What We’re Thinking About in Impact for 2026

January 21, 2026 BlogThe education sector is navigating a fundamental shift. Market forces are driving consolidation, capital is more selective, and…

As the K-12 market works to stabilize in a post-pandemic world, suppliers face both challenge and promise. Federal ESSER funding, which buoyed K-12 spending through COVID-19, has expired, leading many schools and districts to reexamine and reprioritize budgets. Education companies, in turn, have had to adapt to a shrewder market, and deliver on their promises to customers or risk losing ground.

So how did companies fare in 2024?

This month, we share findings from a Tyton Partners survey of K-12 education executives, who offer insight into how their companies performed during the 2024 sales cycle. Our sample includes a diverse range of more than 60 content, technology, and service leaders across K-12. Key findings from this latest installment are highlighted below and include:

Overall, the results paint a picture of an industry grappling with economic headwinds—but filled with cautious optimism. As one executive put it, “We worked much harder to achieve only modest growth (in 2024).” Another noted that despite early challenges, “the market has really started to pick up.” Looking ahead, suppliers must work smarter to realize their growth objectives in a more competitive, fast-evolving K-12 ecosystem.

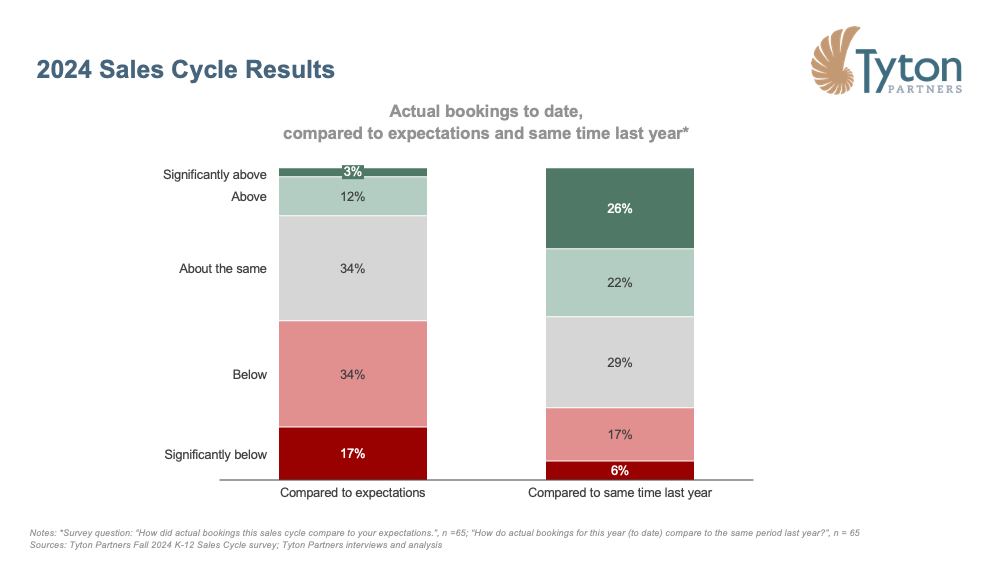

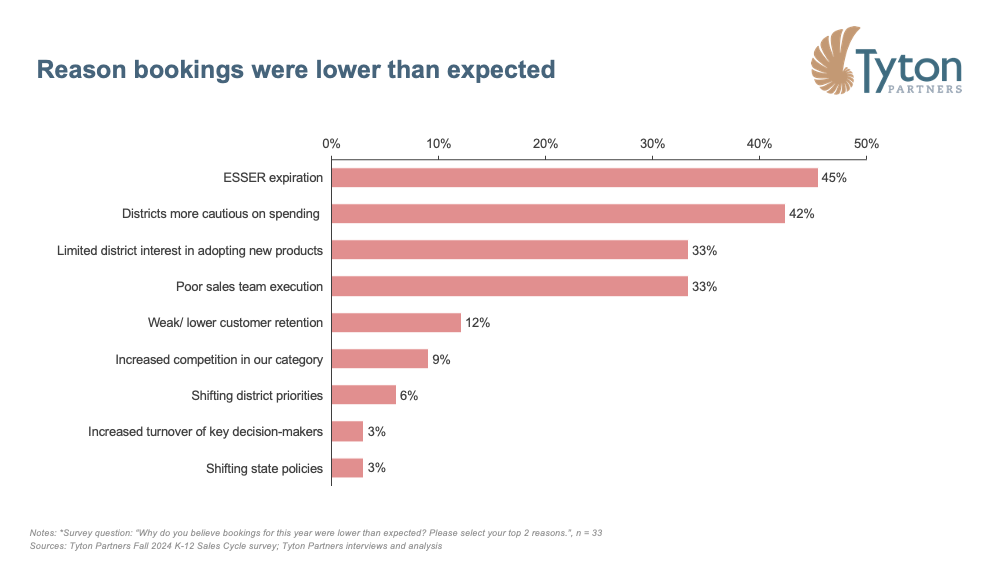

Overall, the 2024 sales season brought mixed results for K-12 suppliers, as companies outperformed their 2023 performance but failed to meet forecasted growth targets. Last November, in a reflection on the 2023 sales cycle, K-12 executives expressed uncertainty around two concurrent market dynamics: the expiration of ESSER and contracting state budgets. Despite these headwinds, suppliers set ambitious growth targets. As it turns out, bookings did increase on average, with 48% of suppliers seeing year-over-year growth from 2023. However, most companies reported that revenues fell below target, attributing performance gaps primarily to ESSER-driven budget pressures (45%) and generally cautious spending by districts (42%). As one executive remarked, “The Federal funding cliff was more impactful than expected,” underscoring the turbulence felt by many in the sector.

Still, the K-12 market’s resilience has begun to show. While companies felt the sharpest pinch from ESSER early in 2024, sales picked up during the latter half of the year as districts addressed delayed purchasing needs. As one executive observed, “Bookings were extremely slow this spring, but have accelerated significantly in Q3 and Q4 so far.” Paired with modest overall growth, this back-to-school recovery gives hope for greater stability on the horizon.

Funding dynamics undoubtedly presented serious challenges for districts in 2024, and, in turn, roadblocks for vendors. The expiration of ESSER not only eliminated a vital financial cushion, but also resulted in decision-making paralysis as administrators scrambled to assess their finances. For suppliers, this meant drawn-out sales cycles (30% longer than 2023) and delayed purchasing decisions. As one executive remarked, “Our prospects did not know their actual budget numbers until fall… many believed they had funding, only to find out last minute that wasn’t true.” This lack of clarity around budgets adds a layer of complexity to vendor-district relationships.

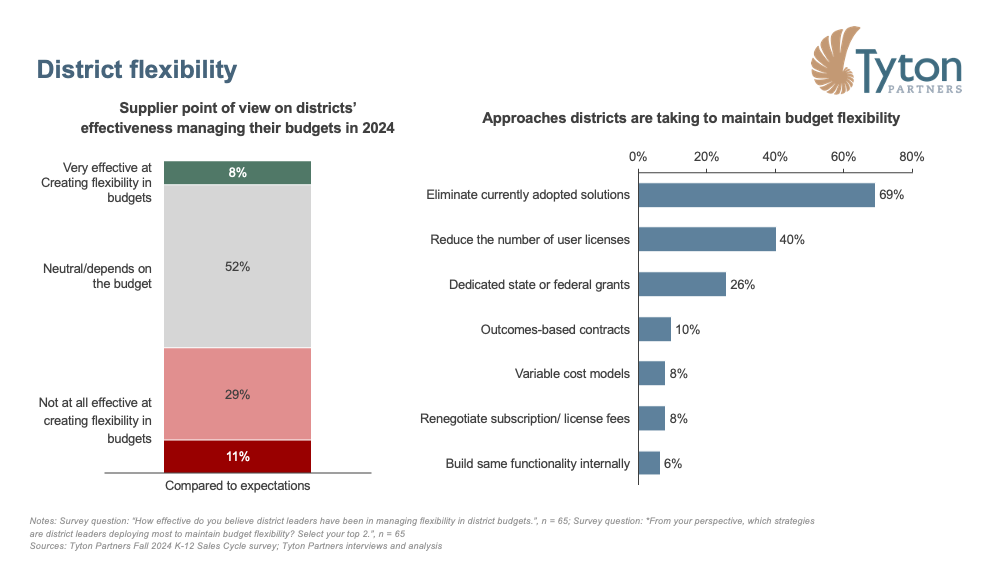

Moving forward, it’s crucial for suppliers to help customers navigate their financial constraints and demonstrate the clear value and ROI of their solutions. Only 8% of executives report districts are equipped to effectively navigate fluctuations in their budgets; throughout 2024, suppliers witnessed districts respond to pressures by eliminating solutions (69%) and/or reducing the number of licenses in use (40%). As one executive stated simply: “Districts are more cautious than ever.”

In this environment, it’s crucial for suppliers to play a more active advisory role, offering district and school leaders’ guidance on funding eligibility—including the “creative use of grant funding” cited by several executives as an effective workaround. By assisting districts in identifying applicable funding sources (and clearly demonstrating how their solutions create value for school communities) suppliers can mitigate the impact of budget cuts and build stronger, more durable partnerships.

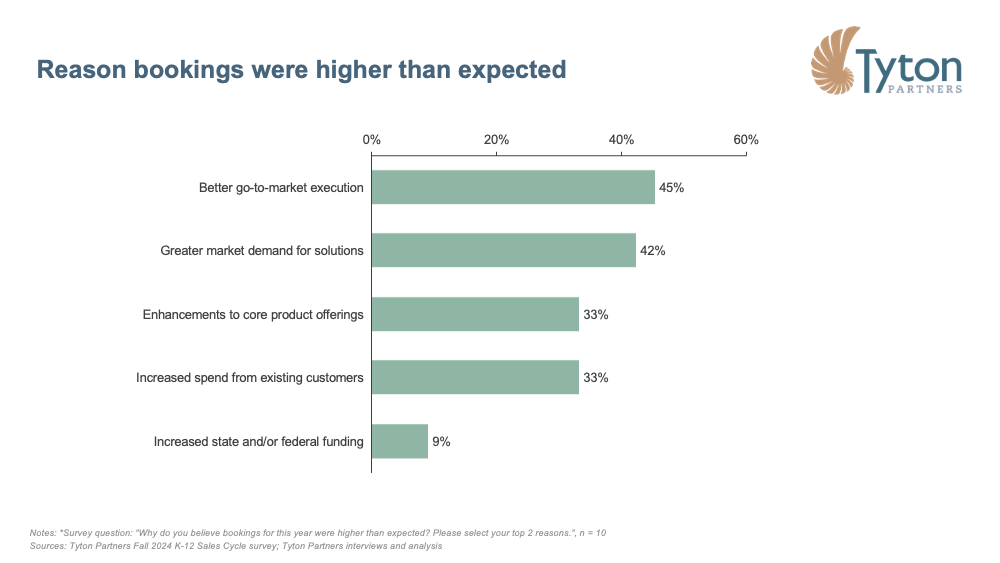

K-12 company leaders are recommitting to the fundamental importance of effective go-to-market (GTM) strategies and execution with an eye toward new customer acquisition. Of those respondents who reported stronger-than-expected bookings in 2024, nearly half attributed their success to more effective positioning and marketing of their core solutions; fewer benefitted from new product innovations (33%) or external factors (e.g., dedicated state or federal funds [9%]). In a climate where districts are apprehensive, suppliers have had to double down on driving the adoption of their core products and services.

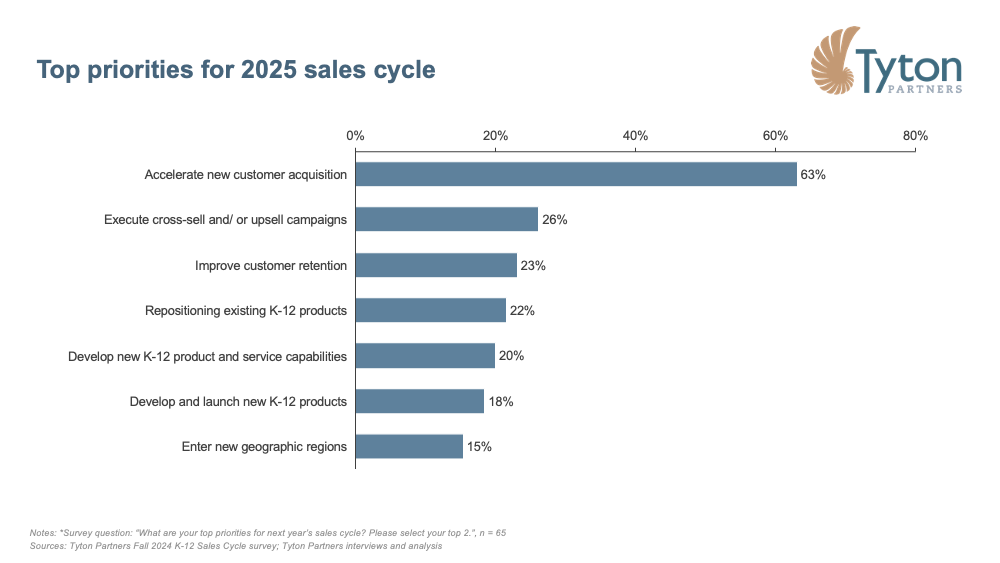

Looking ahead, suppliers will continue to prioritize go-to-market excellence, specifically focusing on expansion into new states and districts. In fact, 63% of executives indicate accelerating new customer acquisition for core solutions is a top priority for the next sales cycle. Guiding their planning is an underlying confidence in the K-12 sector: “The market is already picking up, and a lot of us are looking forward to what might happen post-election,” one executive shared. As districts regain spending confidence, and suppliers see positive signals from buyers, it’s no surprise that they have set their sights on net new customer expansion efforts.

Still, districts are likely to remain discerning regarding new solution purchases, and we expect the competitive pressures that have characterized many K-12 markets post-pandemic will continue to intensify. As districts’ budget flexibility and priorities vary from state to state, geographic targeting will become a crucial element of GTM success. Suppliers who can identify areas with relatively stable budget conditions or state-specific funding programs will be positioned to grow.

At the same time, market consolidation will prompt suppliers to reassess how they position their solutions, ensuring they align with districts’ needs to derive more value from fewer solutions. New customer acquisition will remain an uphill challenge for many organizations; effective cross-sell and upsell strategies will likely be required to recover growth trajectories in what many hope will be a rebound in 2025.

* * *

The 2024 sales cycle serves as a reminder of the dynamic nature of the K-12 market and the importance of a strong, market-validated go-to-market plan. As districts continue to reassess their priorities, they will remain focused on the twin issues of academic proficiency and student and teacher well-being. Suppliers will be compelled to sharpen their positioning and messaging to remain competitive, applying lessons learned from the malaise of the 2024 sales cycle to drive more success in the new year.

Our team at Tyton Partners is continuing to explore these issues—and how they fit into a broader portrait of a K-12 environment that’s going to experience systemic shifts in the latter half of the 2020s. A wholesale embrace of school choice by the new federal administration and the transfer of K-12 dollars into the hands of parents vis-à-vis the proliferation of Education Savings Accounts (ESAs) underscores the need to balance near-term execution with the reflection and innovation necessary for sustained growth.

Our team at Tyton Partners will continue to explore these issues and welcomes further discussion. Reach out below if you would like to continue the discussion and learn more from our K-12 experts.