Understanding Your Needs

Whether you’re a private equity investor seeking sharp diligence and market insight, or an impact funder aligning investments with social outcomes, Tyton Partners delivers the clarity and confidence needed to make the right decisions.

Why Tyton Partners

Unmatched Education Sector Expertise

Strategy Consulting and Investment Banking Services

Rapid Access to Actionable Insights

Key investment questions we help answer include:

- What does the competitive landscape look like across the education sector, and how is it evolving?

- How do current and future market trends impact my investment strategy?

- What risks, performance factors, and financial health indicators should I consider when evaluating potential investments?

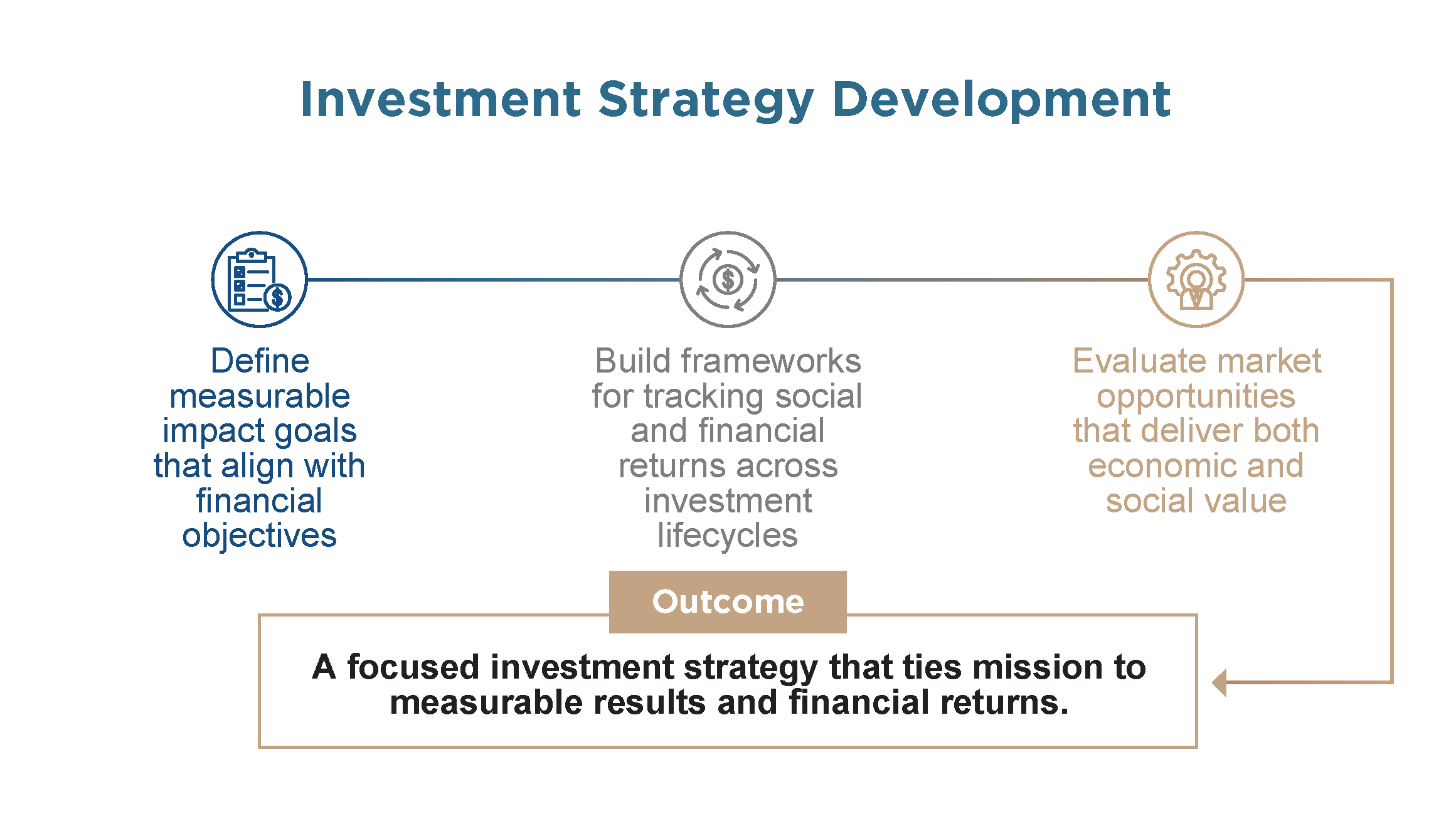

- How do I ensure alignment between financial returns and measurable impact?

- How can I maximize valuation and position an asset for a successful exit?

- What are the drivers and risks in this market?

- How do stakeholders view this opportunity?

Solutions for your success

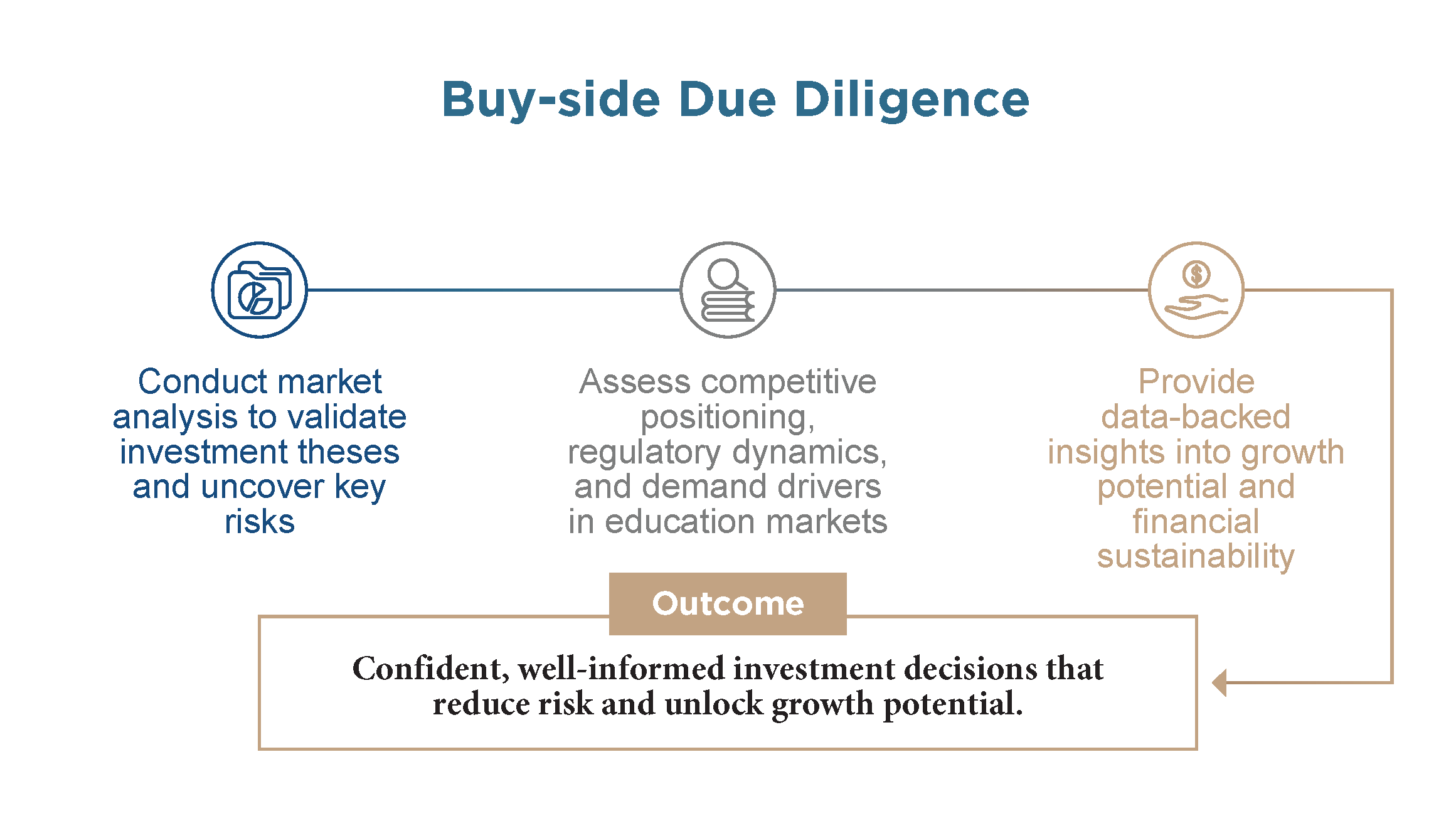

Tyton Partners provides investment advisory services for private equity firms and impact investors, combining rigorous market insight with sector expertise to support sound, strategic, and mission-aware decisions.

Real Results for Education Investors

Tyton Partners supports private equity and impact investors with market insight and strategic guidance to drive returns, reduce risk, and achieve lasting impact. Explore our client success stories:

Take the Next Step Toward a Smarter Investment

With decades of experience advising education investors, Tyton Partners provides the market intelligence and strategic guidance needed to navigate this complex sector. Whether you need buy-side diligence, portfolio strategy, or impact measurement, our team ensures your investment decisions are data-driven and built for success. Connect with us today to discuss your next education investment.

Contact Our Team

From investment banking to strategy consulting, our expertise helps advance change that transforms the education landscape. Because we’re not just experts in the Global Knowledge Sector.

We’re driving its future.

asdf

asdf