GenAI and Higher Education: Safeguarding integrity and ensuring durability

October 30, 2025 BlogIntroduction This is Part 2 of our three-part series on how GenAI is reshaping the education landscape. In…

A coach of mine used to insist “pressure bursts pipes, but can also make diamonds” – this feels like an apt description of the K-12 market in 2025.

Districts across the country are operating in an environment of heightened strain: fiscal concerns, political uncertainties, and shifting student needs are converging to test school systems. Yet, in this volatility lies the potential for reinvention. Some districts and their leaders are beginning to think about ways to adapt and innovate – signs that, even under pressure, new opportunities can arise.

Much of the pressure arises from the new federal administration, whose executive orders and pronouncements shocked the system, raising alarms around funding, teacher supports, and classroom instruction. Rhetoric had outpaced reality – until recently, when the Education Department withheld $6.8 billion in federal K-12 education funds from states. The administration’s stance on public education has already stalled district planning and decision-making; now, it is restricting spend outright.

Amid these disruptions, districts face persistent workforce shortages and student achievement gaps that require them to evaluate how to make the most of remaining funds. Still, there are signs of momentum. Many districts are doubling down on partnerships that provide essential resources for students and staff in the near term.

Looking ahead, today’s high-pressure environment offers a rare opportunity for partners to help districts not just recover but reimagine their systems. In this context, “diamonds” can take many forms: sharper, more agile operations, or bold programmatic innovations that draw students and families to public schools in an increasingly competitive landscape.

In June, we surveyed more than 100 district superintendents to better understand their priorities amid mounting pressures and how they’re planning for the future. Their feedback provides actionable insight for organizations seeking to navigate today’s sales environment while positioning for what’s next. Here’s what we heard:

We explore these themes – and what they mean for suppliers – in this summer’s edition of our K-12 newsletter.

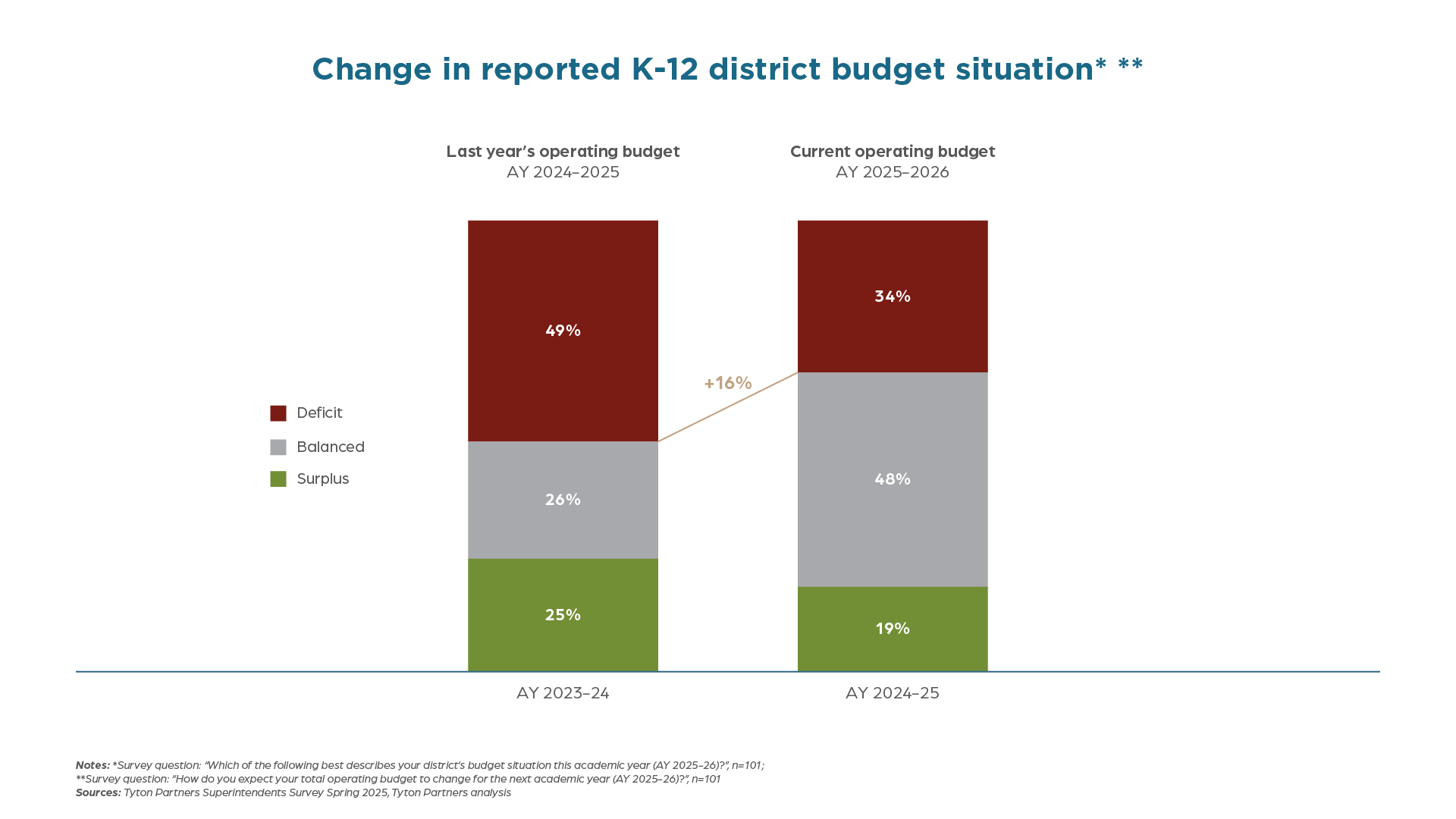

Since ESSER funds expired in Fall 2024, K-12 districts have exercised caution, limiting discretionary spending on third-party content, technology, and services. Despite some reported improvements in the health of operating budgets compared to last year (AY 2024-25), nearly a third of the districts surveyed continue to report deficits.

As salary and operational costs rise, district leaders are making difficult tradeoffs. One superintendent noted, “Trimming our budget is hard – but we must. You never want to touch salaries, so cuts have to be made elsewhere.” Increasingly, those cuts affect programs and wraparound supports adopted widely to address pandemic-era concerns:

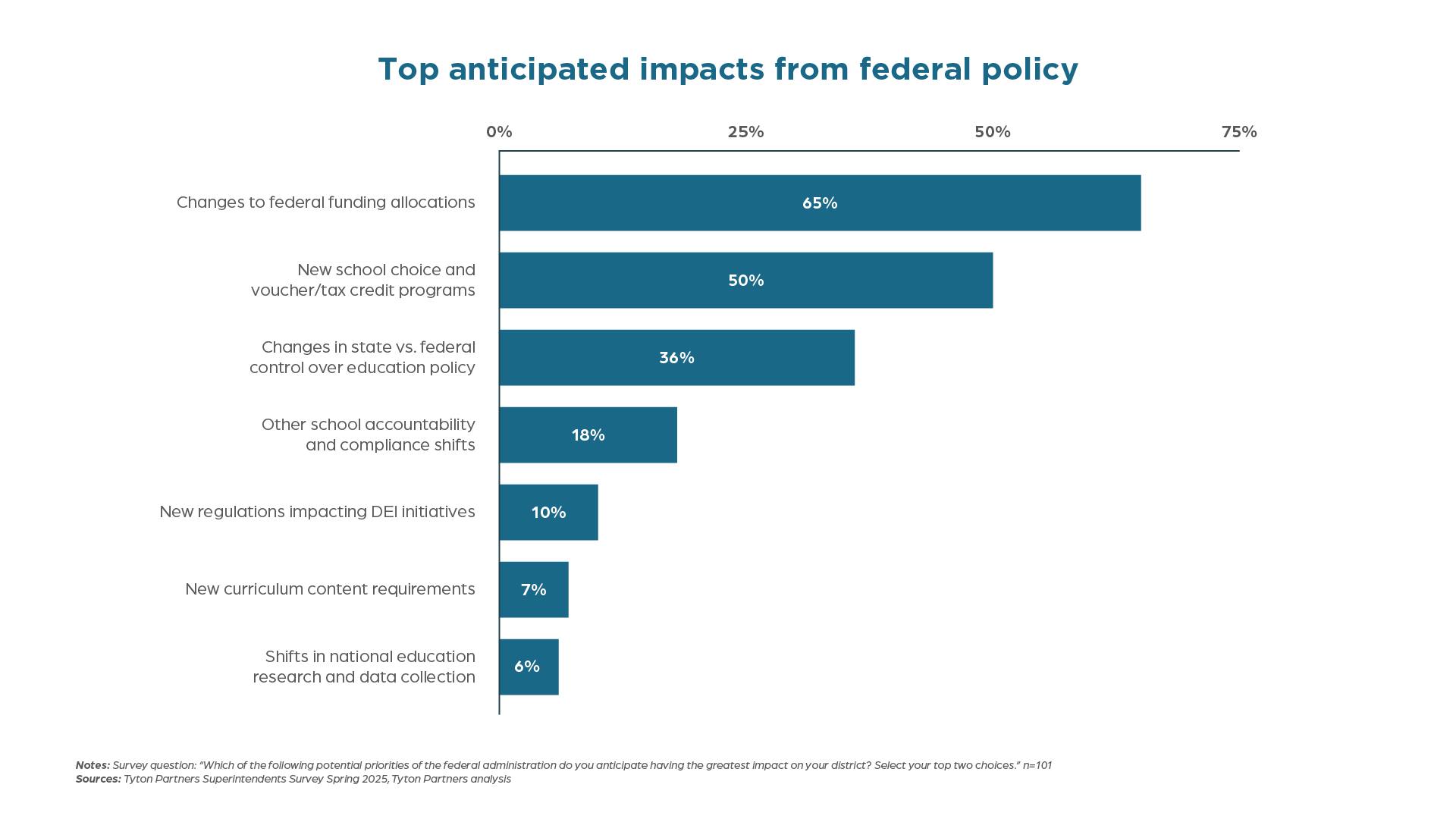

Budget anxiety has intensified under the federal administration’s push to reduce education spending. Given the wave of executive orders issued between January and April, it is no surprise district leaders are principally concerned about the security of federal funding streams along with enrollment-driven financial pressures.

Now, executive action is upending funding in real-time. On July 1, the administration decided to freeze $6.8 billion in education funding to states, sending a shock across the system. The affected dollars – representing more than 10% of total federal spend across 33 states – include sizable allocations for teacher professional development, before- and after-school programs, and academic enrichment. California alone stands to lose $811 million.

While the White House’s Office of Management and Budget emphasized on July 2 that “no decisions have been made” and reiterated the freeze is part of an “ongoing programmatic review”, districts are already facing immediate disruptions – the type of pressure that will undoubtedly burst some pipes. Even if temporary, as some lawmakers suggest, districts will be forced to reallocate funds to continue with in-process summer programs and contend with needed hiring and instructional services investments for the upcoming school year.

For providers, this moment demands clarity, creativity, and strong messaging. Districts are under pressure to do more with less – and they will be looking for partners who understand this reality. It will be critical for sales teams to lead with value, and companies must consider creative ways to reduce barriers for districts, including discounts or deferred payment models. Providers who remain responsive, transparent, and flexible can preserve relationships, and even stand out in a crowded and cautious market.

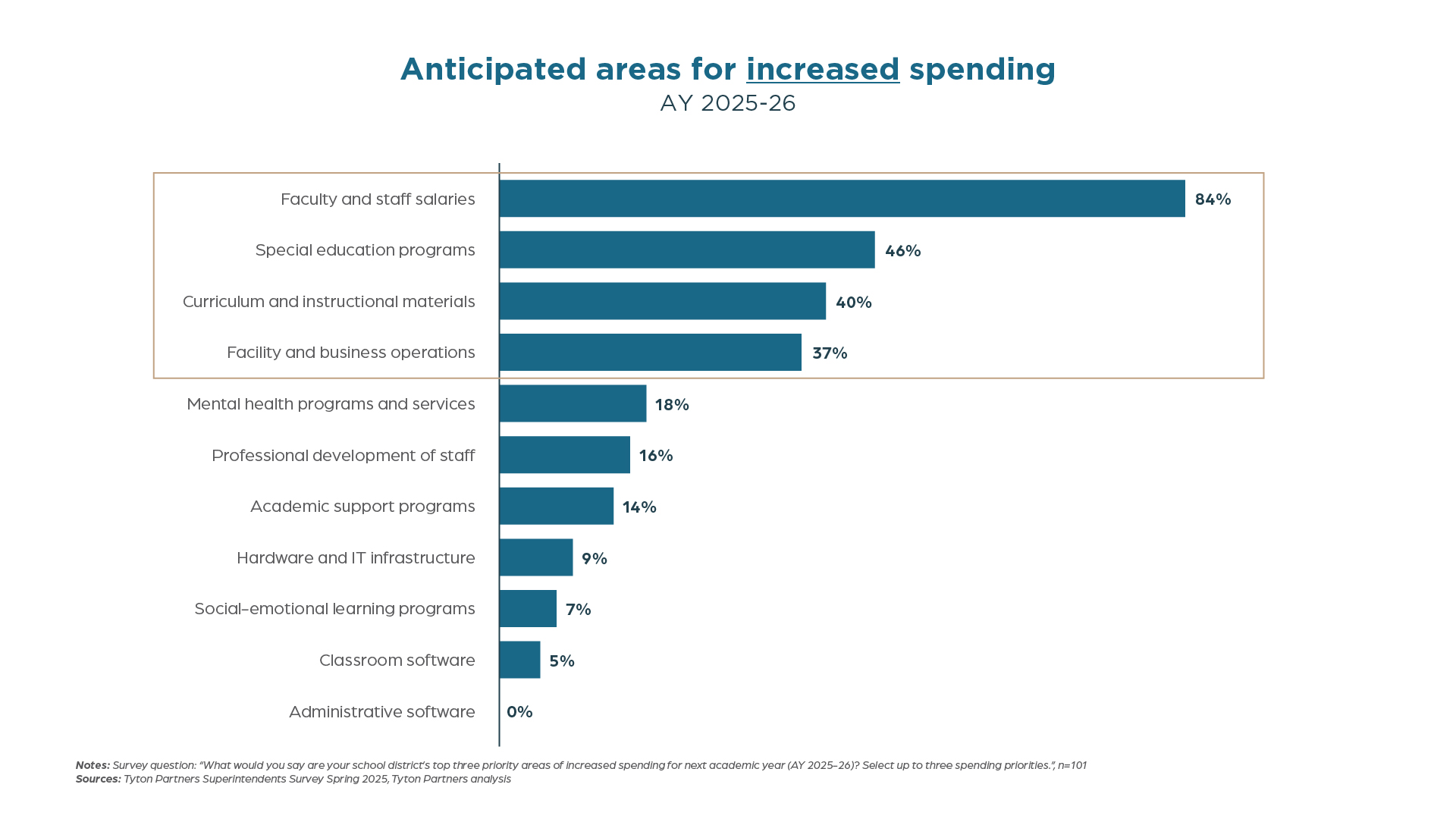

Considering the funding pressures and persistent performance gaps, districts will channel their resources towards “must-have” solutions, particularly those that drive student outcomes and address teacher workforce needs. Feedback from district leaders reveals that in the upcoming year they will increase spending on what they perceive to be non-negotiable; this may occur at the expense of adjacent programs that have gained momentum in recent years, including social-emotional learning and mental health.

Given rising mental health and student engagement challenges – and an active supplier ecosystem – this is a discouraging, if not entirely unsurprising dynamic. As one superintendent notes, “I worry about unfunded mandates making it very hard to meet the needs of all students, but we have to focus on what we can control: academics.” Hopefully, states and school communities are able to rebound from the shock and recommit to these critical student needs and district investments.

Here is a breakdown of top near-term spending priorities:

Even under pressure, value points are crystalizing across the K-12 landscape. For providers, this selling season isn’t about casting a wide net – it’s about precision. The strongest partners will align to these priorities and demonstrate clear ROI on teacher and student outcomes, directly or indirectly. Diamonds don’t just form under pressure – they are cut with intention. So too must providers shape their go-to-market efforts to meet districts’ most pressing areas of need.

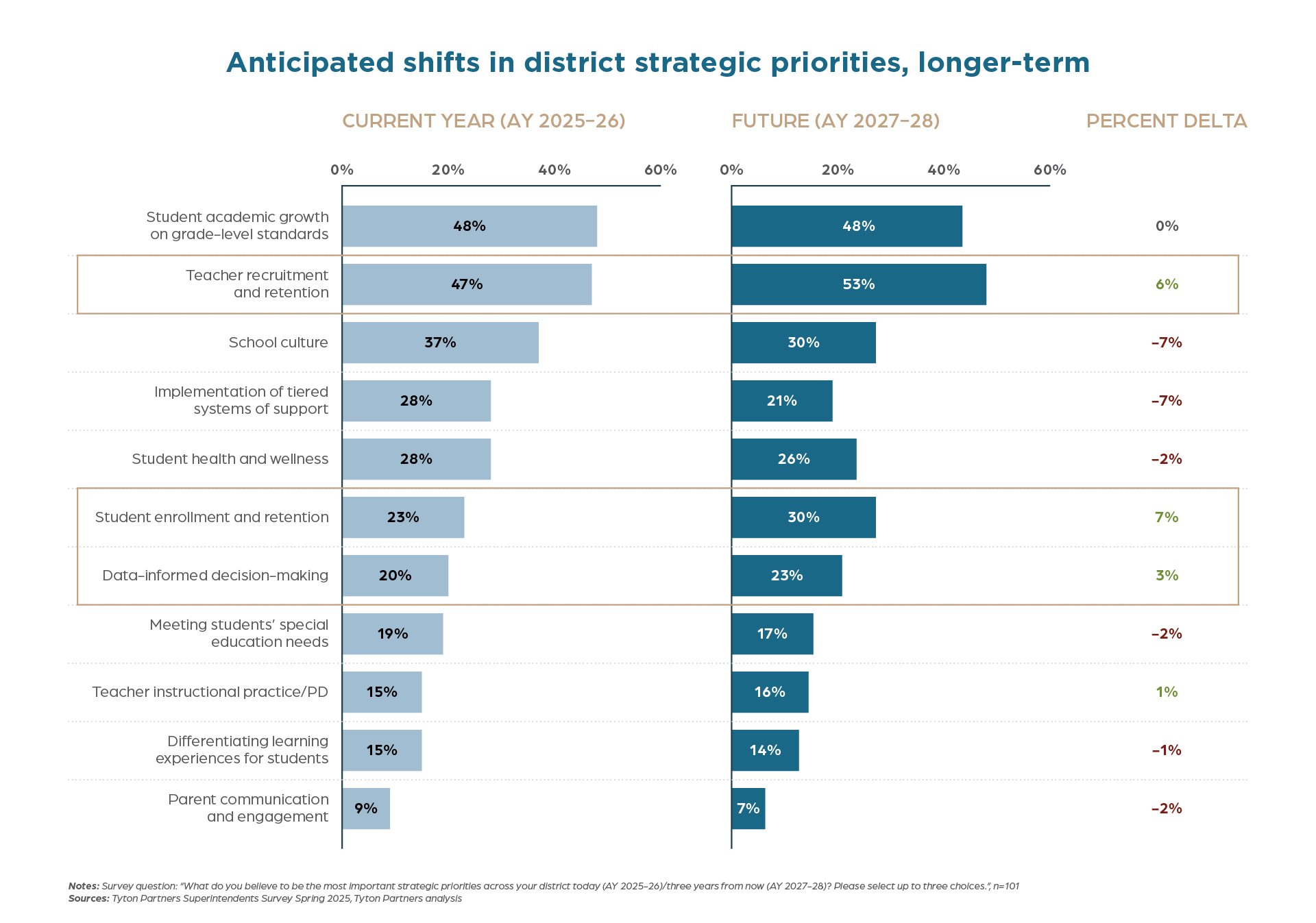

As districts navigate today’s turbulence, forward-thinking partners have a chance to help districts lay the groundwork for transformation. While short-term fixes may dominate this selling season, long-term success for districts will require them to address systemic challenges – especially around teacher workforce, enrollment, and operational sustainability.

Our survey reveals superintendents are looking ahead – still prioritizing student outcomes and staffing but increasingly focused on enrollment strategies and the infrastructure needed to support smarter, system-wide decisions.

To drive sustained impact and outcomes, districts will look beyond point solutions to strategic partners who can support system-wide change. Providers, in turn, should consider how their solution sets can address and enable strategic, durable shifts, not simply temporal ones. Take BetterLesson: through its recent acquisition of Abl, the company has reimagined its historical focus on teacher coaching to district-level talent management and program transformation. Another example is Cariina, a Boston-based startup that represents a new approach to district-wide operations. Its platform enables districts to streamline systems, improve efficiency, and reduce administrative overhead – critical capabilities in a resource-strapped K-12 environment.

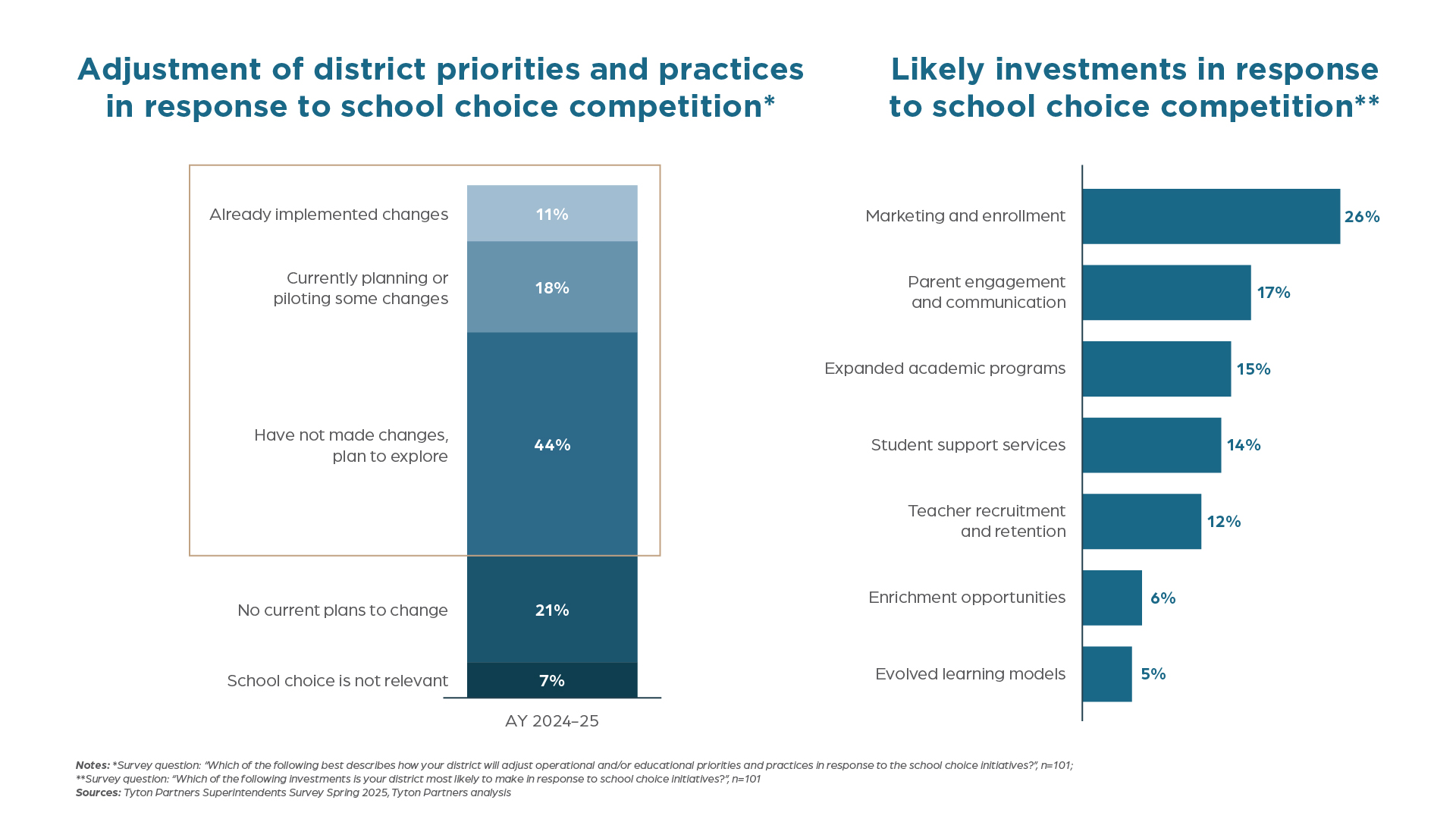

Another force reshaping district behavior is the accelerating momentum around school choice. As our recent Choose to Learn report highlights, expanding Education Savings Account (ESA) legislation has tipped the scales in favor of greater options for parents and students. Texas passed a $1 billion ESA program in April; now, more than 50% of K-12 students nationwide can access some level of state education funds for alternative models and pathways. Conventional wisdom would suggest public school districts have the most to lose, unless…

In the face of this threat, districts take a more pro-active posture and rethink how to attract and retain students. As one district leader puts it, “With the push for voucher expansion, it’s vital to ensure that public schools remain attractive and well-funded. If we don’t adapt, we could widen opportunity gaps and compromise the quality of education for most American students.”

District leaders surveyed suggest that responses to this threat are already emerging – indications of diamonds in the rough. Districts are increasingly open to solutions that help them adapt to the market environment – particularly those focused on enrollment and program innovation.

Companies like SchoolMint and Finalsite are already seeing increased traction from public systems, mirroring strategies used in the private school market. Similarly, providers that help districts enhance and reimagine their program model(s) and options – such as career pathways and flexible school models – are well –positioned in the current environment. Where families once had to look outside their districts for career exposure, organizations like CareerWise and Pathful, among others, are bringing career-relevant experiences more directly into school district pathways and offerings. Moreover, online school providers like Sora Schools and Penn Foster are helping public systems build the kinds of personalized, virtual pathways that once pulled students toward private, out-of-district alternatives.

As the K-12 landscape continues to shift, districts must turn fiscal pressures and competition into a catalyst for reinvention – operationally and programmatically. Increasingly, we (hope) they will shift their focus from short-term fixes to long-term strategic partnerships. Companies that can strengthen district sustainability and drive program innovation will be at the forefront of enabling this evolution.

Just as pressure can crack a system, it can also reveal a greater potential. For providers, the current market environment presents obstacles and, in many cases, may lead to challenged business performance in the current fiscal year. However, it is in these times of uncertainty and complexity that enduring, transformative partnerships can be forged. Balancing your efforts between near-term execution and long-term visioning and partnership is critical to protect your current position and enable a differentiated and defensible future growth trajectory.

If you’d like to discuss these topics in greater depth, or explore what the shifting K-12 landscape means for your organization, we’d be glad to connect.