Parents and students are attracted to 3-year bachelor degrees, but can institutions make the business model work?

September 23, 2025 BlogDifferentiation is going to be critical for colleges and universities to compete, and more than 60 are now…

Education deal activity was depressed in 2023, part of a broader, cross-industry trend. During the first half of this year, we have highlighted reasons for optimism regarding a rebound in education investment opportunities; notable themes include:

We have already seen these themes reflected in the deal activity during the first half of the year. While market activity in H1 2024 was not quite as robust as some may have hoped—with a number of deals put on “hold” and continued challenges regarding bid-ask valuation gaps—H1 2024 deal activity was generally more favorable than the prior year period.

We follow education M&A and investment activity throughout the year and capture various data for each identified and validated transaction.* Notable deal types include:

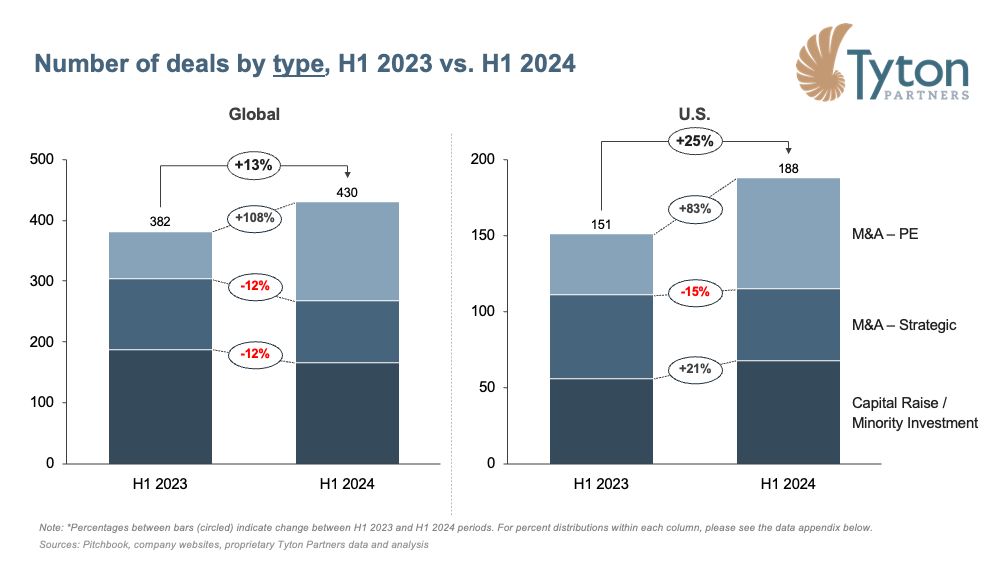

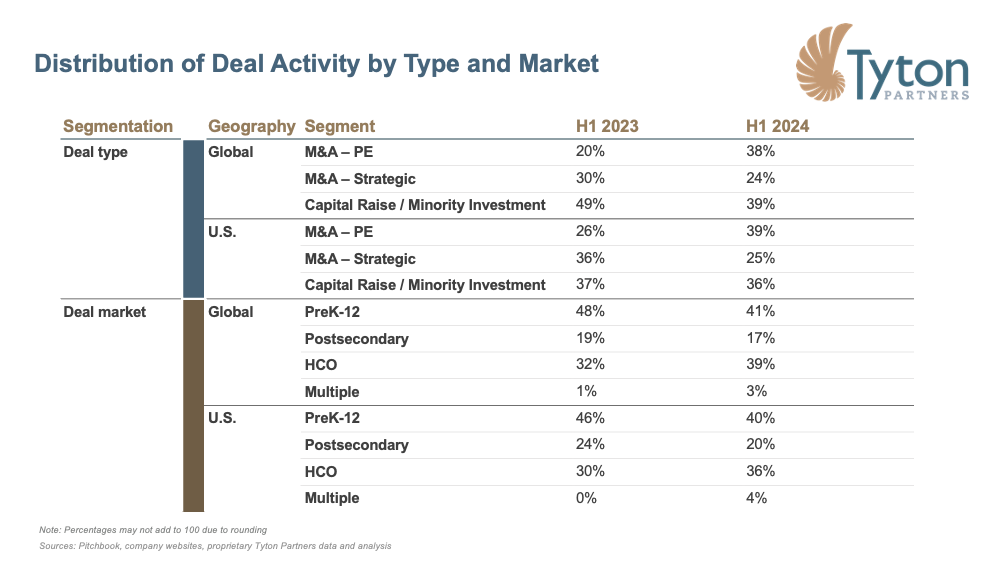

M&A and investment activity volume in the education space rebounded in the first half of 2024 year-over-year globally (+13%) and within the U.S. (+25%). Overall growth was driven almost exclusively by PE M&A activity, with aggressive expansion of deal volume globally (+108%) and in the U.S. (+83%).

On the flip side, Strategic M&A activity decreased from H1 2023 to H1 2024 (-12% global, -15% U.S.), with Capital Raise / Minority Investment volume faltering as well despite U.S. gains (-12% global, +21% U.S.).

H1 2024 also saw a notable jump in both the average and median M&A deal sizes; of transactions with announced deal values, PE and Strategic M&A transactions averaged $492M ($36M median), up from $121M ($22M median) in the first half of last year (average of transaction value with announced deal figures). This trend was driven in part by several large transactions across various end markets, most notably the announced acquisitions of PowerSchool, Universidad Europea, GEMS Education, Parchment, and Udacity.

Mature, scaled, education businesses who have sustained strong performance in the wake COVID (including those from the pandemic-era education investment boom hitting their three-year hold mark) will find their way to market during H2 2024 and beyond.

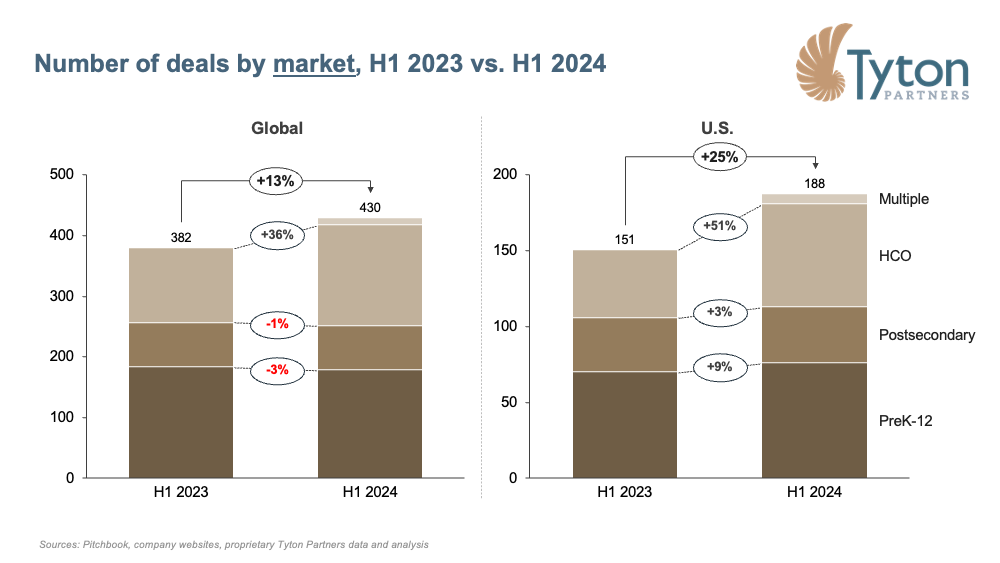

Viewing deal volume by targeted end market, increased investor activity in the human capital optimization (“HCO”) space drove the stronger H1 2024 deal activity. Overall, HCO activity increased 36% globally and 51% in the U.S. in the year-over-year comparison. (A transaction is tagged as “Multiple” when the target company operates in more than one end market and assigning a single primary market is not feasible.)

Global PreK-12 and Postsecondary deal activity saw slight declines (-3% PreK-12 and -1% Postsecondary), with the U.S. markets experiencing modest growth (+9% and +3%, respectively). While PreK-12 deals represent the largest share of sector transactions both globally and within the U.S., HCO’s H1 2024 surge has closed the gap considerably.

However, except for Accenture’s acquisition of Udacity, HCO deal activity during the first half of the year was characterized by the number of deals completed, not deal size. The median announced M&A valuation in H1 2024 in the HCO segment was $27M, compared to $56M for M&A in the PreK-12 and Postsecondary segments combined.

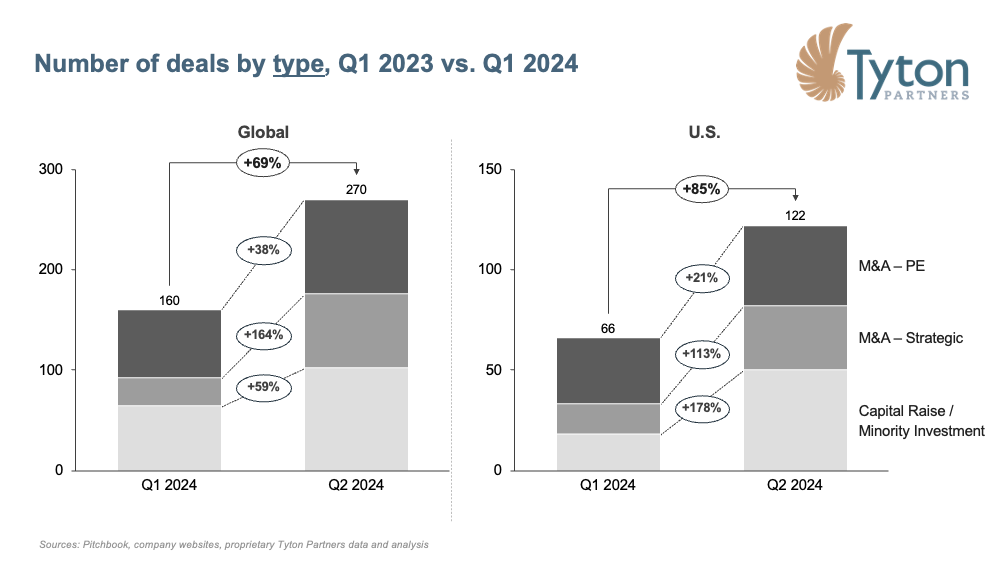

Education investment activity is gaining momentum this year, not just in the year-over-year comparison. Overall, global deal volume increased by 69% between the first and second quarters of 2024, with U.S. deal activity increasing by 85% across the same period. While some of this acceleration is likely attributable to deals taking longer to close in the current market environment, activity by all deal types and across all end markets is heating up.

By deal type globally, PE Mergers/Acquisitions increased 38% from Q1 into Q2, despite decreasing slightly as a proportion of all education deal activity during the period. In the U.S., we saw a similar proportional decline in PE M&A overall, paired with a 21% increase on an absolute basis. Both Minority Investment and Strategic M&A activity also saw rapidly accelerating volumes, particularly in the U.S.

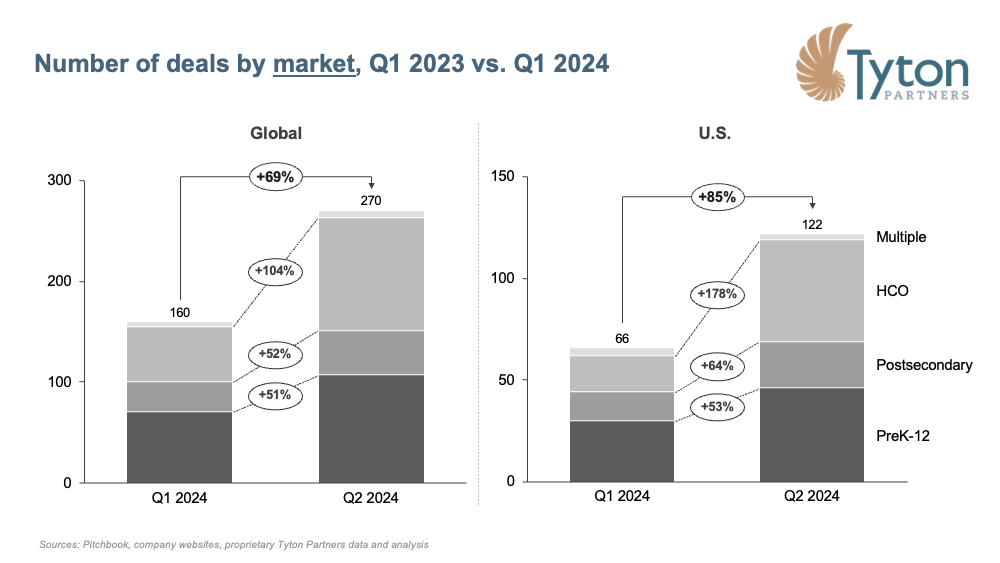

In looking at the data from an end-market perspective, all segments grew on an absolute basis. Significant growth in HCO (+104% global, +178% U.S.) drove proportional deal volume declines in the PreK-12 and Postsecondary markets.

While we are still far from 2021 transaction-level highs (and valuations), the education sector is showing a solid pick-up in 2024. We are actively tracking (as you undoubtedly are as well) a number of high-quality platforms across the markets that should be in the market shortly.

When married with fairly robust market dynamics regarding follow-on transactions (i.e., moderating target value expectations and intensifying growth imperatives), we expect education deal activity to continue accelerating into 2025.

As the education investment space continues to exit the 2022-23 “down” period, competition for higher-quality deals will be intense. Keep in touch with our team at Tyton Partners to stay ahead of what’s happening in the markets. If you have any questions or comments on this article, we look forward to continuing the conversation with you.

*Tyton Partners tracks education market activity through various public and proprietary sources. All announced deals are reviewed to ensure the accuracy of data and alignment with methodologies developed across 10+ years of monitoring the landscape.