What We’re Thinking About in Impact for 2026

January 21, 2026 BlogThe education sector is navigating a fundamental shift. Market forces are driving consolidation, capital is more selective, and…

While pandemic-driven disruptions to classroom learning may feel like they are in the rear-view mirror, new and ongoing challenges continue to create obstacles for K-12 schools and districts. During March, we surveyed district Superintendents to better understand their current challenges and how they plan to respond. Broadly, our pulse survey of ~100 district Superintendents reveals:

While tightening district budgets may be unwelcome news for many, addressing the teacher staffing shortage and student mental health and well-being issues creates new opportunities for K-12 school and district partners. We invite you to download the accompanying presentation to view additional data on our findings.

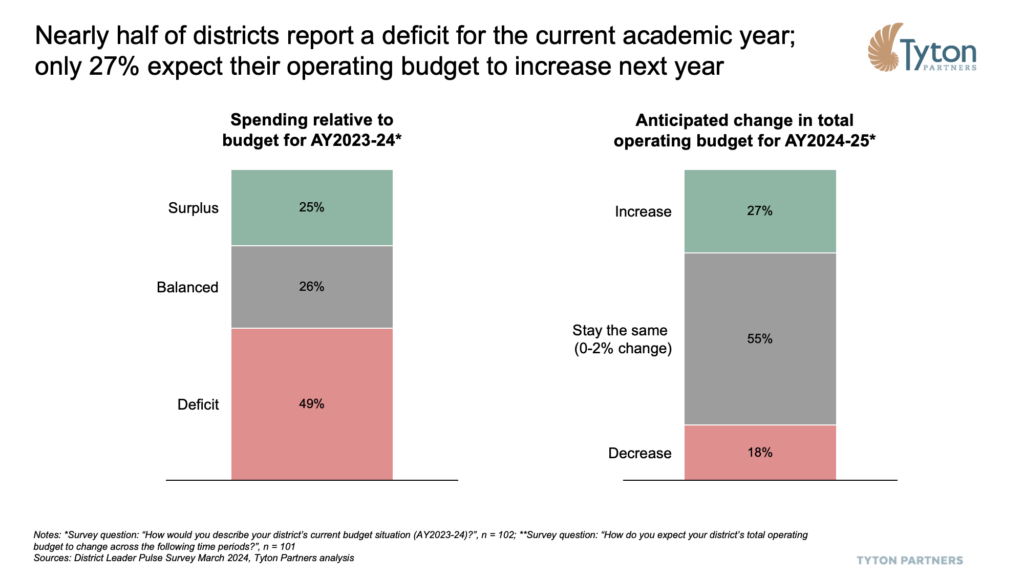

District budgets are tightening due to the expiration of ESSER funds, enrollment declines, and state budget cuts. Despite nearly 50% of Superintendents reporting a budget deficit for the current academic year, they are a bit more optimistic regarding next year: 73% expect operating budgets to stay the same (55%) or increase (27%).

It will be interesting to see if and how Superintendents’ expectations regarding their AY2024-25 evolve given the high percentage experiencing deficits currently. Have they effectively “re-set“ expectations across the district coming out of this year? Or, are they holding onto hopes that next year will be better? Tracking this sentiment – and the practical reality from a spending perspective – will be critical as most providers enter the core selling season/cycle.

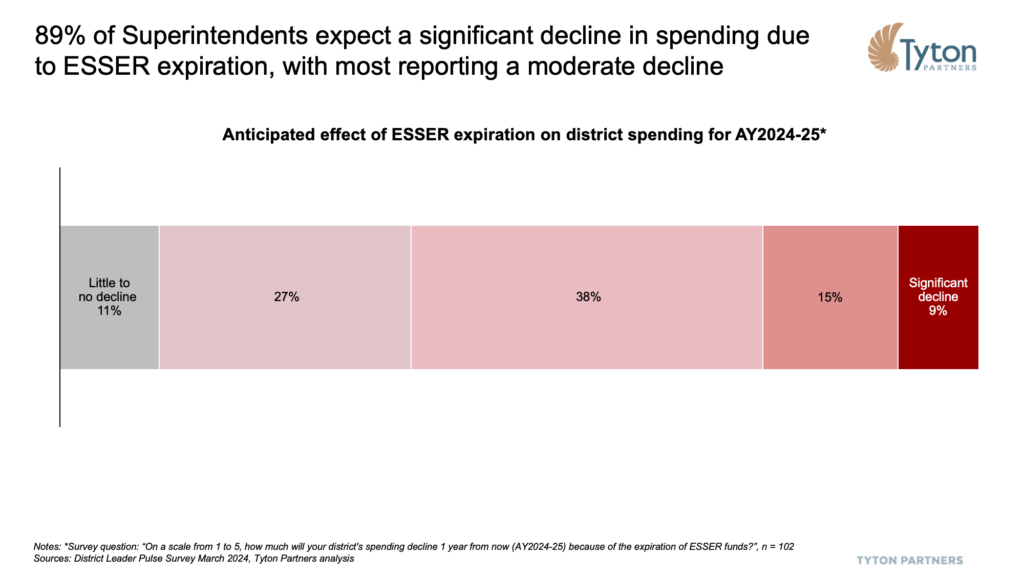

District Superintendents report a similar level of uncertainty anticipating the impact of ESSER expiration on their spending. ESSER III funds will ultimately inject ~$122 billion into K-12 districts, buoying operating budgets for many. With the requirement to allocate – but not necessarily expend – all ESSER III funds by September 2024, many fear a historic contraction in district spending in their absence. While nearly all district leaders expect the expiration of ESSER to have some adverse impact on district budgets in academic year 2024-25, only 9% expect it to result in a significant decline.

While some budget cuts are likely for many districts, how much and in what areas will undoubtedly vary and require heightened levels of sales and customer success execution by companies and organizations serving schools and districts.

Uncertainty regarding future district funding is prompting leaders to find new sources – or more creatively apply existing ones. Some districts, for example, are exploring how to use Title I and other federal sources to fill the gap left by ESSER funds. District Superintendents also report taking a more intentional and strategic approach to managing their investments, using the occasion to optimize and recalibrate the budget to ensure dollars are being spent effectively. Noted one superintendent, “We not only need to reduce spending, we will need to be more productive with spending.”

Going forward, companies and organizations serving K-12 institutional customers will need to actively assist them in identifying explicit funding sources for their solutions instead of relying on the comfort of a fungible operating budget. And, in those districts where cuts are being considered, providers will need to demonstrate clearly evidenced and expected benefits, impact, and even ROI of their solutions if they are to survive the sales and renewal gauntlet.

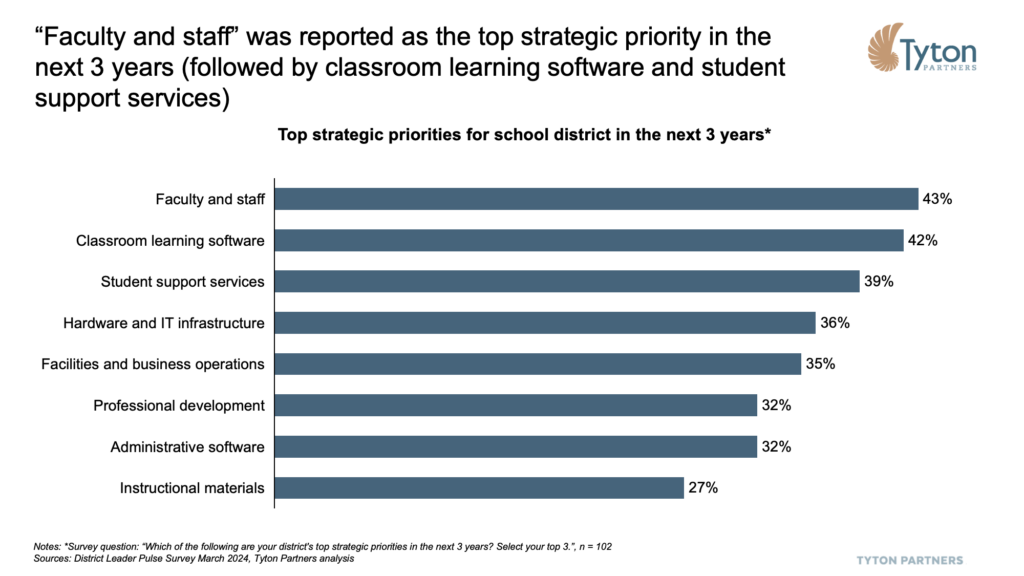

To that end, district leaders already anticipate shifting spending in response to changing priorities. Superintendents report faculty and staff (43%), classroom learning software (42%), and student support services (39%) as their top three strategic priorities in the next three years. Notably, pandemic-driven emphasis on instructional materials has softened, likely driven by solution fatigue after the rush to adopt instructional resources during COVID.

Given the emphasis districts are placing on teacher capacity and student well-being – and the fundamental role these “twin issues“ play in the operational excellence of schools – we provide a deep-dive into both priorities below.

While budgets may tighten, districts are still willing to spend on solutions to solve urgent problems, as is the case with teacher attrition and other staffing shortages. “Faculty and staffing” challenges were reported by district Superintendents as their top strategic priority, a proclamation undoubtedly rooted in the oft-cited teacher retention and shortage crisis across the country.

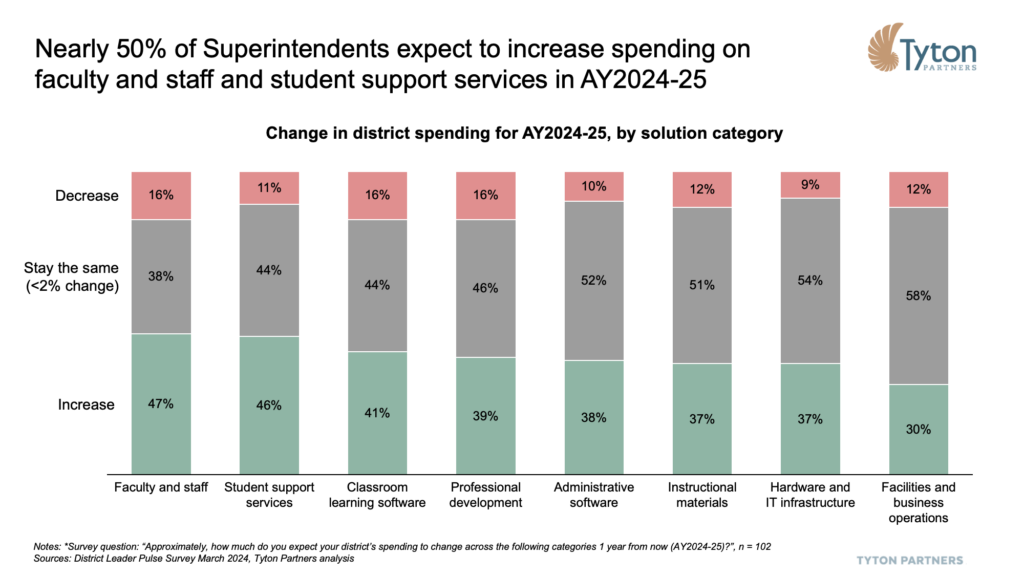

In turn, nearly half of districts expect to increase spending on faculty and staff next academic year, more than any other solution category. As one superintendent noted: “Because we are student first, we are staff second, and we must increase spending on staffing to address teacher shortages and support all of our students”.

Increased district spending on staffing is expected to go beyond salary increases and one-time bonuses to increasingly include new initiatives with external partners. At the moment, only 19% of the responding Superintendents report working with an external partner to support faculty and staffing needs; this figure is expected to nearly double in the next three years.

This dynamic is particularly relevant to staffing and software companies that leverage talent networks to build capacity for schools and districts. Illustrative players in this space include Education School Solutions (ESS), Elevate K-12, Swing Education, Teachers on Call, University Instructors, among others.

Moreover, the opportunity is not limited to staffing companies and organizations; established providers should also take notice. Providers of non-staffing solutions can benefit from this tailwind by considering and – as appropriate – positioning their solutions as tools for driving teacher retention and/ or maximizing teacher productivity and efficacy.

As we know too well, students are in crisis too. Researchers report record numbers of students facing mental health challenges. Districts, in turn, are seeing this manifest in significant student behavioral challenges and record absenteeism. Not surprisingly, nearly 40% of Superintendents report student support services are a top strategic priority, with 46% expecting their district’s spending on relevant services to increase in the next year.

As with staff management and recruiting, districts will increasingly rely on external partners to meet the challenge. Today, 33% of districts report partnering with an external organization to facilitate student support services; this figure is expected to increase to nearly 50% in the next three years.

While filling counseling vacancies is a clear motivator for district partnerships, Superintendents suggest a need that goes beyond staff to build and enable a more strategic approach: “We not only need more counselors, we need to build a reliable system of support around students.” For most school districts, developing a comprehensive system cannot be done alone and represents an opportunity for various providers to support systems-level change.

Providers who are positioned to support districts are an active and attractive area of focus for investors. Companies participating in these efforts include services-oriented companies like eLuma, Hazel Health, and PresenceLearning and platform-oriented solutions such as Branching Minds, GoSolutions, LessonBee, and Panorama Education. In the near future, it will be interesting to see how and the extent to which districts utilize these types of services and technology platforms to quell the student well-being crisis and related challenges as post-COVID effects regrettably continue to simmer and linger.

The path forward for districts and schools continues to evolve. Based on Superintendents’ current budget perspectives, this path may be somewhat obscured given an array of swirling factors. Staffing and student support services are among districts’ most pressing priorities today; fortunately, Superintendents have an increasing number of new ways to navigate these issues, with new models and partners stepping in and up to offer guidance, many accelerated by pandemic-catalyzed dynamics.

We will build on these insights with a teacher-focused pulse survey later this spring and welcome feedback for what issues are most important for you and your organization to better understand.

As always, we invite you to contact us with questions, additional thoughts, or interest in continuing the conversation more directly.