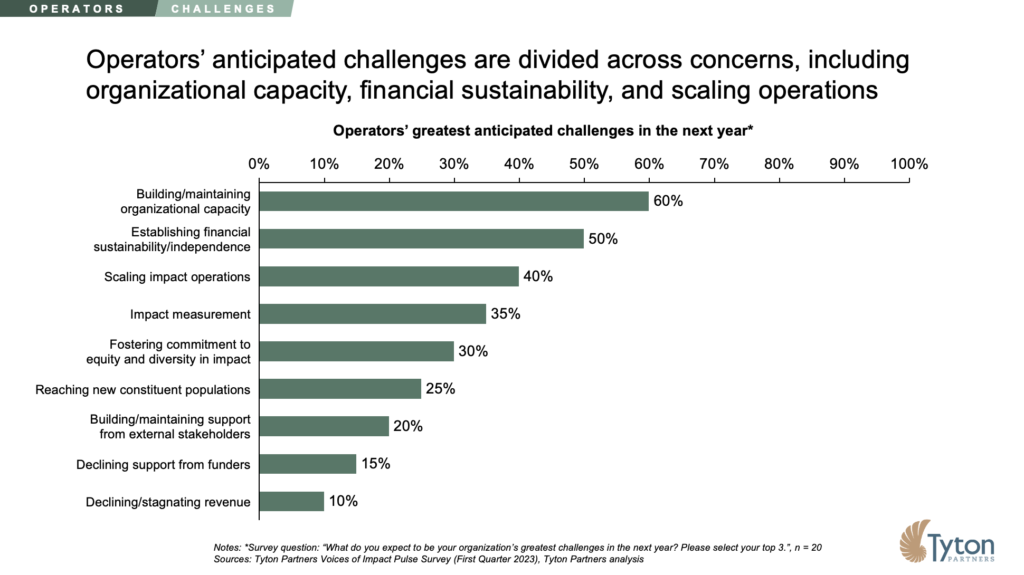

As a result, key challenges of operators in the coming year are diverse, although building organizational capacity (60%), and continuing to establish financial sustainability (50%) are top-of-mind.

While the optimism of operators is encouraging, a disconnect between them and funders may have unintended consequences. Going forward, for-profit ventures need to understand the economic concerns of investors, while non-profits must produce evidence of impact beyond revenue when working with grant-makers. Regardless, partnerships which prioritize cooperation, emphasize communication, and align measures of success will underly successful models of impact going forward – especially as stakeholders continue to view the events of the coming year through their own lens.