Parents and students are attracted to 3-year bachelor degrees, but can institutions make the business model work?

September 23, 2025 BlogDifferentiation is going to be critical for colleges and universities to compete, and more than 60 are now…

Economic uncertainty has led some experts to warn that the hot job market may soon cool. However, the jury is still out as several bearish indicators (from the perspective of employees, who are at a job marketplace disadvantage should there be a recession and the labor market cools) are counterbalanced by those that are more bullish.

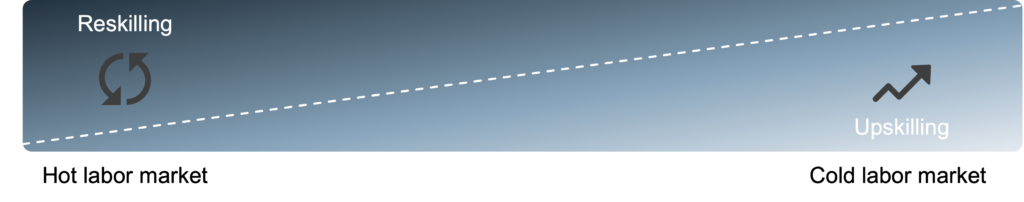

Regardless of the labor market forecast, employers and providers of skills-based training and assessments should be prepared with talent strategies that address both reskilling and upskilling for new and current employees. These strategies mitigate the risks of skill shortages whether in a hot or cold labor market and address the changing needs of employers as the economy becomes more technologically driven and employers navigate the ongoing demographic shift in the United States. This month, we explore the dynamics between these two strategies.

As we’ve shared over the past few months, today’s labor shortages are only a glimpse into longer-term trends. Structurally, demographics point toward a hot labor market for at least the next decade. Cyclically, however, concerns about an economic slowdown, fueled by factors including inflation and a declining stock market, indicate a cooling labor market. Moreover, overall workforce participation is rising, which means labor is becoming less scarce, and unemployment hit a new pandemic low this quarter. Yet, these factors are counterbalanced by declining labor productivity and volatile consumer signals, with Wall Street turning cautious while Main Street remains bullish as consumers choose services over goods. In addition, the total number of unfulfilled job openings continues to reach historic levels, thus requiring a severe economic recession to switch from a hot to cold labor market.

In response to this economic uncertainty, reskilling and upskilling are necessary talent strategies for employers to overcome a perennial skill shortage. While these strategies are not mutually exclusive, they often have more or less of an emphasis based on labor market dynamics.

Reskilling means looking for people with adjacent skills that are close to the new skills your organization requires and training those people to do a different job. Reskilling is more often the strategic emphasis in a hot labor market with more job openings than job seekers.

A strategy of upskilling, on the other hand, means teaching employees new skills to close talent gaps. It involves continuous education for your employees, an emphasis more in a cold labor market with a preference for talent investments in current employees who know your customer and culture.

As for providers of corporate training and skills & professional development, it is critical that their offerings be inclusive of both reskilling and upskilling. A dual approach in either a B2B or B2C model mitigates risk in a hot or cold labor market and is an economic imperative to facilitate the future of work and talent retention. It is also a social imperative as automation has far-reaching impact on the workforce and America rapidly ages. These two trends are evident in the projected job gains and losses in two occupations: specialized mechanics and health aides. Based on scenarios of work displaced by automation to 2030 and of labor demand created in the same period, specialized mechanics are likely to see a 6% increase in employment whereas health aides are likely to see a 30% increase.

Interplay Learning and ChargerHelp focus almost exclusively on specialized (i.e., skilled) trades. In February 2021, Interplay Learning raised an $18M Series B round to develop on-the-job-skills in HVAC, solar, plumbing, and electrical through digital training simulations and virtual reality. In March 2021, ChargerHelp raised a $2.75M Seed round at a $11M post-money valuation to scale its hiring and training of a diverse workforce to service electrical vehicle charging stations nationwide.

CareAcademy most recently raised a $9.5M Series A round in June 2020. CareAcademy is a training platform for home care professionals preparing workers for the growing eldercare market as older adults are projected to outnumber children by 2034. We will continue to monitor which ways the economic and labor market winds are blowing, which providers are emerging in response, and what effect these dynamics have on talent strategies for a future-ready workforce.