GenAI and Higher Education: Safeguarding integrity and ensuring durability

October 30, 2025 BlogIntroduction This is Part 2 of our three-part series on how GenAI is reshaping the education landscape. In…

For those desperately trying to get from Point A to Point B during the holidays, you may have missed that Congress finally passed its 2023 budget, nearly three months after the start of the October 1 fiscal year. (If only we ran our own organizations the same way!) Much of the federal budget narrative has been focused on ESSER funds – how much is left, where it will be spent, and will the Department of Education provide extensions? At the same time, it’s likely time we start turning an eye back toward the “traditional” annual federal funding allocations as we head towards the potential 2024 ESSER cliff.

While several notable programs saw increased funding in this year’s budget, the combination of Congress’ failure to deliver on the aggressive expansions sought by President Biden in his initial proposal and our current inflationary environment leaves K-12 federal funding in a delicate spot, excluding the impact of ESSER. Moreover, with recessionary fears on the horizon and prospects for a thoroughly dysfunctional House of Representatives across the next two years, the future budget picture grows murkier.

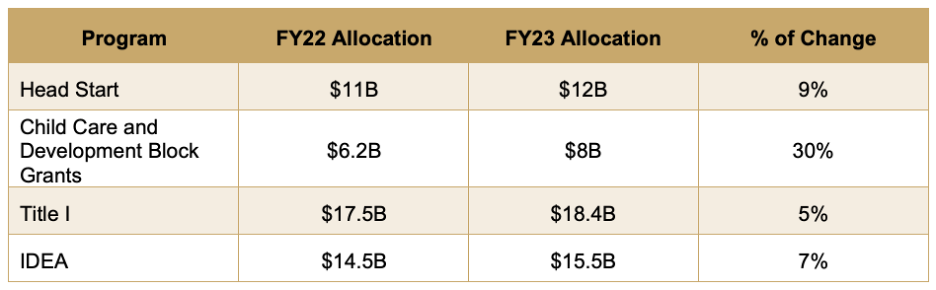

The table below highlights key early childhood and K-12 federal funding programs – and their change from FY22 to FY23.

Within the K-12 ecosystem the most oft-asked question is how “hard” the September 2024 deadline is for spending of ESSER III funds. While funds must be obligated to be spent by this date, there is much wishful thinking in the market that the Department of Education will extend the spending requirement beyond this date. We expect various K-12 advocacy groups to keep pressure on the Department to relax the timeline.

More pragmatically, with a return to more “normal” funding levels on the horizons, business execution will be critical for those selling into K-12 schools and districts. Organizations’ customer acquisition and success teams have little room for error at a time when districts will be making decisions about which products to keep and which to jettison. For company leaders managing a board comprised of financial investors, set appropriate growth expectations soon – if it’s not too late in your budgeting calendar cycle.

Broadly, we expect M&A will remain an active component of the K-12 landscape in 2023, particularly among market-leading companies. For those pursuing this growth lever, we expect the most successful ones will be intuitively additive and minimally distractive; from the outside, looking in at Instructure’s acquisition of LearnPlatform last month (see below) is a prime example.

In other late-breaking 2022 news, Instructure announced in mid-December the acquisition of LearnPlatform, a leading decision-support platform for districts’ purchase and evaluation of digital learning solutions. The deal marries K-12’s market-leading instructional learning platform – and its robust edtech application partner ecosystem – with an innovator helping state and district leaders make sense of the cacophony of digital learning solutions in their communities and their value in contributing to desired learning outcomes.

One of our predictions for 2023 and beyond is that districts will increasingly look for evidence of outcomes from their edtech providers as they look to reduce the number of tools in use. Instructure’s acquisition represents a smart bet on this trend; LearnPlatform’s motto, “enabling evidence-based education decisions,” speaks to the challenge district leaders face in measuring effectiveness of the range of teaching and learning products in use across their systems. And given Instructure’s position in state and districts’ enterprise digital infrastructure, the cross-sell potential for LearnPlatform’s core solution is significant.

Moreover, LearnPlatform has extended this effort to digital learning providers themselves, with the launch of its “Evidence-as-a-service” offering in 2022. Based on the four tiers of evidence defined in the Every Student Succeeds Act (ESSA), it helps providers establish well-designed experimental studies to generate the type of data increasingly required to support state and district adoption processes]. As we head further into 2023, we’ll likely see providers prioritizing rigorous outcomes studies, with heightened thresholds for standards of evidence.

The Instructure-LearnPlatform deal falls squarely into the “intuitively additive” camp that we expect to continue to see in 2023; now it’s up to the two businesses and their post-merger integration strategy to effectively capitalize on the logic of the deal.