Parents and students are attracted to 3-year bachelor degrees, but can institutions make the business model work?

September 23, 2025 BlogDifferentiation is going to be critical for colleges and universities to compete, and more than 60 are now…

It’s an exciting and hopeful time of year, as millions of students return to school to continue their learning journey. While some students are chasing their last few days of summer vacation, others have already completed several homework assignments delivered through their school’s classroom learning platform.

In fact, this year’s classroom learning platform may also offer an assessment authoring environment – with access to an item bank – which in turn feeds post-quiz performance data to teachers who can quickly recommend to each student a supplemental content “playlist”. Not that long ago, today’s platform “solution” was at least three or four different offerings; today, it’s often one, at most two.

For many K-12 suppliers, navigating this convergence can be challenging. It leaves suppliers wondering what market(s) they are actually in and which competitor(s) they really need to monitor. This month, we offer perspective on what this dynamic requires for K-12 leaders striving to steer their organizations.

I recently watched “Dream Home Makeover” on Netflix. In the second season, they remodel the kitchen of a historic home and explain that older homes tend to have separate, designated spaces for the kitchen, living room, and dining room. Over time, however, homes have evolved toward open floor plans in which those rooms merge into one large, great room. This allows for more “togetherness”; parents can cook dinner while supervising kids doing homework at the kitchen table or seamlessly shift from lounging to dining when hosting friends. At its best, an open floor plan is a unified, interactive, and multipurpose environment fit for modern families.

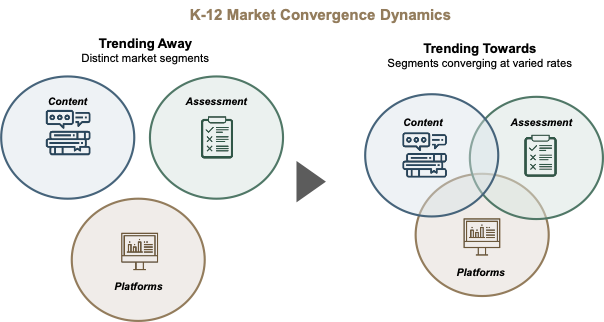

As we move into the post-pandemic world, markets within the K-12 industry seem to be on a similar journey. They are evolving from designated spaces – content, assessment, and learning platforms – to an “open floor plan”, where the proverbial walls between these markets have been knocked down. The result has been an increasing number of company solutions operating as an educational “great room”, blending instructional programs, formative and interim assessments, and digital learning environments.

As a result, instructional material and learning platform providers have an opportunity to take a more expansive view of how they serve the evolving needs of teachers and students and determine which adjacent markets could be growth opportunities.

In the past, content, assessment, and platform companies have operated within discrete market segments designed for distinct buyers, specific use cases, and established budgets. However, in the last several years, these markets have evolved and converged due to shifting buyer expectations and classroom needs.

Even before the pandemic, companies had collapsed the walls between instructional content and measurement of student learning and were gaining traction. Solutions like i-Ready, Istation, DreamBox Learning, and Exact Path, among others, introduced tightly integrated instruction and assessment models, finding favor among schools and districts.

However, the pandemic accelerated teachers’ and districts’ reliance on technology, particularly with broad-based adoption of teacher- and classroom-centric learning platforms. This dynamic not only increased teacher’s familiarity and comfort with technology, but also created higher expectations of what platforms can offer to better support learning environments and workflows – for many, this included sourcing instructional content within these newly adopted digital platforms. As a result, there will be lasting shifts in how we view K-12 markets and our education system more broadly.

To take advantage of these market shifts, organizational leaders need to consider how they want to remodel. Which walls should they knock down to create their optimal great room for both company and student success? What should the redesign look like to allow for expansion over time?

Before redrawing plans, leaders need to assess their foundation and measure out the new vision to ensure it bridges existing capabilities to the future dream. A key part of this effort is performing thoughtful analysis of the growth opportunities available. This includes generating the right sizing data and evaluating the risk/reward of adjacent markets and product use cases to ensure which new spaces will be worth the cost and mess of remodeling.

Resetting boundaries between markets also requires fully understanding the new competitive threats – and prospective acquisition opportunities – building a great classroom solution may involve. Failing to account for these can risk dooming the project from the start.

Similar to remodeling, the number of options and decisions – big and small – can be formidable. However, thoughtfully evaluating the opportunity set can provide the structure and conviction companies require to adeptly capitalize on this market convergence and more effectively serve students and instructors.