Education Philanthropy and the 2024 Election: Part 1

July 16, 2024 BlogThe 2024 U.S. presidential election is shaping up to be one of the most consequential in recent history,…

The K-12 market continues to be an evolving sector as we move post-COVID with the persistence of new staffing models, the role of new integrated technologies, continued concerns around students’ and teachers’ health and well-being, and the status of ESSER funding.

Tyton Partners Represented the following K-12 transactions: School Specialty’s divestiture of EPS School Specialty, a K-12 supplemental curriculum product provider, to Excolere Capital Partners; Fairmont Schools, a private PreK-12 educational institution, in its sale to International School Partnerships; and Tinkergarten, an early childhood curriculum and educator training provider, in its sale to Highlights.

Higher Education remains a priority for investors and is experiencing transformative shifts as the preference for online and hybrid models has surpassed face-to-face learning for the first time, the continued integration of digital learning tools as part of broader core back-office technology platforms, and the increasing adoption of AI solutions led by students with faculty and administrators lagging behind.

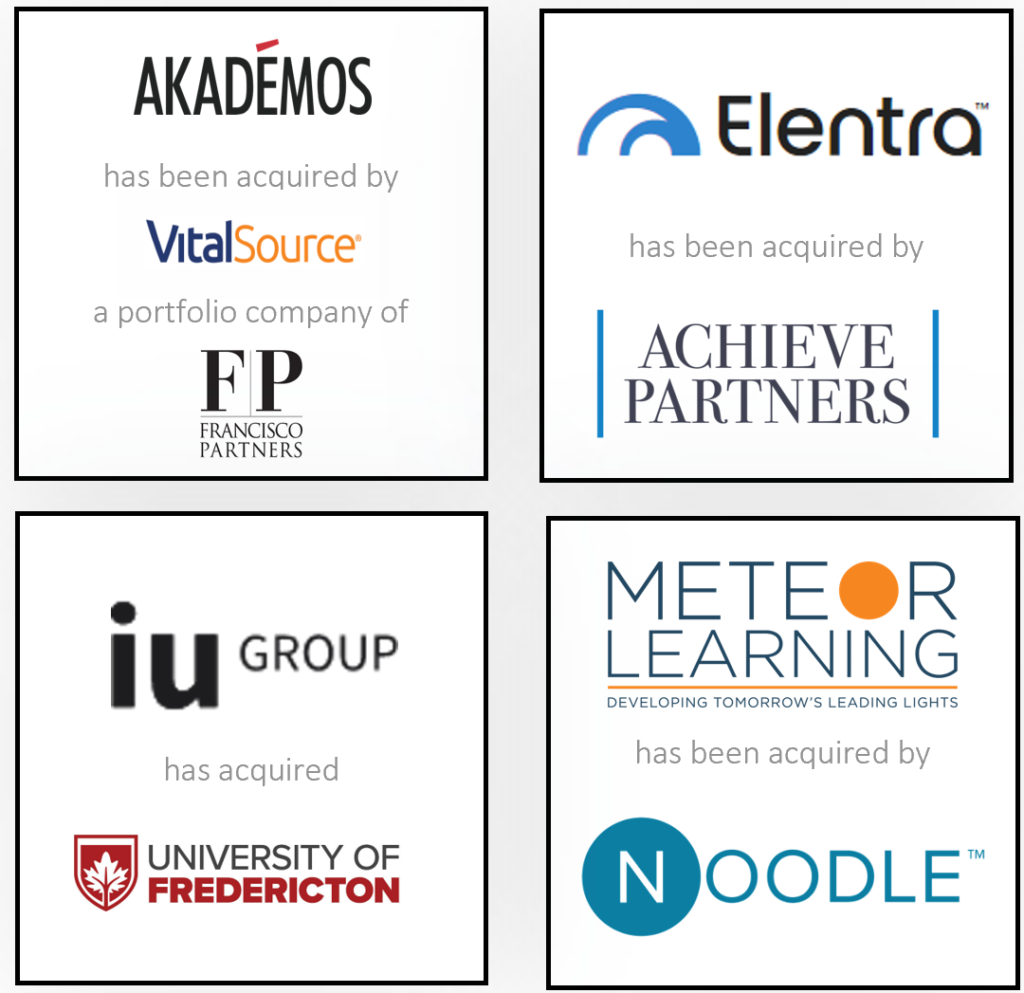

Tyton Partners represented the following higher education transactions: Akademos, a leading online bookstore, and course materials provider, in its sale to VitalSource Technologies, a portfolio company of Francisco Partners; Elentra, a SaaS platform for health science colleges and universities, in its sale to Achieve Partners; IU Group in its acquisition of the University of Fredericton; and Meteor Learning, an OPM for online competency-based education program, in its sale to Noodle Partners.

The corporate training and continuing education space continues to expand as organizations recognize they face a historically low national unemployment rate, a skills gap with current employees, and a lack of internal tools to upskill and retrain their employees in many cases. The capital for emerging companies, as well as established players, is up for grabs as expanding learning and development budgets support further growth in this market.

Tyton Partners represented the following corporate training and continuing education transactions: Pryor Learning, an online training platform for businesses, in its sale to Trive Capital & Epic Partners; Wiley in its divestiture of Wiley Efficient Learning, an online business training platform, to UWorld; Wiley in their divestiture of Advancement Courses, a professional development course platform for teachers, to Teaching Channel, a portfolio company of Quad-C; and LiteracyPro Systems a SaaS-based adult learner information system platform, in its sale to Genius SIS, a portfolio company of Leeds Equity Partners.

We are pleased to announce that Tyton Partners Investment Banking division has picked up right where it left off in 2022 closing a record number of deals across the PreK-12, Higher Education, and Corporate L&D markets. As of the end of the first half of 2023, we are continuing to execute at this record pace and have strong momentum going into the back half of the year.

We remain optimistic for the remainder of 2023 and the prospect for 2024 with a strong active roster of clients in-market, ready to go-to-market post-Labor Day, and already in exclusivity with prospective acquirers. Despite the macroeconomic headwinds, investor sentiment remains supportive of M&A in the lower middle market, particularly across the Global Knowledge and Education market. We continue to bolster our pipeline with a diverse set of potential targets including privately owned and founder-led profitable and growing enterprises, a set of tactical add-ons for institutionally backed and public strategics, carve-outs and divestitures for public and PE-backed strategics, and a set of impact and institutional investors on the buy side eager to expand their presence in the global knowledge sector. We are excited to continue to assist our clients in navigating the complexity of the global knowledge and EdTech marketplace by deploying the firm’s expansive sector and transactional experience. We look forward to discussing the latest trends and their impact on your business with you over the remainder of 2023, please reach out to us to schedule a conversation.